Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all working and equations used and not on excel, thank you. Question 1 City Construction Limited builds commercial and industrial buildings throughout New

Please show all working and equations used and not on excel, thank you.

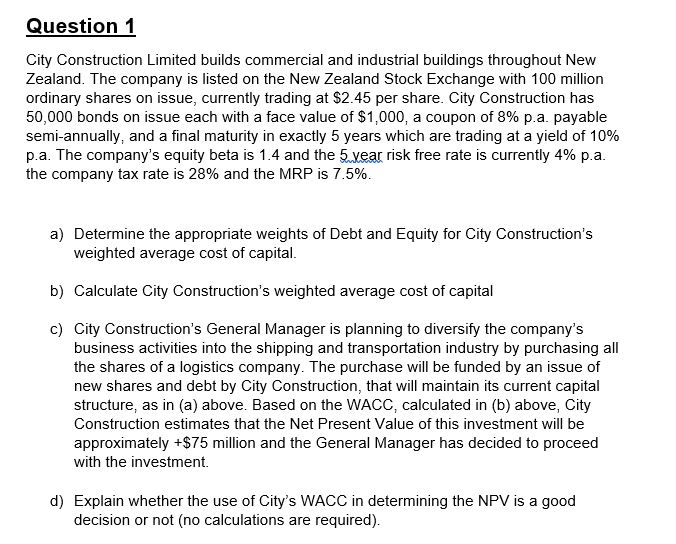

Question 1 City Construction Limited builds commercial and industrial buildings throughout New Zealand. The company is listed on the New Zealand Stock Exchange with 100 million ordinary shares on issue, currently trading at $2.45 per share. City Construction has 50,000 bonds on issue each with a face value of $1,000, a coupon of 8% p.a. payable semi-annually, and a final maturity in exactly 5 years which are trading at a yield of 10% p.a. The company's equity beta is 1.4 and the 5 year risk free rate is currently 4% p.a. the company tax rate is 28% and the MRP is 7.5%. a) Determine the appropriate weights of Debt and Equity for City Construction's weighted average cost of capital. b) Calculate City Construction's weighted average cost of capital c) City Construction's General Manager is planning to diversify the company's business activities into the shipping and transportation industry by purchasing all the shares of a logistics company. The purchase will be funded by an issue of new shares and debt by City Construction, that will maintain its current capital structure, as in (a) above. Based on the WACC, calculated in (b) above, City Construction estimates that the Net Present Value of this investment will be approximately +$75 million and the General Manager has decided to proceed with the investment. d) Explain whether the use of City's WACC in determining the NPV is a good decision or not (no calculations are required)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started