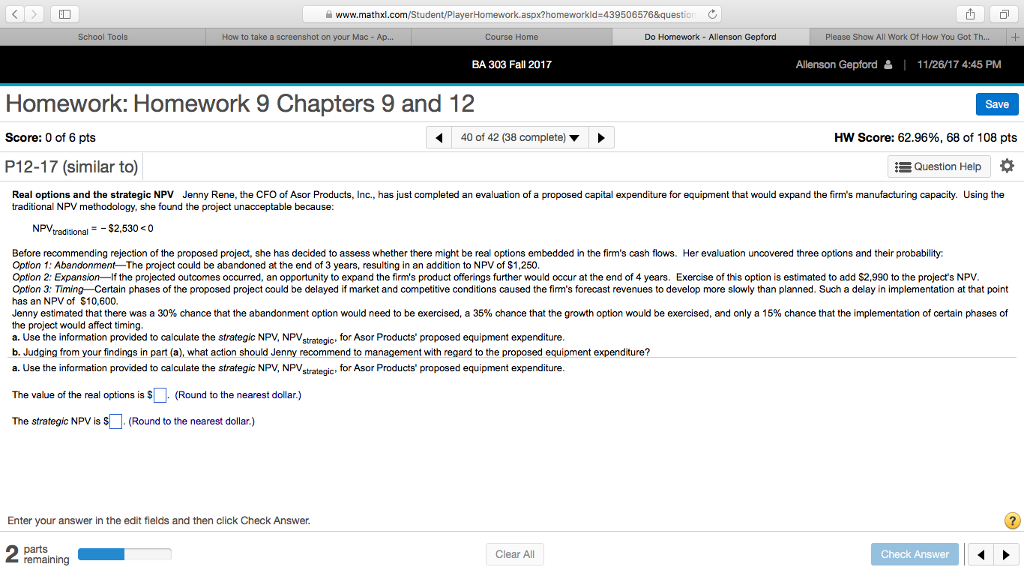

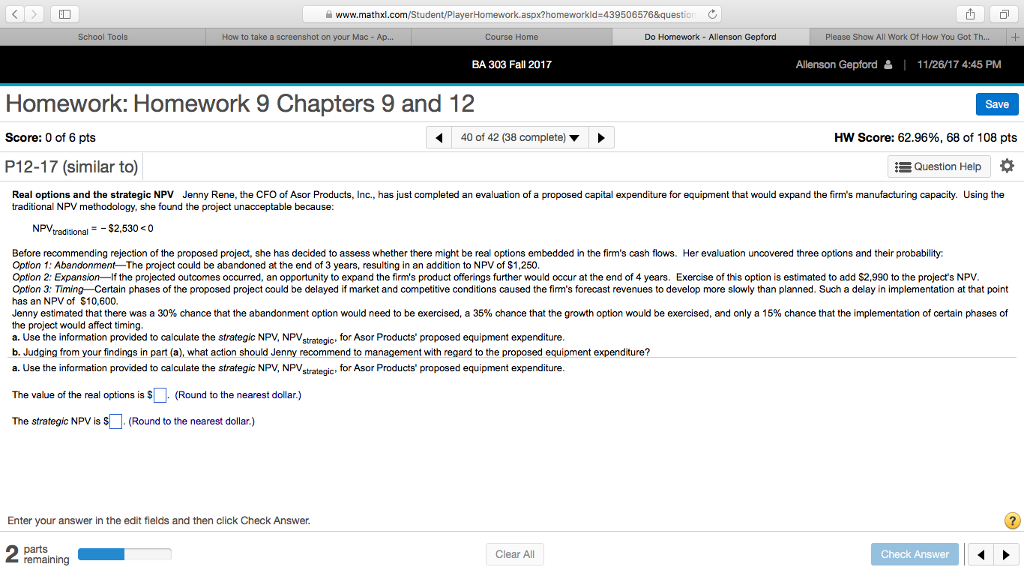

Please show all work to answer!

IED www.mathxl.com/Stu x?homework!d=439506576&questio School Tools How to take a screenshot on your Mac Ap Course Home Do Homework Allenson Gepford Please Show All Work Of How You Got Th..+ BA 303 Fall 2017 Allenson Gepford 1 1 1/26/17 4:45 PM Homework: Homework 9 Chapters 9 and 12 Score: 0 of 6 pts P12-17 (similar to) Save 40 of 42 (38 complete) Score: 62.96%, 68 of 108 pts Question Help Real options and the strategic NPV Jenny Rene, the CFO of Asor Products, Inc., has just completed an evaluation of a proposed capital expenditure for equipment that would expand the firm's manufacturing capacity. Using the traditional NPV methodology, she found the project unacceptable because NPV traditional--$2.530-0 Before recommending rejection of the proposed project, she has decided to assess whether there might be real options embedded in the firm's cash flows. Her evaluation uncovered three options and their probability Option : Abandonment The project could be abandoned at the end of 3 years, resulting in an addition to NPV of $1,250 Option 2: Expansion-If the projected outcomes occurred, an opportunity to expand the firm's product offerings further would occur at the end of 4 years. Exercise of this option is estimated to add $2,990 to the project's NPV Option 3: Timing Certain phases of the proposed project could be delayed if market and competitive conditions caused the firm's forecast revenues to develop more slowly than planned. Such a delay in implementation at that point has an NPV of $10,600. Jenny estimated that there was a 30% chance that the abandonment option would need to be exercised, a 35% chance that the growth option would be exercised, and only a 15% chance that the implementation of certain phases the project would affect timing. a. Use the information provided to calculate the strategic NPV, NPVstratogic for Asor Products' proposed equipment expenditure b. Judging from your findings in part (a), what action should Jenny recommend to management with regard to the proposed equipment expenditure? a. Use the information provided to calculate the strategic NPV, NPVstrategic for Asor Products' proposed equipment expenditure The value of the real options is $ (Round to the nearest dollar.) The strategic NPV is(Round to the nearest dollar.) Enter your answer in the edit fields and then click Check Answer parts Clear All Check