Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW ALL WORK. THANKS! Q1) You lend money to a business colleague at a rate of i=10%. Expected inflation is E()= 3.5%. What is

PLEASE SHOW ALL WORK. THANKS!

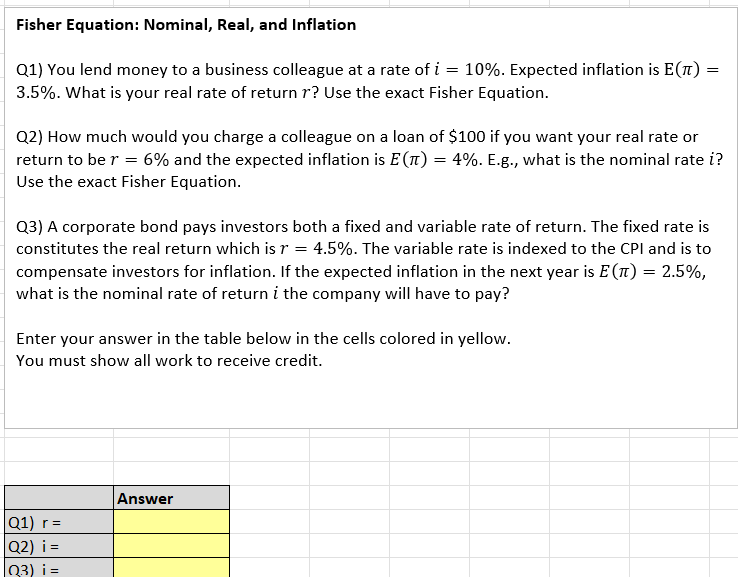

Q1) You lend money to a business colleague at a rate of i=10%. Expected inflation is E()= 3.5%. What is your real rate of return r ? Use the exact Fisher Equation. Q2) How much would you charge a colleague on a loan of $100 if you want your real rate or return to be r=6% and the expected inflation is E()=4%. E.g., what is the nominal rate i ? Use the exact Fisher Equation. Q3) A corporate bond pays investors both a fixed and variable rate of return. The fixed rate is constitutes the real return which is r=4.5%. The variable rate is indexed to the CPI and is to compensate investors for inflation. If the expected inflation in the next year is E()=2.5%, what is the nominal rate of return i the company will have to pay? Enter your answer in the table below in the cells colored in yellow. You must show all work to receive credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started