Answered step by step

Verified Expert Solution

Question

1 Approved Answer

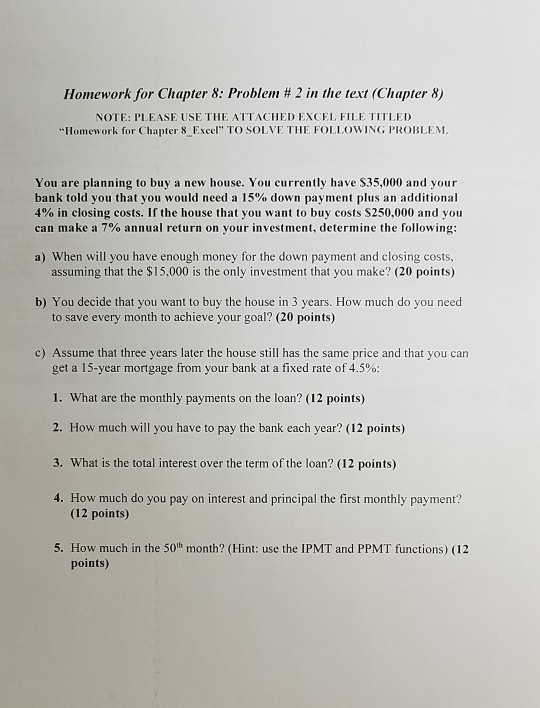

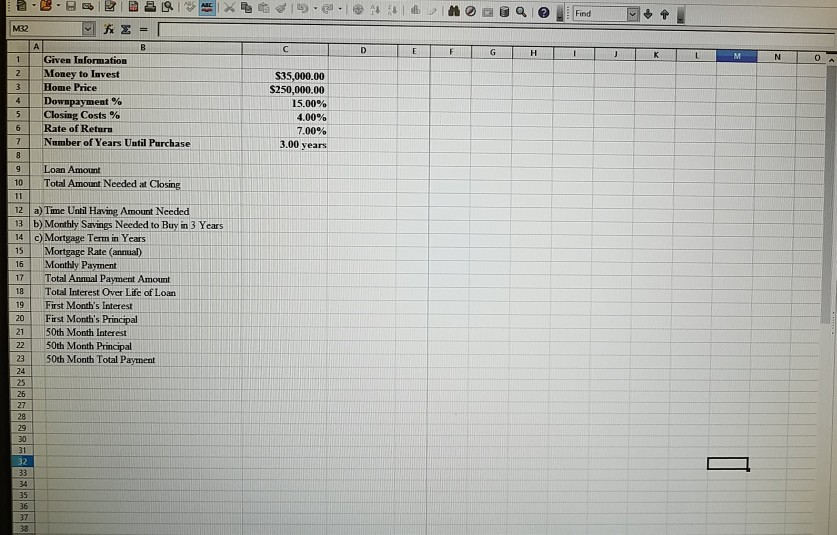

please show all work in excel Homework for Chapter 8: Problem #2 in the text (Chapter 8) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED

please show all work in excel

Homework for Chapter 8: Problem #2 in the text (Chapter 8) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homework for Chapter 8 Excel" TO SOLVE THE FOLLOWING PROBLEM You are planning to buy a new house. You currently have $35,000 and your bank told you that you would need a 15% down payment plus an additional 4% in closing costs. If the house that you want to buy costs $250,000 and you can make a 7% annual return on your investment, determine the following: a) When will you have enough money for the down payment and closing costs, assuming that the $15,000 is the only investment that you make? (20 points) b) You decide that you want to buy the house in 3 years. How much do you need to save every month to achieve your goal? (20 points) C) Assume that three years later the house still has the same price and that you can get a 15-year mortgage from your bank at a fixed rate of 4.5%: 1. What are the monthly payments on the loan? (12 points) 2. How much will you have to pay the bank each year? (12 points) 3. What is the total interest over the term of the loan? (12 points) 4. How much do you pay on interest and principal the first monthly payment? (12 points) 5. How much in the 50 month? (Hint: use the IPMT and PPMT functions) (12 points) 19 1 6 NaQ@ Find 212&1915 MERK I = A Given Information Money to Invest Home Price Downpayment % Closing Costs % Rate of Return Number of Years Until Purchase 21 $35,000.00 $250,000.00 15.00% 4.00% 7.00% 3.00 years Loan Amount Total Amount Needed at Closing 10 11 12 a) Time Until Having Amount Needed 13 b) Monthly Savings Needed to Buy in 3 Years 14 c) Mortgage Termin Years 15 Mortgage Rate (annual) 16 Monthly Payment 17 Total Annual Payment Amount Total Interest Over Life of Loan First Month's Interest First Month's Principal 50th Month Interest 50th Month Principal 50th Month Total Payment 18 Te Homework for Chapter 8: Problem #2 in the text (Chapter 8) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homework for Chapter 8 Excel" TO SOLVE THE FOLLOWING PROBLEM You are planning to buy a new house. You currently have $35,000 and your bank told you that you would need a 15% down payment plus an additional 4% in closing costs. If the house that you want to buy costs $250,000 and you can make a 7% annual return on your investment, determine the following: a) When will you have enough money for the down payment and closing costs, assuming that the $15,000 is the only investment that you make? (20 points) b) You decide that you want to buy the house in 3 years. How much do you need to save every month to achieve your goal? (20 points) C) Assume that three years later the house still has the same price and that you can get a 15-year mortgage from your bank at a fixed rate of 4.5%: 1. What are the monthly payments on the loan? (12 points) 2. How much will you have to pay the bank each year? (12 points) 3. What is the total interest over the term of the loan? (12 points) 4. How much do you pay on interest and principal the first monthly payment? (12 points) 5. How much in the 50 month? (Hint: use the IPMT and PPMT functions) (12 points) 19 1 6 NaQ@ Find 212&1915 MERK I = A Given Information Money to Invest Home Price Downpayment % Closing Costs % Rate of Return Number of Years Until Purchase 21 $35,000.00 $250,000.00 15.00% 4.00% 7.00% 3.00 years Loan Amount Total Amount Needed at Closing 10 11 12 a) Time Until Having Amount Needed 13 b) Monthly Savings Needed to Buy in 3 Years 14 c) Mortgage Termin Years 15 Mortgage Rate (annual) 16 Monthly Payment 17 Total Annual Payment Amount Total Interest Over Life of Loan First Month's Interest First Month's Principal 50th Month Interest 50th Month Principal 50th Month Total Payment 18 TeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started