Please show all work, I am struggling to complete the formula and solution. Thank you!

The question above comes from this question (below Q # 1) (also posted as a question for help)

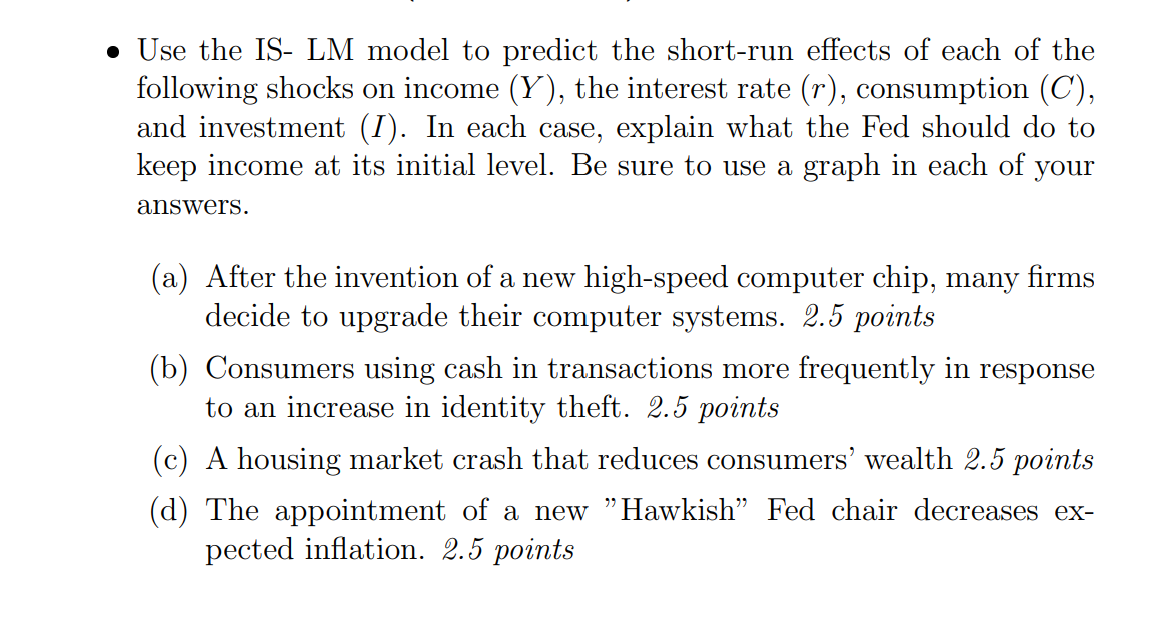

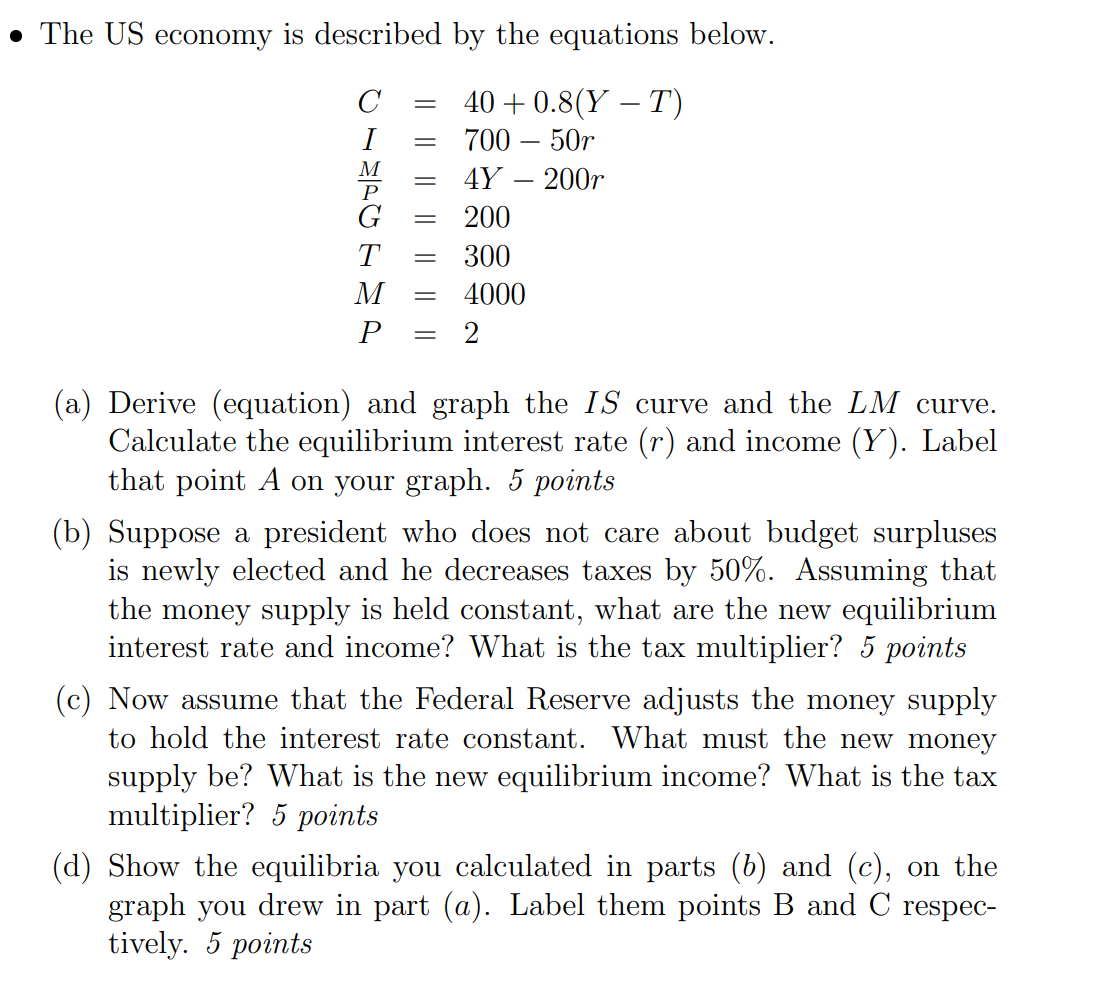

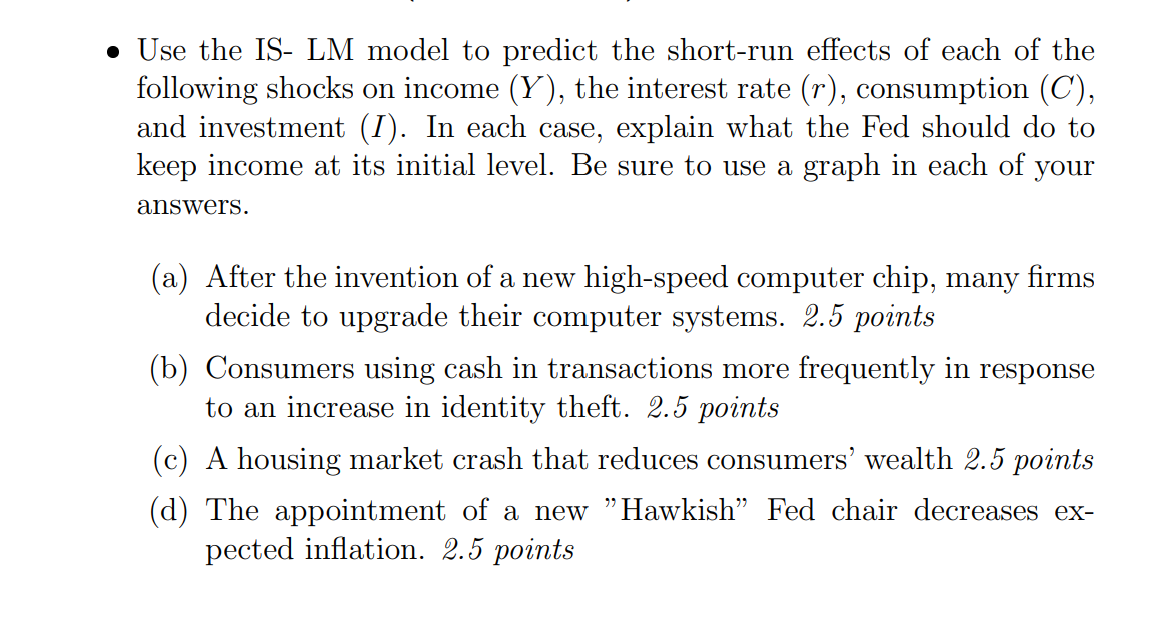

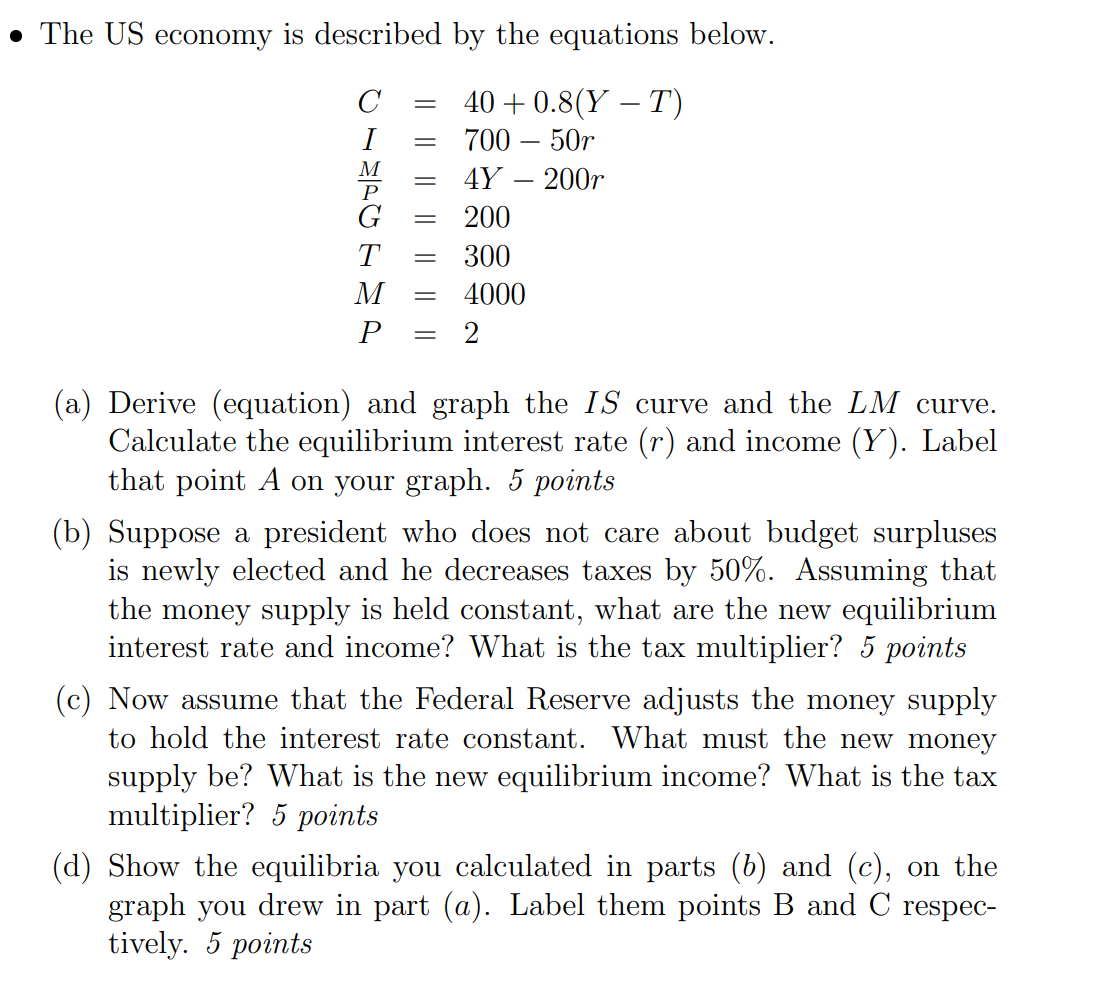

2 Use the IS-LM model to predict the short-run effects of each of the following shocks on income (Y), the interest rate (r), consumption (C), and investment (I). In each case, explain what the Fed should do to keep income at its initial level. Be sure to use a graph in each of your answers. (a) After the invention of a new high-speed computer chip, many firms decide to upgrade their computer systems. 2.5 points (b) Consumers using cash in transactions more frequently in response to an increase in identity theft. 2.5 points (c) A housing market crash that reduces consumers' wealth 2.5 points (d) The appointment of a new Hawkish Fed chair decreases ex- pected inflation. 2.5 points The US economy is described by the equations below. = I - - 40 +0.8(Y - T) 700 50r 4Y 200r 200 300 4000 2 = T M P - IL 10 (a) Derive (equation) and graph the IS curve and the LM curve. Calculate the equilibrium interest rate (r) and income (Y). Label that point A on your graph. 