Please show all work. Thanks in advance!

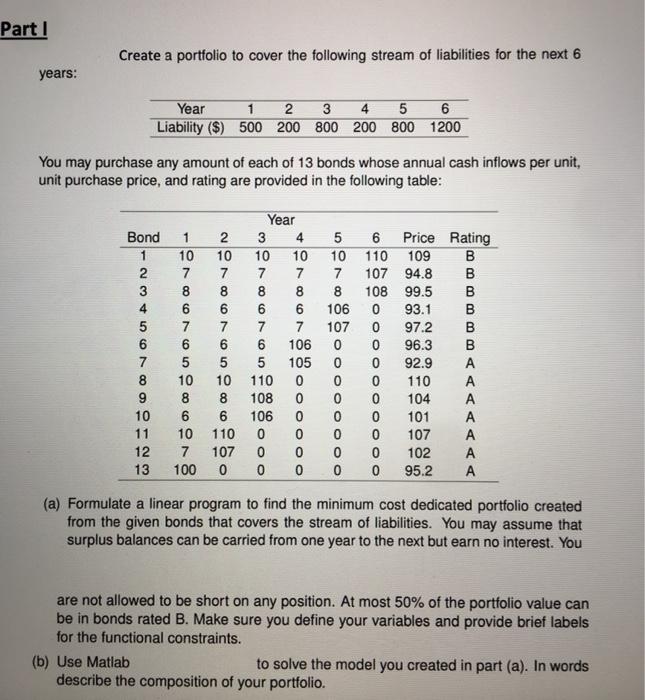

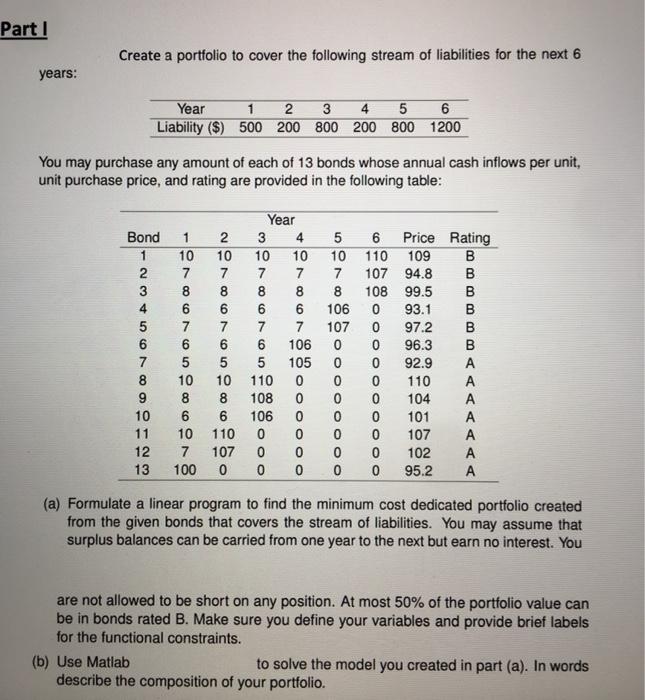

Part! Create a portfolio to cover the following stream of liabilities for the next 6 years: Year 2 3 4 5 6 Liability ($) 500 200 800 200 800 1200 You may purchase any amount of each of 13 bonds whose annual cash inflows per unit, unit purchase price, and rating are provided in the following table: 5 2 10 7 8 6 5 10 7 8 106 107 Bond 1 2 3 4 5 6 7 8 9 10 11 12 13 10 7 8 6 7 6 5 10 8 6 10 7 100 6 5 10 Year 3 4 10 10 7 7 8 6 6 7 7 6 106 5 105 110 0 108 0 106 0 0 0 0 0 0 0 6 Price Rating 110 109 B 107 94.8 B 108 99.5 B 0 93.1 B 0 97.2 B 0 96.3 B 0 92.9 A 0 110 A 0 104 A 0 101 A 0 107 0 102 A 0 95.2 A 6 110 107 0 (a) Formulate a linear program to find the minimum cost dedicated portfolio created from the given bonds that covers the stream of liabilities. You may assume that surplus balances can be carried from one year to the next but earn no interest. You are not allowed to be short on any position. At most 50% of the portfolio value can be in bonds rated B. Make sure you define your variables and provide brief labels for the functional constraints. (b) Use Matlab to solve the model you created in part (a). In words describe the composition of your portfolio. Part II Suppose the interest rate is not constant over the six year period. Rather, the following term structure of risk-free interest rates should be used: Year Rate(%) 1 2 3 4 5 6 5.04 5.94 6.36 7.18 7.89 8.39 (a) Formulate a linear program to find the minimum cost immunized portfolio created from the given bonds that covers the stream of liabilities subject to the same con- straints outlined in Part1 . Use the Fischer-Weil duration and convexity mea- sures in your model. (It may help to review the slides on Immunization.) Make sure you define your variables and provide brief labels for the functional constraints. (b) Use Matlab to solve the model you created in part (a). In words describe the composition of your portfolio. (c) Compare and contrast the solution you obtained in Part 1 versus what you obtained in part (b) of this problem. Hint: If you are having trouble finding a feasible solution: 1. Round to two decimal places. 2. Use the FW dollar duration and FW dollar convexity in your model. Part! Create a portfolio to cover the following stream of liabilities for the next 6 years: Year 2 3 4 5 6 Liability ($) 500 200 800 200 800 1200 You may purchase any amount of each of 13 bonds whose annual cash inflows per unit, unit purchase price, and rating are provided in the following table: 5 2 10 7 8 6 5 10 7 8 106 107 Bond 1 2 3 4 5 6 7 8 9 10 11 12 13 10 7 8 6 7 6 5 10 8 6 10 7 100 6 5 10 Year 3 4 10 10 7 7 8 6 6 7 7 6 106 5 105 110 0 108 0 106 0 0 0 0 0 0 0 6 Price Rating 110 109 B 107 94.8 B 108 99.5 B 0 93.1 B 0 97.2 B 0 96.3 B 0 92.9 A 0 110 A 0 104 A 0 101 A 0 107 0 102 A 0 95.2 A 6 110 107 0 (a) Formulate a linear program to find the minimum cost dedicated portfolio created from the given bonds that covers the stream of liabilities. You may assume that surplus balances can be carried from one year to the next but earn no interest. You are not allowed to be short on any position. At most 50% of the portfolio value can be in bonds rated B. Make sure you define your variables and provide brief labels for the functional constraints. (b) Use Matlab to solve the model you created in part (a). In words describe the composition of your portfolio. Part II Suppose the interest rate is not constant over the six year period. Rather, the following term structure of risk-free interest rates should be used: Year Rate(%) 1 2 3 4 5 6 5.04 5.94 6.36 7.18 7.89 8.39 (a) Formulate a linear program to find the minimum cost immunized portfolio created from the given bonds that covers the stream of liabilities subject to the same con- straints outlined in Part1 . Use the Fischer-Weil duration and convexity mea- sures in your model. (It may help to review the slides on Immunization.) Make sure you define your variables and provide brief labels for the functional constraints. (b) Use Matlab to solve the model you created in part (a). In words describe the composition of your portfolio. (c) Compare and contrast the solution you obtained in Part 1 versus what you obtained in part (b) of this problem. Hint: If you are having trouble finding a feasible solution: 1. Round to two decimal places. 2. Use the FW dollar duration and FW dollar convexity in your model