Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work in EXCEL including formulas. thank you in advance! will upvote once all finished (1-5) of the same question. you are mvp!

please show all work in EXCEL including formulas. thank you in advance! will upvote once all finished (1-5) of the same question. you are mvp!

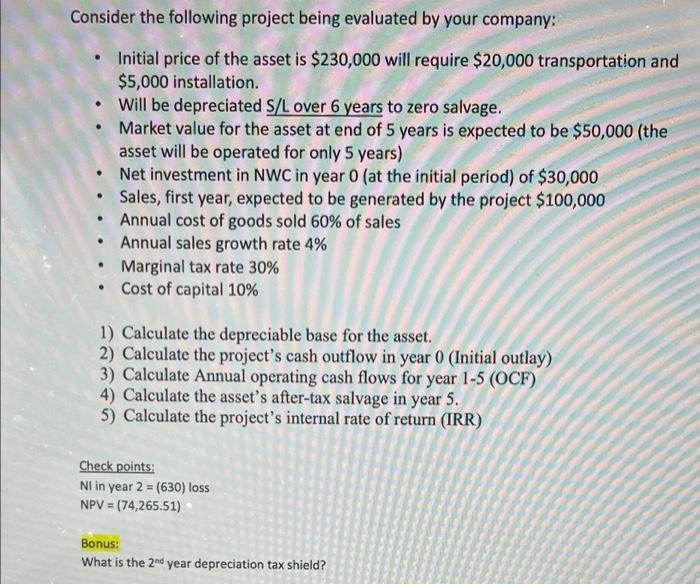

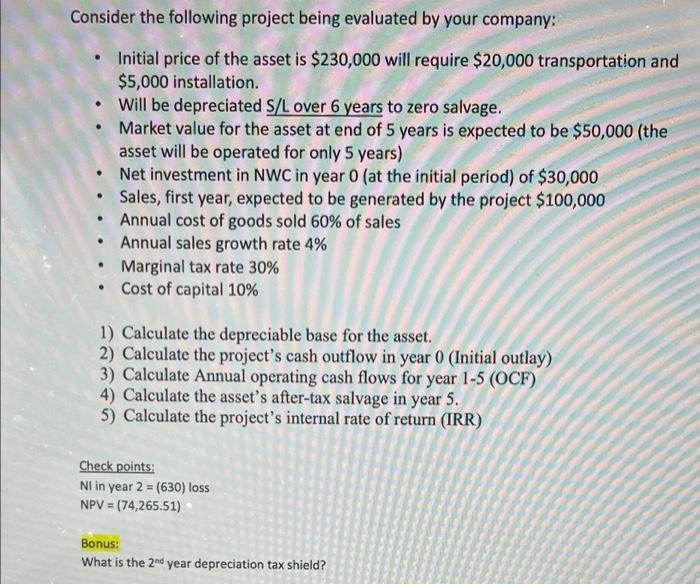

Consider the following project being evaluated by your company: - Initial price of the asset is $230,000 will require $20,000 transportation and $5,000 installation. - Will be depreciated S/L over 6 years to zero salvage. - Market value for the asset at end of 5 years is expected to be $50,000 (the asset will be operated for only 5 years) - Net investment in NWC in year 0 (at the initial period) of $30,000 - Sales, first year, expected to be generated by the project $100,000 - Annual cost of goods sold 60% of sales - Annual sales growth rate 4% - Marginal tax rate 30\% - Cost of capital 10% 1) Calculate the depreciable base for the asset. 2) Calculate the project's cash outflow in year 0 (Initial outlay) 3) Calculate Annual operating cash flows for year 1-5 (OCF) 4) Calculate the asset's after-tax salvage in year 5. 5) Calculate the project's internal rate of return (IRR) Check points: Nl in year 2=(630) loss NPV=(74,265.51) Bonus: What is the 2ne year depreciation tax shield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started