Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all working Global Sports Limited (GSL) has developed a new all-terrain sports shoe called the Stealth. The product is estimated to have a

please show all working

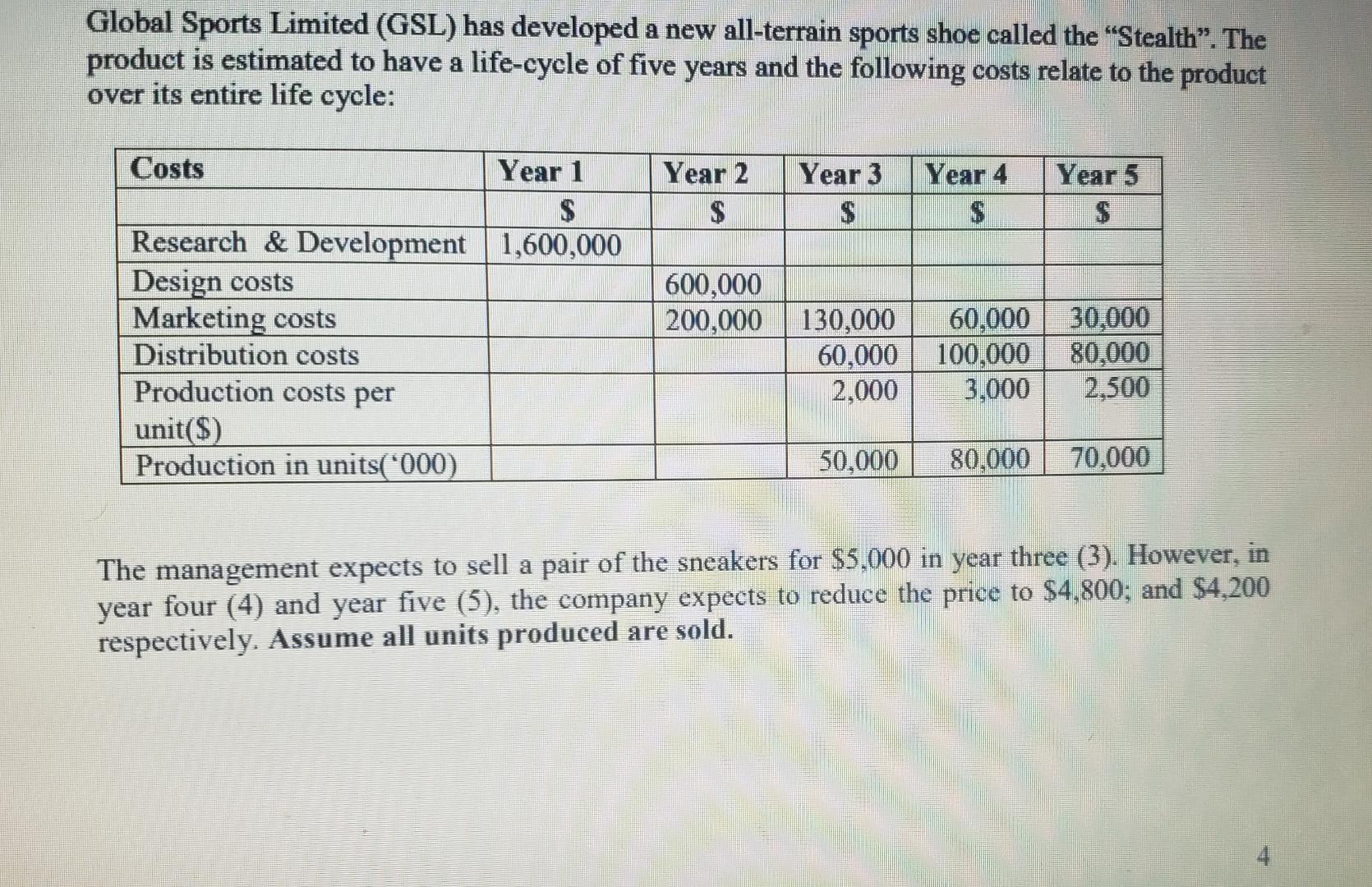

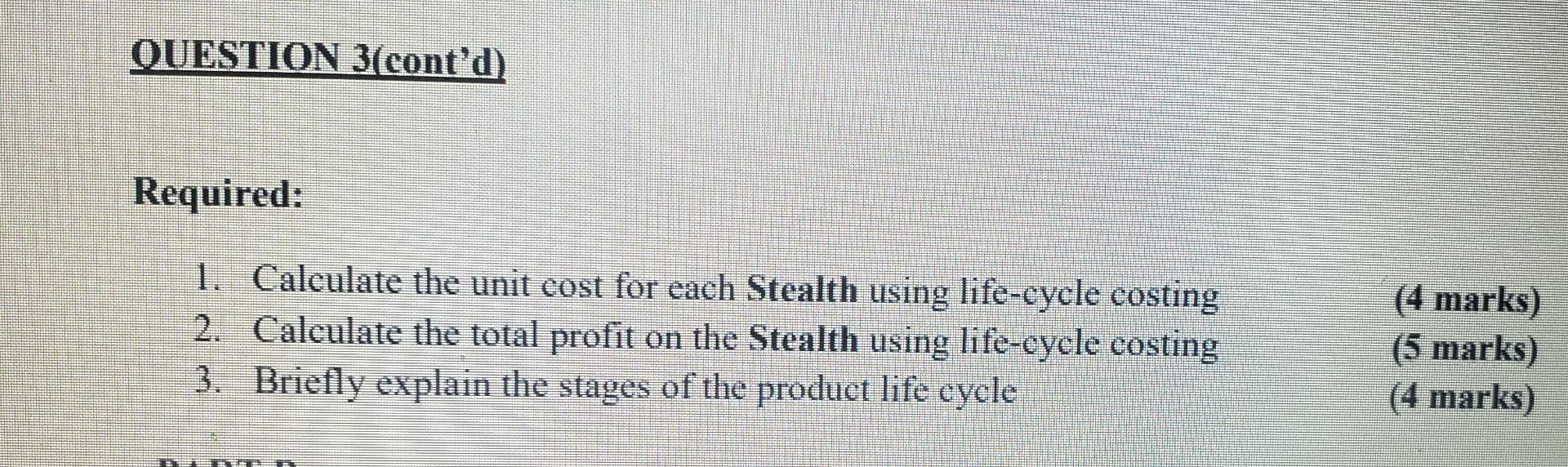

Global Sports Limited (GSL) has developed a new all-terrain sports shoe called the "Stealth. The product is estimated to have a life-cycle of five years and the following costs relate to the product over its entire life cycle: Year 3 Year 4 Year 5 Year 2 $ Costs Year 1 $ Research & Development 1,600,000 Design costs Marketing costs Distribution costs Production costs per unit($) Production in units('000) 600,000 200,000 130,000 60,000 2,000 60,000 100,000 3,000 30,000 80,000 2,500 50,000 80.000 70,000 The management expects to sell a pair of the sneakers for $5,000 in year three (3). However, in year four (4) and year five (5), the company expects to reduce the price to $4,800; and $4,200 respectively. Assume all units produced are sold. QUESTION 3(cont'd) Required: 1. Calculate the unit cost for each Stealth using life-cycle costing 2. Calculate the total profit on the Stealth using life-cycle costing 3. Briefly explain the stages of the product life cycle (4 marks) (5 marks) (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started