Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work. Road Truck Company is a large trucking company. The company uses the units-of-production (UOP) method to depreciate its trucks. To follow

Please show all work.

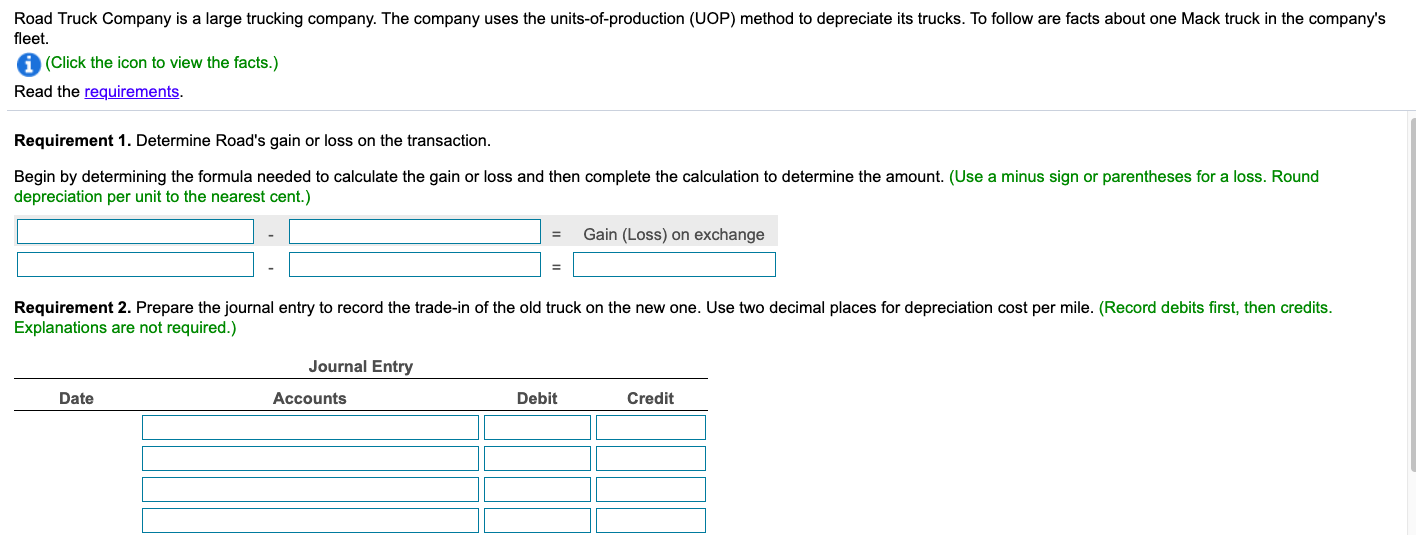

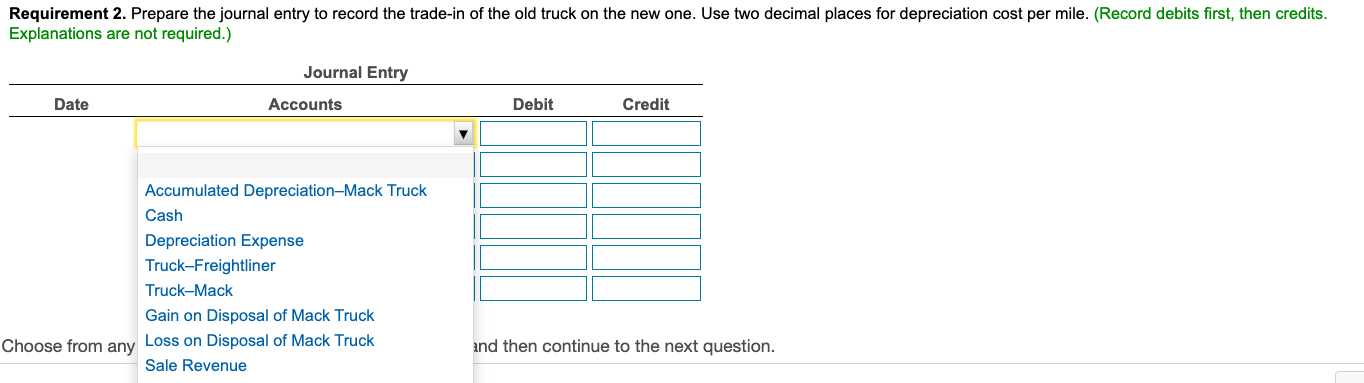

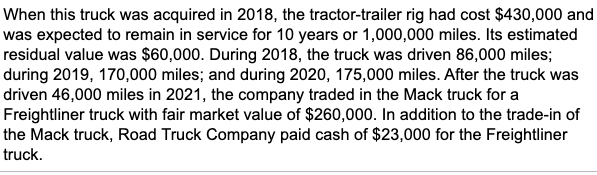

Road Truck Company is a large trucking company. The company uses the units-of-production (UOP) method to depreciate its trucks. To follow are facts about one Mack truck in the company's fleet. (Click the icon to view the facts.) Read the requirements. Requirement 1. Determine Road's gain or loss on the transaction. Begin by determining the formula needed to calculate the gain or loss and then complete the calculation to determine the amount. (Use a minus sign or parentheses for a loss. Round depreciation per unit to the nearest cent.) = Gain (Loss) on exchange Requirement 2. Prepare the journal entry to record the trade-in of the old truck on the new one. Use two decimal places for depreciation cost per mile. (Record debits first, then credits. Explanations are not required.) Journal Entry Accounts Date Debit Credit Requirement 2. Prepare the journal entry to record the trade-in of the old truck on the new one. Use two decimal places for depreciation cost per mile. (Record debits first, then credits. Explanations are not required.) Journal Entry Accounts Date Debit Credit Accumulated Depreciation-Mack Truck Cash Depreciation Expense Truck-Freightliner Truck-Mack Gain on Disposal of Mack Truck Choose from any Loss on Disposal of Mack Truck Sale Revenue and then continue to the next question. When this truck was acquired in 2018, the tractor-trailer rig had cost $430,000 and was expected to remain in service for 10 years or 1,000,000 miles. Its estimated residual value was $60,000. During 2018, the truck was driven 86,000 miles; during 2019, 170,000 miles, and during 2020, 175,000 miles. After the truck was driven 46,000 miles in 2021, the company traded in the Mack truck for a Freightliner truck with