Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW CALCULATIONS AND FORMULA USED PLEASE SHOW CALCULATIONS AND FORMULA USED 15) Which of the following will result in a future value of greater

PLEASE SHOW CALCULATIONS AND FORMULA USED

PLEASE SHOW CALCULATIONS AND FORMULA USED

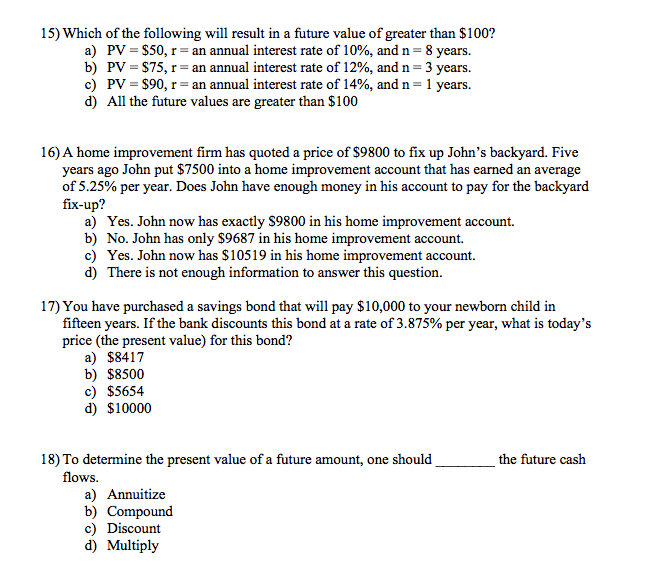

15) Which of the following will result in a future value of greater than $100? a) b) c) d) PV-$50, r-an annual interest rate of 10%, and n 8 years. PV-$75, r-an annual interest rate of 12%, and n-3 years. PV = $90, r-an annual interest rate of 14%, and n-1 years. All the future values are greater than $100 16) A home improvement firm has quoted a price of S9800 to fix up John's backyard. Five years ago John put $7500 into a home improvement account that has earned an average of 5.25% per year. Does John have enough money in his account to pay for the backyard fix-up? a) Yes. John now has exactly S9800 in his home improvement account. b) No. John has only $9687 in his home improvement account. c) Yes. John now has S10519 in his home improvement account. There is not enough information to answer this question. 17) You have purchased a savings bond that will pay $10,000 to your newborn child in fifteen years. If the bank discounts this bond at a rate of 3.875% per year, what is today's price (the present value) for this bond? a) $8417 b) $8500 c) $5654 d) $10000 18) To determine the present value of a future amount, one should the future cash flows a) Annuitize b) Compound c) Discount d) MultiplyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started