Answered step by step

Verified Expert Solution

Question

1 Approved Answer

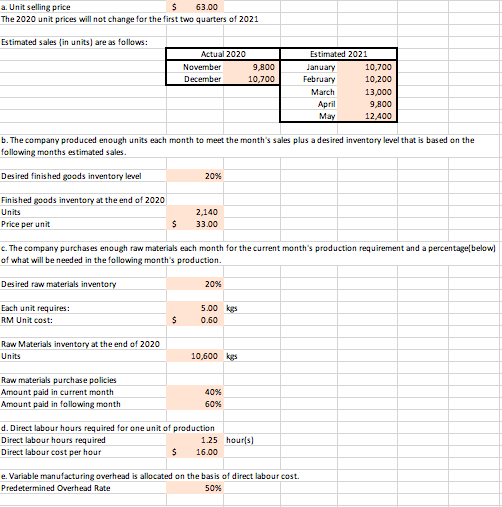

Please show calculations so I can understand how to actually do it please. Thanks a. Unit selling price $ 63.00 The 2020 unit prices will

Please show calculations so I can understand how to actually do it please. Thanks

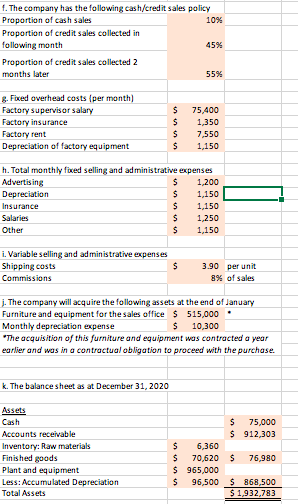

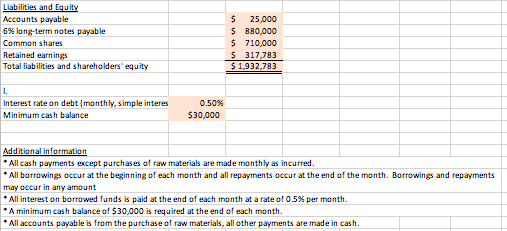

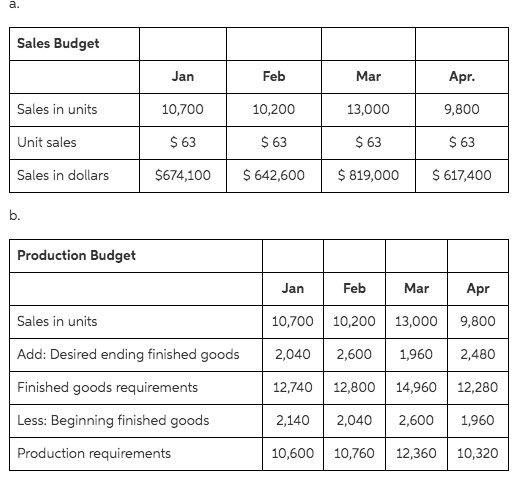

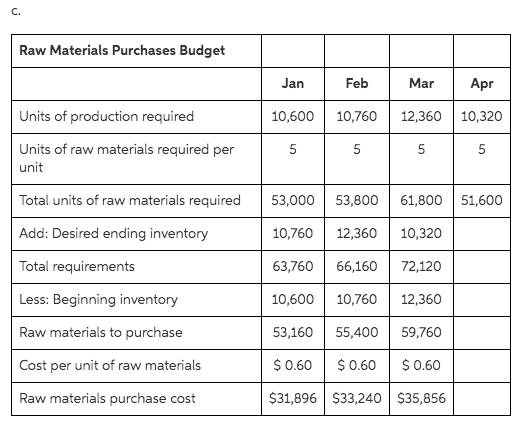

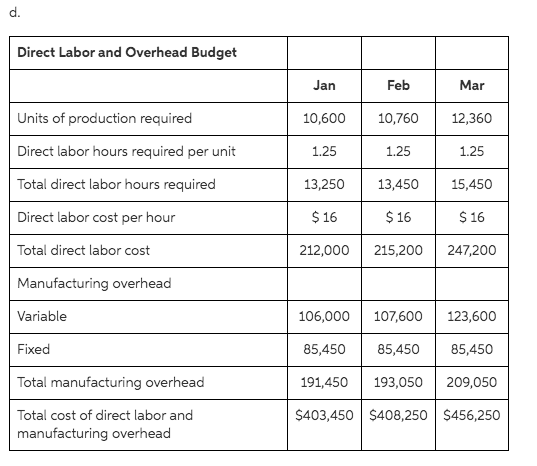

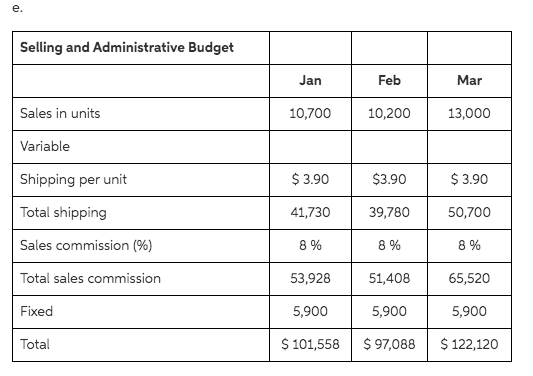

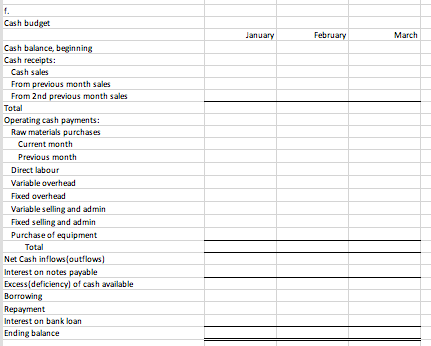

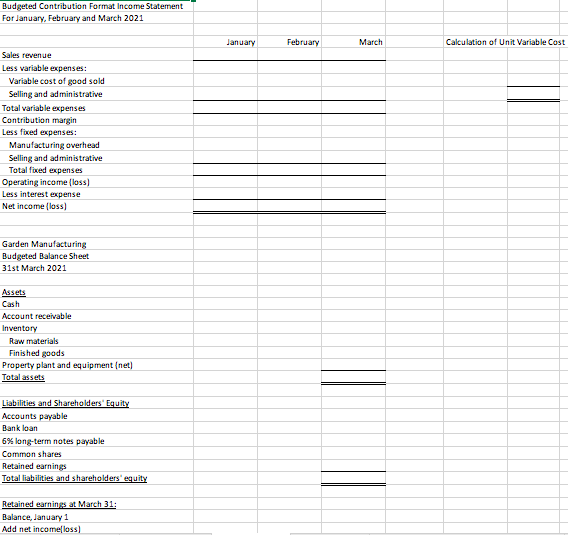

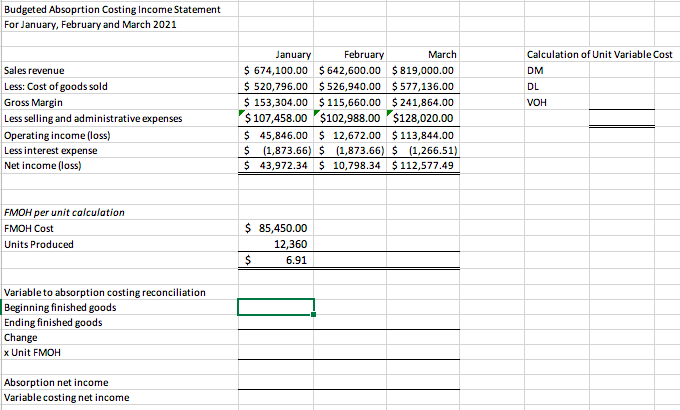

a. Unit selling price $ 63.00 The 2020 unit prices will not change for the first two quarters of 2021 Estimated sales in units) are as follows: Actual 2020 November 9,800 December 10,700 Estimated 2021 January 10,700 February 10,200 March 13,000 April 9,800 May 12,400 b. The company produced enough units each month to meet the month's sales plus a desired inventory level that is based on the following months estimated sales. Desired finished goods inventory level 20% Finished goods inventory at the end of 2020 Units Price per unit 2,140 33.00 $ c. The company purchases enough raw materials each month for the current month's production requirement and a percentage[below of what will be needed in the following month's production. Desired raw materials inventory 20% Each unit requires: RM Unit cost: 5.00 kgs 0.60 $ Raw Materials inventory at the end of 2020 Units 10,600 kgs Raw materials purchase policies Amount paid in current month Amount paid in following month 40% 60% d. Direct labour hours required for one unit of production Direct labour hours required 1.25 hours Direct labour cost per hour $ 16.00 e. Variable manufacturing overhead is allocated on the basis of direct labour cost. Predetermined Overhead Rate 50% f. The company has the following cash/credit sales policy Proportion of cash sales 10% Proportion of credit sales collected in following month 45% Proportion of credit sales collected 2 months later 55% g. Fixed overhead costs (per month) Factory supervisor salary Factory insurance Factory rent Depreciation of factory equipment $ $ S $ 75,400 1,350 7,550 1,150 ht. Total monthly fixed selling and administrative expenses Advertising $ 1,200 Depreciation $ 1,150 Insurance S 1,150 Salaries $ 1,250 Other S 1,150 i. Variable selling and administrative expenses Shipping costs Commissions $ 3.90 per unit 8% of sales j. The company will acquire the following assets at the end of January Furniture and equipment for the sales office $ 515,000 Monthly depreciation expense $ 10,300 "The acquisition of this furniture and equipment was contracted a year earlier and was in a contractual obligation to proceed with the purchase k. The balance sheet as at December 31, 2020 S 75,000 $ 912,303 Assets Cash Accounts receivable Inventory: Raw materials Finished goods Plant and equipment Less: Accumulated Depreciation Total Assets $ 76,980 $ 