Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW ALL WORK. THANKS! Question: You are a portfolio manager. You need to determine the dollar weight to invest in the market portfolio and

PLEASE SHOW ALL WORK. THANKS!

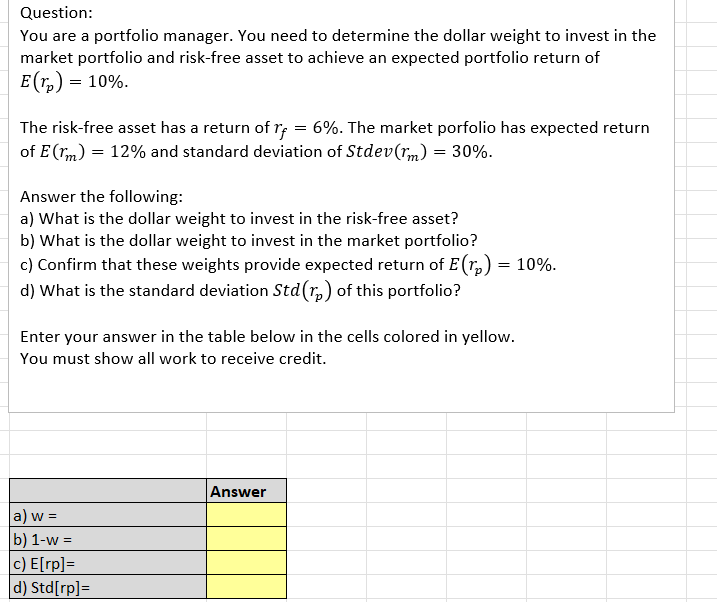

Question: You are a portfolio manager. You need to determine the dollar weight to invest in the market portfolio and risk-free asset to achieve an expected portfolio return of E(rp)=10% The risk-free asset has a return of rf=6%. The market porfolio has expected return of E(rm)=12% and standard deviation of Stdev(rm)=30%. Answer the following: a) What is the dollar weight to invest in the risk-free asset? b) What is the dollar weight to invest in the market portfolio? c) Confirm that these weights provide expected return of E(rp)=10%. d) What is the standard deviation Std(rp) of this portfolio? Enter your answer in the table below in the cells colored in yellow. You must show all work to receive creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started