Answered step by step

Verified Expert Solution

Question

1 Approved Answer

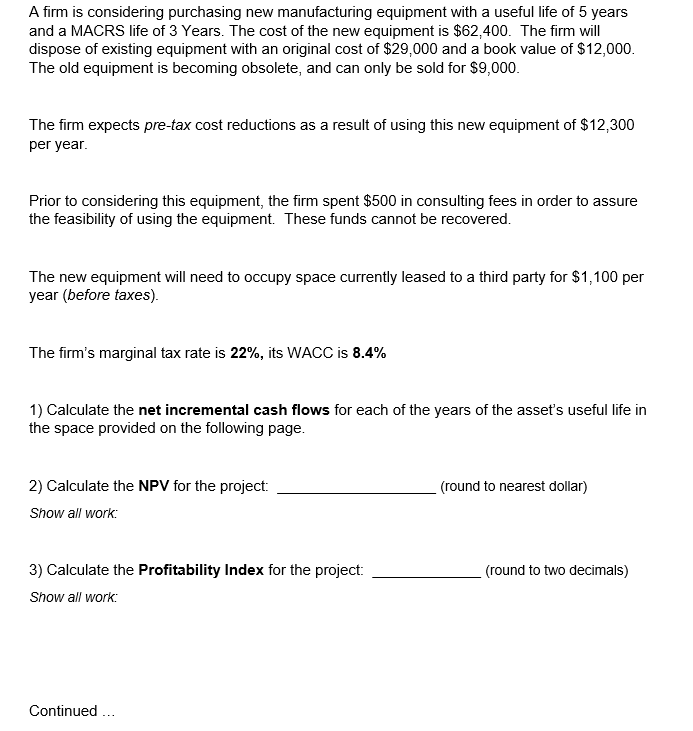

Please show any and all work or sub-calculations. A firm is considering purchasing new manufacturing equipment with a useful life of 5 years and a

Please show any and all work or sub-calculations.

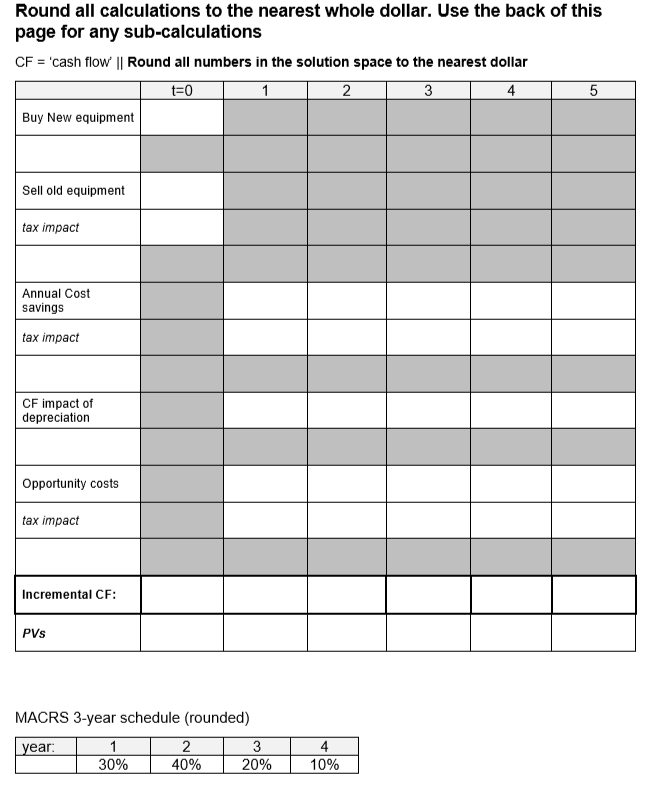

A firm is considering purchasing new manufacturing equipment with a useful life of 5 years and a MACRS life of 3 Years. The cost of the new equipment is $62,400. The firm will dispose of existing equipment with an original cost of $29,000 and a book value of $12,000. The old equipment is becoming obsolete, and can only be sold for $9,000. The firm expects pre-tax cost reductions as a result of using this new equipment of $12,300 per year. Prior to considering this equipment, the firm spent $500 in consulting fees in order to assure the feasibility of using the equipment. These funds cannot be recovered. The new equipment will need to occupy space currently leased to a third party for $1,100 per year (before taxes). The firm's marginal tax rate is 22%, its WACC is 8.4% 1) Calculate the net incremental cash flows for each of the years of the asset's useful life in the space provided on the following page (round to nearest dollar) 2) Calculate the NPV for the project: Show all work: 3) Calculate the Profitability Index for the project: (round to two decimals) Show all work: Continued... Round all calculations to the nearest whole dollar. Use the back of this page for any sub-calculations CF = 'cash flow || Round all numbers in the solution space to the nearest dollar t=0 | 1 | 2 3 4 5 Buy New equipment Sell old equipment tax impact Annual Cost Savings tax impact CF impact of depreciation Opportunity costs tax impact Incremental CF: PVs MACRS 3-year schedule (rounded) year: 1 2 3 30% 40% 20% 4 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started