Answered step by step

Verified Expert Solution

Question

1 Approved Answer

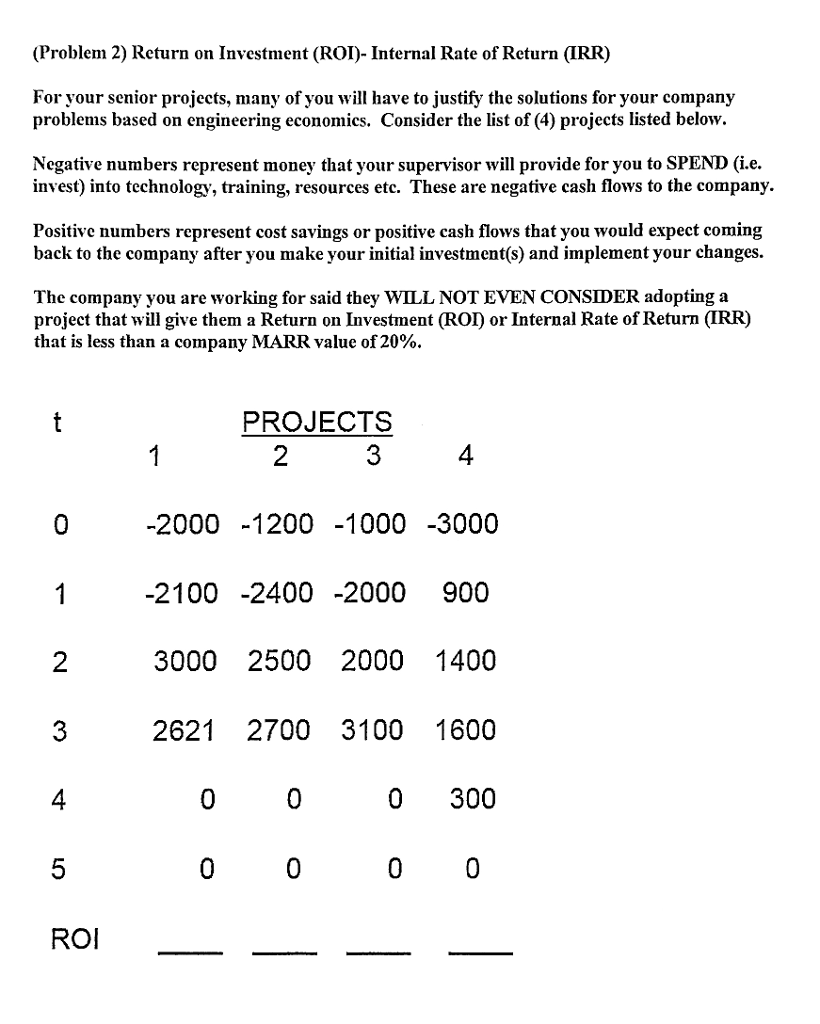

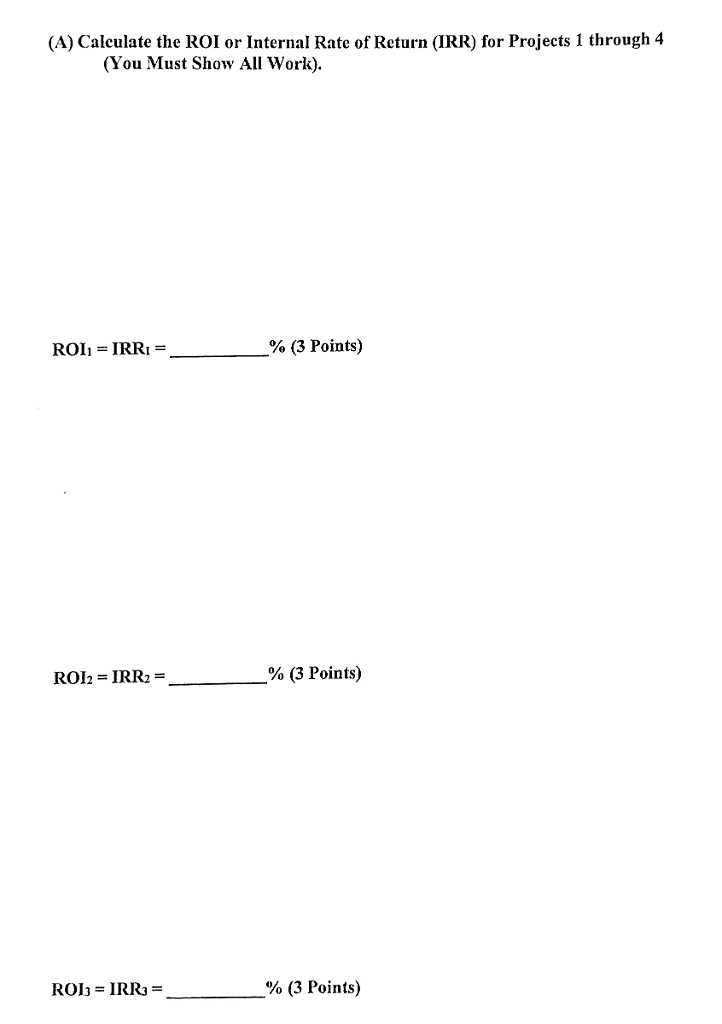

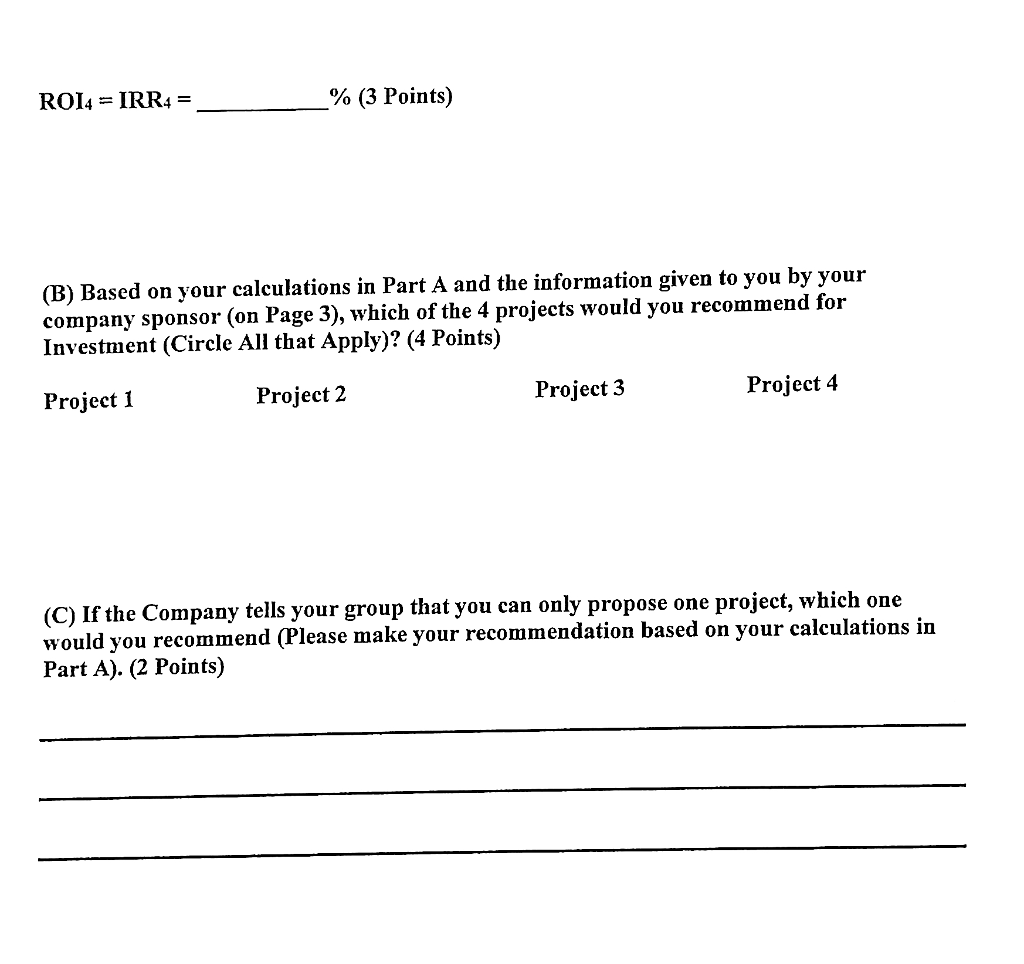

Please SHOW ALL WORK (STEPS!!) when getting the ROI/IRR for projects 1 through 4. Thanks. (Problem 2) Return on Investment (ROI)-Internal Rate of Return (IRR)

Please SHOW ALL WORK (STEPS!!) when getting the ROI/IRR for projects 1 through 4. Thanks.

(Problem 2) Return on Investment (ROI)-Internal Rate of Return (IRR) For your senior projects, many of you will have to justify the solutions for your company problems based on engineering economics. Consider the list of (4) projects listed below. Negative numbers represent money that your supervisor will provide for you to SPEND (i.e. invest) into technology, training, resources etc. These are negative cash flows to the company. Positive numbers represent cost savings or positive cash flows that you would expect coming back to the company after you make your initial investment(s) and implement your changes. The company you are working for said they WILL NOT EVEN CONSIDER adopting a project that will give them a Return on Investment (ROI) or Internal Rate of Return (IRR) that is less than a company MARR value of 20%. PROJECTS 3 4 2000 -1200 -1000 -3000 -2100 -2400 -2000 900 3000 2500 2000 1400 2621 2700 3100 1600 0 300 4 0 0 ROI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started