Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all working Clarendon Producers Limited has two (2) divisions, the Metro division and the Ultra Division. Currently the Metro Division sells a part

Please show all working

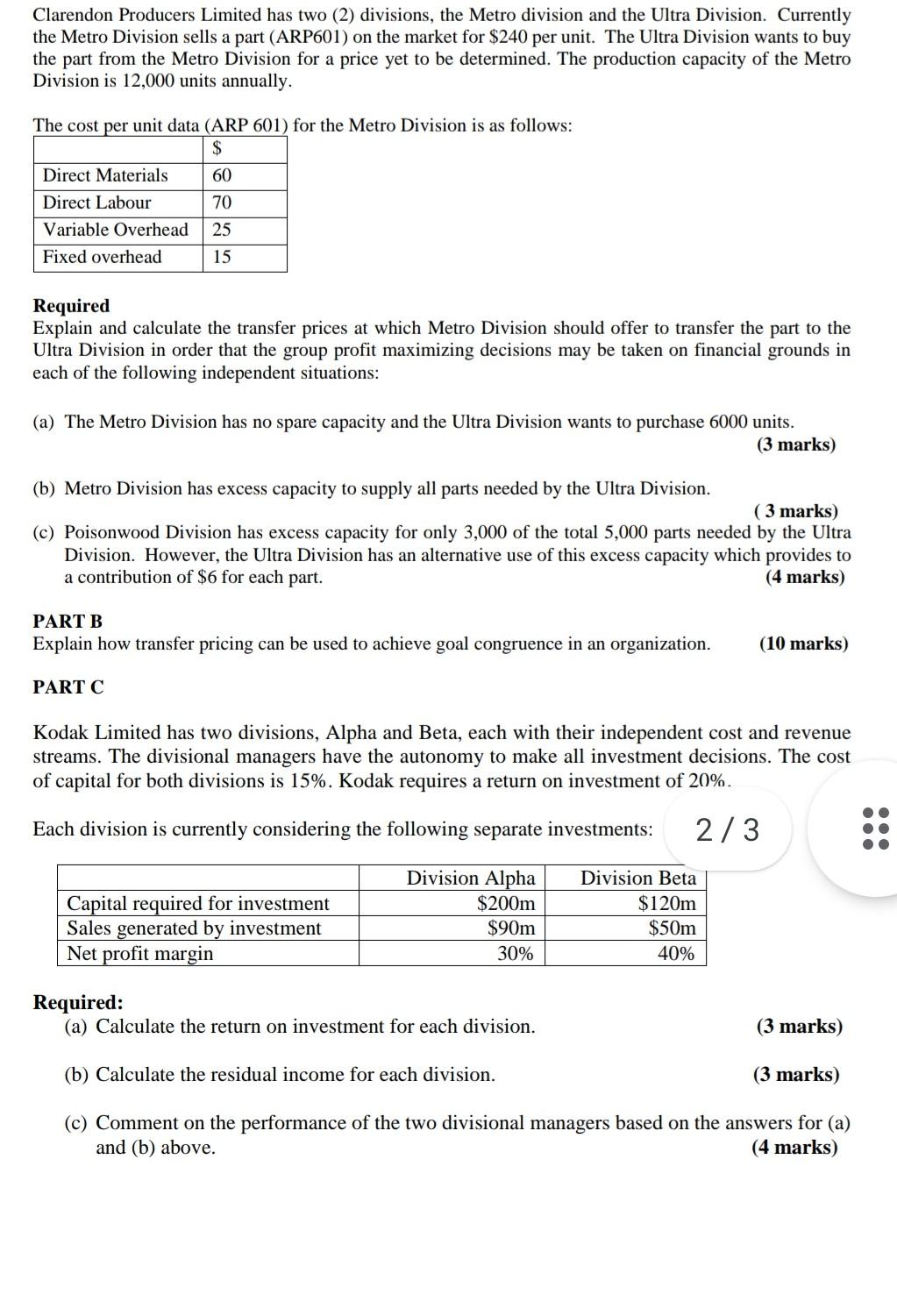

Clarendon Producers Limited has two (2) divisions, the Metro division and the Ultra Division. Currently the Metro Division sells a part (ARP601) on the market for $240 per unit. The Ultra Division wants to buy the part from the Metro Division for a price yet to be determined. The production capacity of the Metro Division is 12,000 units annually. The cost per unit data (ARP 601) for the Metro Division is as follows: $ Direct Materials 60 Direct Labour 70 Variable Overhead 25 Fixed overhead 15 Required Explain and calculate the transfer prices at which Metro Division should offer to transfer the part to the Ultra Division in order that the group profit maximizing decisions may be taken on financial grounds in each of the following independent situations: (a) The Metro Division has no spare capacity and the Ultra Division wants to purchase 6000 units. (3 marks) (b) Metro Division has excess capacity to supply all parts needed by the Ultra Division. (3 marks) (c) Poisonwood Division has excess capacity for only 3,000 of the total 5,000 parts needed by the Ultra Division. However, the Ultra Division has an alternative use of this excess capacity which provides to a contribution of $6 for each part. (4 marks) PART B Explain how transfer pricing can be used to achieve goal congruence in an organization. (10 marks) PART C Kodak Limited has two divisions, Alpha and Beta, each with their independent cost and revenue streams. The divisional managers have the autonomy to make all investment decisions. The cost of capital for both divisions is 15%. Kodak requires a return on investment of 20%. Each division is currently considering the following separate investments: 2/3 Capital required for investment Sales generated by investment Net profit margin Division Alpha $200m $90m 30% Division Beta $120m $50m 40% Required: (a) Calculate the return on investment for each division. (3 marks) (b) Calculate the residual income for each division. (3 marks) (c) Comment on the performance of the two divisional managers based on the answers for (a) and (b) above. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started