5 points (b) Suppose a president who does not care about budget surpluses is newly elected and he decreases taxes by 50%. Assuming that the money supply is held constant, what are the new equilibrium interest rate and income? What is the tax multiplier? 5 points (c) Now assume that the Federal Reserve adjusts the money supply to hold the interest rate constant. What must the new money supply be? What is the new equilibrium income? What is the tax multiplier? 5 points (d) Show the equilibria you calculated in parts (6) and (c), on the graph you drew in part (a). Label them points B and C respec- tively. 5 points 2 Use the IS-LM model to predict the short-run effects of each of the following shocks on income (Y), the interest rate (r), consumption (C), and investment (I). In each case, explain what the Fed should do to keep income at its initial level. Be sure to use a graph in each of your answers. (a) After the invention of a new high-speed computer chip, many firms decide to upgrade their computer systems. 2.5 points (b) Consumers using cash in transactions more frequently in response to an increase in identity theft. 2.5 points (c) A housing market crash that reduces consumers' wealth 2.5 points (d) The appointment of a new Hawkish Fed chair decreases ex- pected inflation. 2.5 points The US economy is described by the equations below. = I - - 40 +0.8(Y - T) 700 50r 4Y 200r 200 300 4000 2 = T M P - IL 10 (a) Derive (equation) and graph the IS curve and the LM curve. Calculate the equilibrium interest rate (r) and income (Y). Label that point A on your graph. 5 points (b) Suppose a president who does not care about budget surpluses is newly elected and he decreases taxes by 50%. Assuming that the money supply is held constant, what are the new equilibrium interest rate and income? What is the tax multiplier? 5 points (c) Now assume that the Federal Reserve adjusts the money supply to hold the interest rate constant. What must the new money supply be? What is the new equilibrium income? What is the tax multiplier? 5 points (d) Show the equilibria you calculated in parts (6) and (c), on the graph you drew in part (a). Label them points B and C respec- tively. 5 points