Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work. Thank you! Consider the following project. Your initial investment cost is $300 million, and that investment wil depreciate in straight-line form

Please show all work. Thank you!

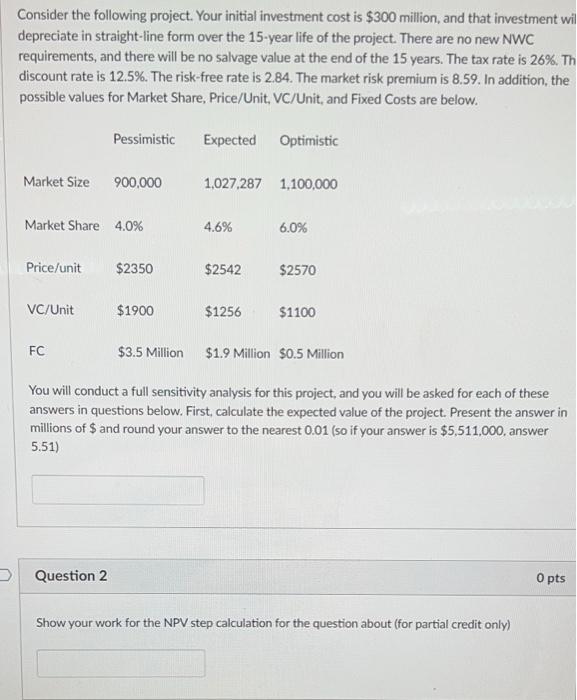

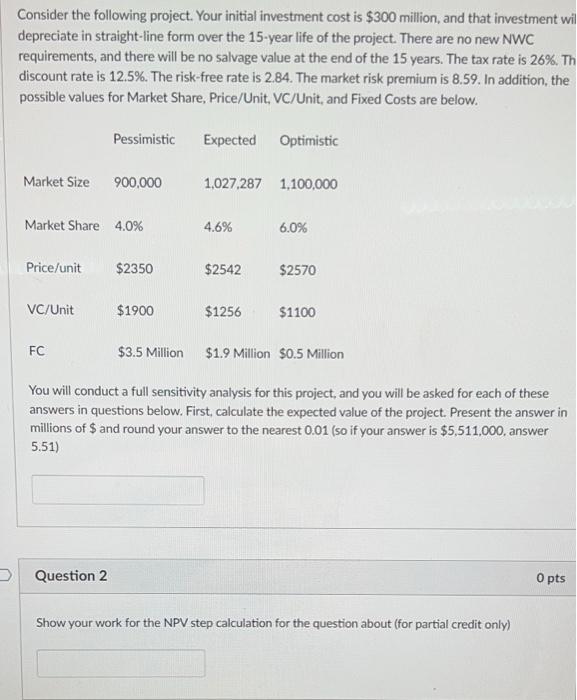

Consider the following project. Your initial investment cost is $300 million, and that investment wil depreciate in straight-line form over the 15-year life of the project. There are no new NWC requirements, and there will be no salvage value at the end of the 15 years. The tax rate is 26%. Th discount rate is 12.5%. The risk-free rate is 2.84. The market risk premium is 8.59. In addition, the possible values for Market Share, Price/Unit, VC/Unit, and Fixed Costs are below. Pessimistic Expected Optimistic Market Size 900,000 1,027.287 1.100,000 Market Share 4.0% 4.6% 6.0% Price/unit $2350 $2542 $2570 VC/Unit $1900 $1256 $1100 FC $3.5 Million $1.9 Million $0.5 Million You will conduct a full sensitivity analysis for this project, and you will be asked for each of these answers in questions below. First, calculate the expected value of the project. Present the answer in millions of $ and round your answer to the nearest 0.01 (so if your answer is $5,511,000, answer 5.51) Question 2 O pts Show your work for the NPV step calculation for the question about (for partial credit only)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started