Answered step by step

Verified Expert Solution

Question

1 Approved Answer

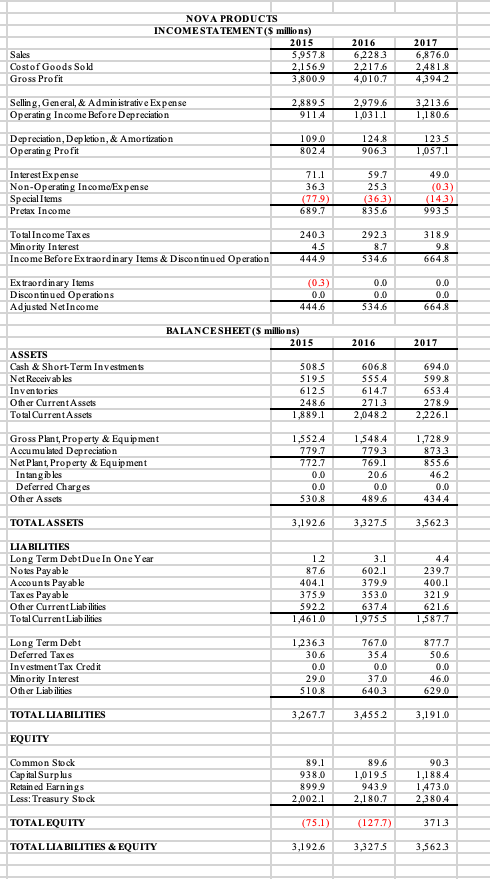

Please show calculations as well as complete sentences. Using the financial statements provided below to answer the following questions: a . What was the book

Please show calculations as well as complete sentences. Using the financial statements provided below to answer the following questions:

a What was the book value of Nova's shareholders' equity from to What were Nova's debttoassets and timesinterestearned ratios in these years? Use pretax income plus interest expense as EBIT. What do these figures suggest about Nova's use of financial leverage? Consulting Table in the text, what bond rating would Nova have in if the rating were based solely on the firm's coverage ratio?

b What percentage decline in EBIT could Nova have suffered in each year before Nova would have been unable to make its interest payments out of operating income?

c Assuming a percent corporate tax rate, and earnings before interest and taxes of $ million, by how much did Nova's $ million interest expense reduce taxes?

d Answer question a and b again for assuming the company had borrowed an additional $ billion in debt at percent interest at the start of the year and distributed the proceeds to shareholders as a special dividend. You may ignore the effect of added interest expense on Nova's balance sheet. Might shareholders benefit from such an increase in financial leverage? Enlain.

e Based on your analysis, is Nova heavily or modestly indebted? Should the company acquire more debt, or shed existing debt? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started