fair market value of $260,000. In addition to the trade-in of the Mack truck, Road Truck Company paid cash of $23,000 for the Freightliner truck. Road Truck Company is a large trucking company. The company uses the units-of-production (UOP) method to depreciate its trucks. To follow are facts about one Mack truck in the company's fleet. (Click the icon to view the facts.) Read the requirements. Requirement 1. Determine Road's gain or loss on the transaction. Begin by determining the formula needed to calculate the gain or loss and then complete the calculation to determine the amount. (Use a minus sign or parentheses for a loss. Round depreciation per unit to the nearest cent.) = Gain (Loss) on exchange Requirement 2. Prepare the journal entry to record the trade-in of the old truck on the new one. Use two decimal places for depreciation cost per mile. (Record debits first, then credits. Explanations are not required.) Journal Entry Accounts Date Debit Credit Requirement 2. Prepare the journal entry to record the trade-in of the old truck on the new one. Use two decimal places for depreciation cost per mile. (Record debits first, then credits. Explanations are not required.) Journal Entry Accounts Date Debit Credit Accumulated Depreciation-Mack Truck Cash Depreciation Expense Truck-Freightliner Truck-Mack Gain on Disposal of Mack Truck Choose from any Loss on Disposal of Mack Truck Sale Revenue and then continue to the next question. When this truck was acquired in 2018, the tractor-trailer rig had cost $430,000 and was expected to remain in service for 10 years or 1,000,000 miles. Its estimated residual value was $60,000. During 2018, the truck was driven 86,000 miles; during 2019, 170,000 miles, and during 2020, 175,000 miles. After the truck was driven 46,000 miles in 2021, the company traded in the Mack truck for a Freightliner truck with fair market value of $260,000. In addition to the trade-in of the Mack truck, Road Truck Company paid cash of $23,000 for the Freightliner truckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started