Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE show all work in excel, thanks! Q1 The current price of American Airlines stock is $6. In the next year, this stock price can

PLEASE show all work in excel, thanks!

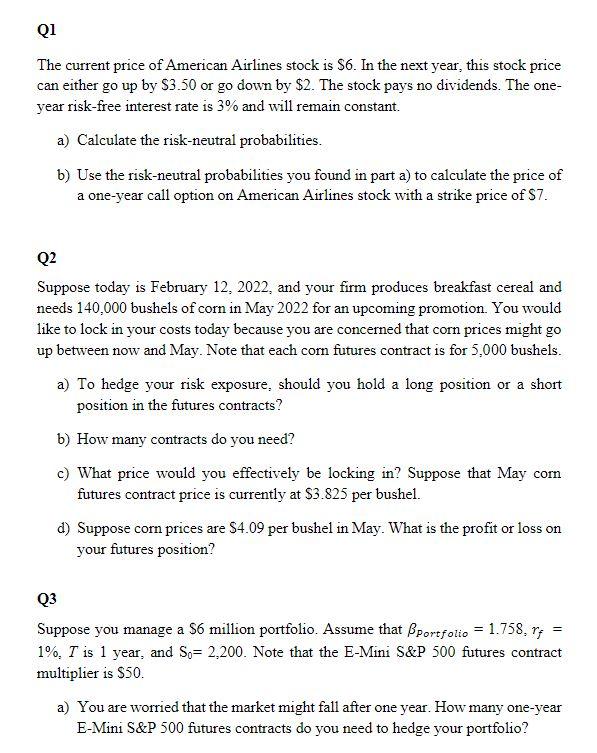

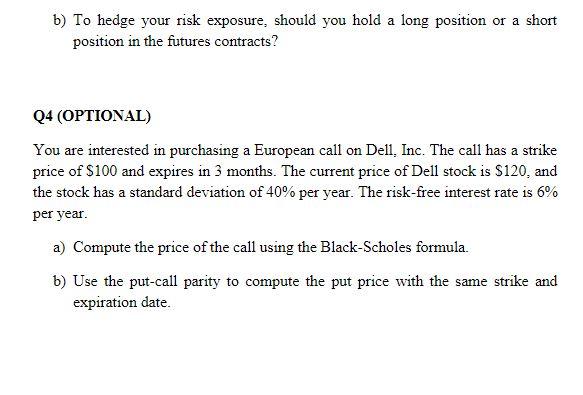

Q1 The current price of American Airlines stock is $6. In the next year, this stock price can either go up by $3.50 or go down by $2. The stock pays no dividends. The oneyear risk-free interest rate is 3% and will remain constant. a) Calculate the risk-neutral probabilities. b) Use the risk-neutral probabilities you found in part a) to calculate the price of a one-year call option on American Airlines stock with a strike price of $7. Q2 Suppose today is February 12, 2022, and your firm produces breakfast cereal and needs 140,000 bushels of corn in May 2022 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and May. Note that each corn futures contract is for 5,000 bushels. a) To hedge your risk exposure, should you hold a long position or a short position in the futures contracts? b) How many contracts do you need? c) What price would you effectively be locking in? Suppose that May corn futures contract price is currently at $3.825 per bushel. d) Suppose corn prices are $4.09 per bushel in May. What is the profit or loss on your futures position? Q3 Suppose you manage a $6 million portfolio. Assume that Portfolio=1.758,rf= 1%,T is 1 year, and S0=2,200. Note that the E-Mini S&P500 futures contract multiplier is $50. a) You are worried that the market might fall after one year. How many one-year E-Mini S\&P 500 futures contracts do you need to hedge your portfolio? b) To hedge your risk exposure, should you hold a long position or a short position in the futures contracts? Q4 (OPTIONAL) You are interested in purchasing a European call on Dell, Inc. The call has a strike price of $100 and expires in 3 months. The current price of Dell stock is $120, and the stock has a standard deviation of 40% per year. The risk-free interest rate is 6% per year. a) Compute the price of the call using the Black-Scholes formula. b) Use the put-call parity to compute the put price with the same strike and expiration date. Q1 The current price of American Airlines stock is $6. In the next year, this stock price can either go up by $3.50 or go down by $2. The stock pays no dividends. The oneyear risk-free interest rate is 3% and will remain constant. a) Calculate the risk-neutral probabilities. b) Use the risk-neutral probabilities you found in part a) to calculate the price of a one-year call option on American Airlines stock with a strike price of $7. Q2 Suppose today is February 12, 2022, and your firm produces breakfast cereal and needs 140,000 bushels of corn in May 2022 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and May. Note that each corn futures contract is for 5,000 bushels. a) To hedge your risk exposure, should you hold a long position or a short position in the futures contracts? b) How many contracts do you need? c) What price would you effectively be locking in? Suppose that May corn futures contract price is currently at $3.825 per bushel. d) Suppose corn prices are $4.09 per bushel in May. What is the profit or loss on your futures position? Q3 Suppose you manage a $6 million portfolio. Assume that Portfolio=1.758,rf= 1%,T is 1 year, and S0=2,200. Note that the E-Mini S&P500 futures contract multiplier is $50. a) You are worried that the market might fall after one year. How many one-year E-Mini S\&P 500 futures contracts do you need to hedge your portfolio? b) To hedge your risk exposure, should you hold a long position or a short position in the futures contracts? Q4 (OPTIONAL) You are interested in purchasing a European call on Dell, Inc. The call has a strike price of $100 and expires in 3 months. The current price of Dell stock is $120, and the stock has a standard deviation of 40% per year. The risk-free interest rate is 6% per year. a) Compute the price of the call using the Black-Scholes formula. b) Use the put-call parity to compute the put price with the same strike and expiration dateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started