Answered step by step

Verified Expert Solution

Question

1 Approved Answer

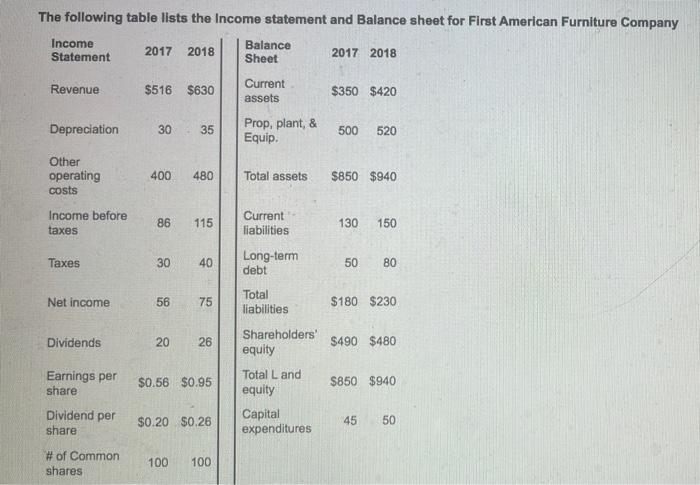

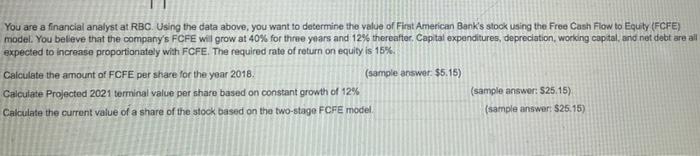

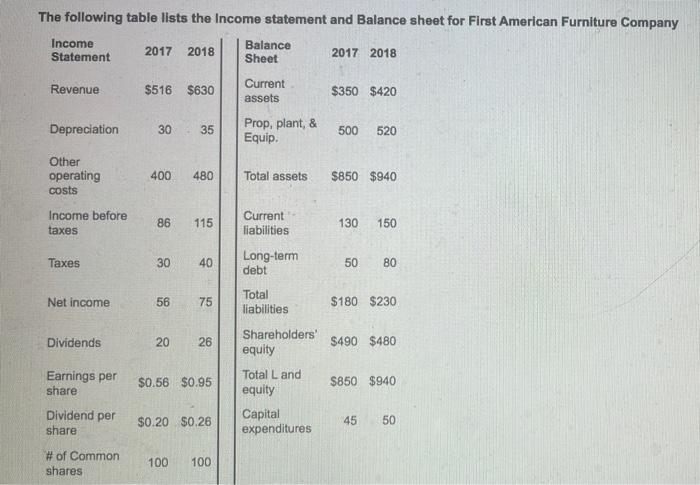

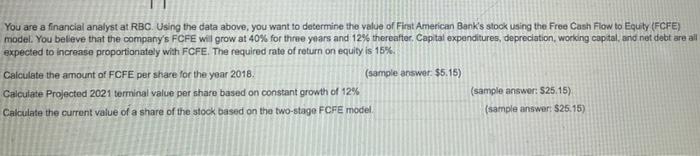

please show all work The following table lists the Income statement and Balance sheet for First American Furniture Company Income Statement Revenue Depreciation Other operating

please show all work

The following table lists the Income statement and Balance sheet for First American Furniture Company Income Statement Revenue Depreciation Other operating costs Income before taxes Taxes Net income Dividends Earnings per share Dividend per share # of Common shares 2017 2018 $516 $630 30 400 480 35 86 115 30 40 56 20 75 26 $0.56 $0.95 $0.20 $0.26 100 100 Balance Sheet Current assets Prop, plant, & Equip. Total assets Current liabilities Long-term debt Total liabilities Shareholders' equity Total L and equity Capital expenditures 2017 2018 $350 $420 500 520 $850 $940 130 150 50 80 $180 $230 $490 $480 $850 $940 45 50 You are a financial analyst at RBC. Using the data above, you want to determine the value of First American Bank's stock using the Free Cash Flow to Equity (FCFE) model. You believe that the company's FCFE will grow at 40% for three years and 12% thereafter. Capital expenditures, depreciation, working capital, and net debt are all expected to increase proportionately with FCFE. The required rate of return on equity is 15% (sample answer: $5.15) Calculate the amount of FCFE per share for the year 2018. Calculate Projected 2021 terminal value per share based on constant growth of 12% Calculate the current value of a share of the stock based on the two-stage FCFE model. (sample answer: $25.15) (sample answer: $25.15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started