Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show calculations Alice Waldon, owner of Water Way Company, decides to start a new company that will be operated as a corporation, Nature Camp

please show calculations

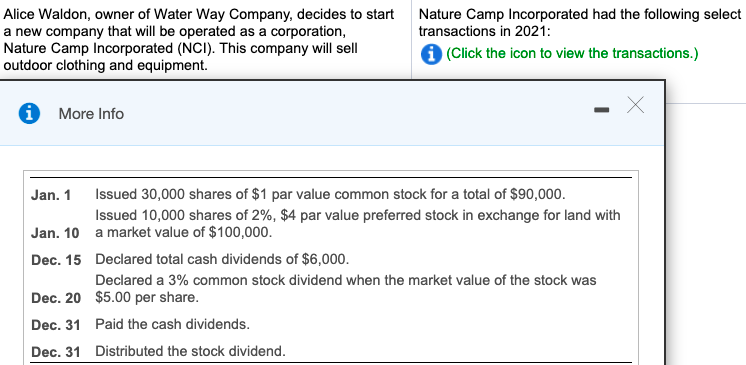

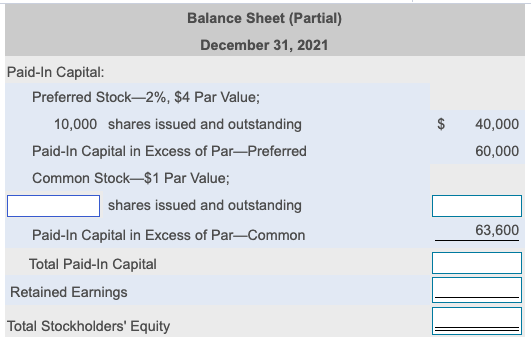

Alice Waldon, owner of Water Way Company, decides to start a new company that will be operated as a corporation, Nature Camp Incorporated (NCI). This company will sell outdoor clothing and equipment. Nature Camp Incorporated had the following select transactions in 2021: (Click the icon to view the transactions.) 0 More Info X Jan. 1 Issued 30,000 shares of $1 par value common stock for a total of $90,000. Issued 10,000 shares of 2%, $4 par value preferred stock in exchange for land with Jan. 10 a market value of $100,000. Dec. 15 Declared total cash dividends of $6,000. Declared a 3% common stock dividend when the market value of the stock was Dec. 20 $5.00 per share. Dec. 31 Paid the cash dividends. Dec. 31 Distributed the stock dividend. Balance Sheet (Partial) December 31, 2021 Paid-In Capital: Preferred Stock2%, $4 Par Value; 10,000 shares issued and outstanding Paid-In Capital in Excess of ParPreferred Common Stock-$1 Par Value; shares issued and outstanding Paid-In Capital in Excess of Par-Common Total Paid-In Capital Retained Earnings 40,000 60,000 63,600 Total Stockholders' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started