Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work Suppose you have just finished the final year of your undergraduate degree at university and are faced with the choice of

Please show all work

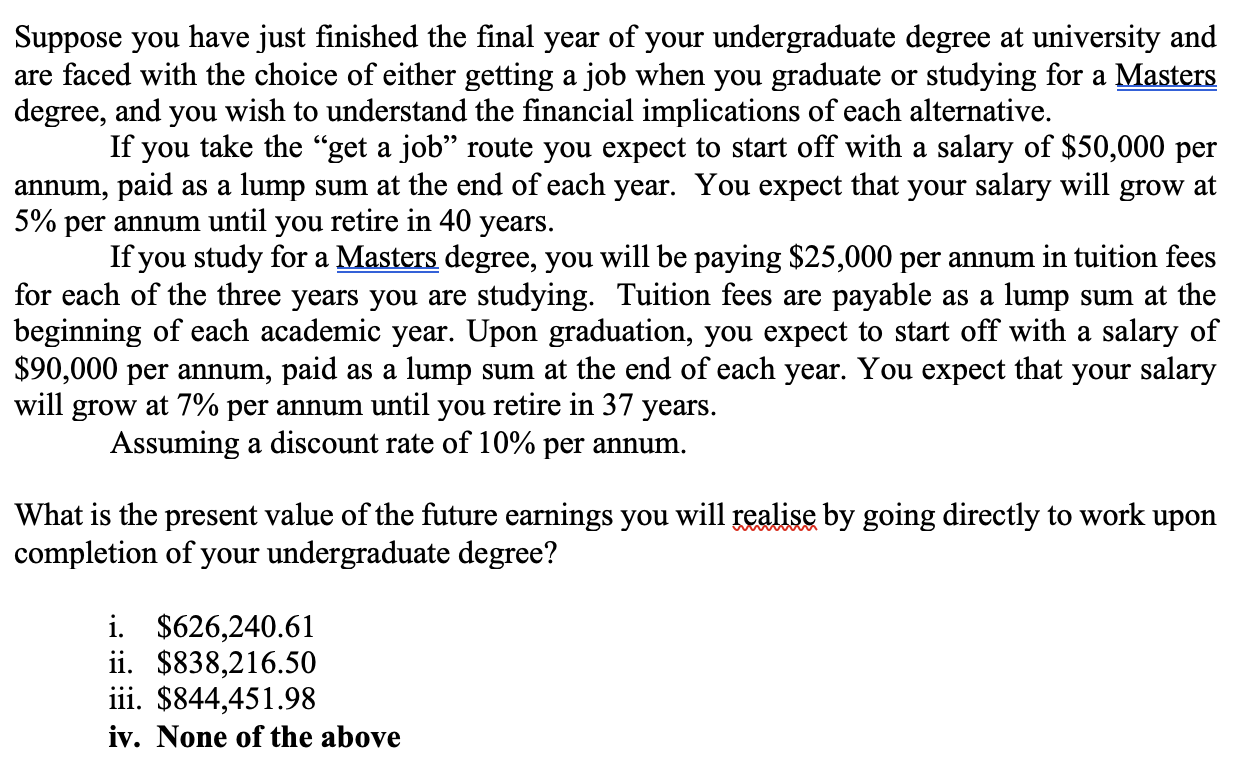

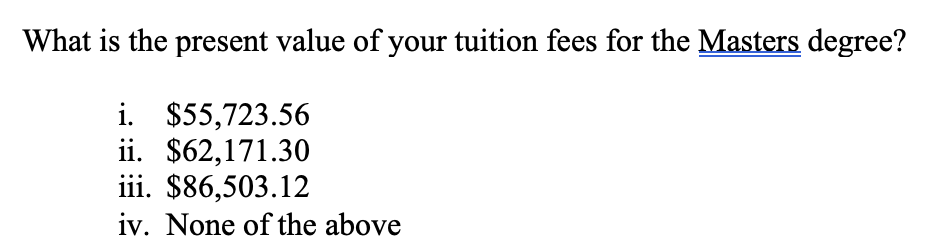

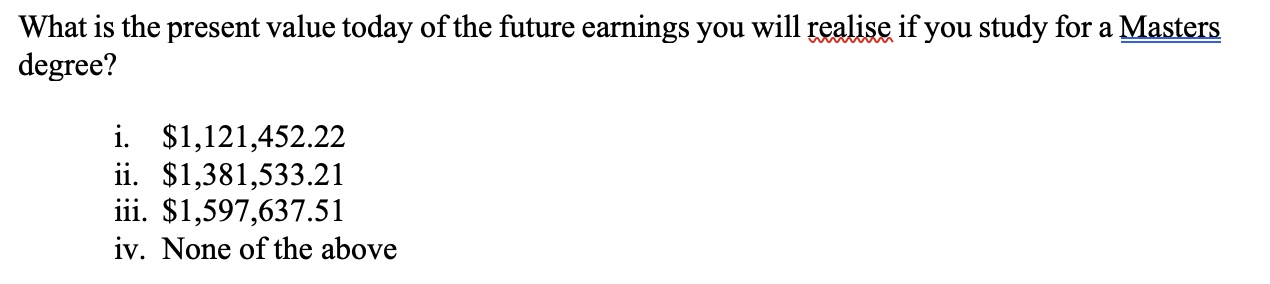

Suppose you have just finished the final year of your undergraduate degree at university and are faced with the choice of either getting a job when you graduate or studying for a Masters degree, and you wish to understand the financial implications of each alternative. If you take the get a job route you expect to start off with a salary of $50,000 per annum, paid as a lump sum at the end of each year. You expect that your salary will grow at 5% per annum until you retire in 40 years. If you study for a Masters degree, you will be paying $25,000 per annum in tuition fees for each of the three years you are studying. Tuition fees are payable as a lump sum at the beginning of each academic year. Upon graduation, you expect to start off with a salary of $90,000 per annum, paid as a lump sum at the end of each year. You expect that your salary will grow at 7% per annum until you retire in 37 years. Assuming a discount rate of 10% per annum. What is the present value of the future earnings you will realise by going directly to work upon completion of your undergraduate degree? i. $626,240.61 ii. $838,216.50 iii. $844,451.98 iv. None of the above What is the present value of your tuition fees for the Masters degree? i. $55,723.56 ii. $62,171.30 iii. $86,503.12 iv. None of the above What is the present value today of the future earnings you will realise if you study for a Masters degree? i. $1,121,452.22 ii. $1,381,533.21 iii. $1,597,637.51 iv. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started