6,360 $ 70,620 $ 965,000 $ 96,500 $ 868,500 $ 1,932,783 Liabilities and Equity Accounts payable 6% long-term notes payable Common shares Retained earnings Total liabilities and shareholders' equity S 25,000 $ 880,000 $ 710,000 $317,783 $ 1,932,783 L Interest rate on debt monthly, simple interes Minimum cash balance 0.50% $30,000 Additional information * All cash payments except purchases of raw materials are made monthly as incurred. * All borrowings occur at the beginning of each month and all repayments occur at the end of the month. Borrowings and repayments may occur in any amount * All interest on borrowed funds is paid at the end of each month at a rate of 0.5% per month * A minimum cash balance of $30,000 is required at the end of each month. * All accounts payable is from the purchase of raw materials, all other payments are made in cash. a. Sales Budget Jan Feb Mar Apr. Sales in units 10,700 10,200 13,000 9,800 Unit sales $ 63 $63 $ 63 $ 63 Sales in dollars $674,100 $ 642,600 $ 819,000 $ 617,400 b. Production Budget Jan Feb Mar Apr Sales in units 10,700 10,200 13,000 9,800 2,040 2,600 1,960 2,480 Add: Desired ending finished goods Finished goods requirements Less: Beginning finished goods 12,740 12,800 14,960 12,280 2,140 2,040 2,600 1,960 Production requirements 10,600 10,760 12,360 10,320 C. Raw Materials Purchases Budget Jan Feb Mar Apr 10,600 10,760 12,360 10,320 Units of production required Units of raw materials required per unit 5 5 5 5 Total units of raw materials required 53,000 53,800 61,800 51,600 Add: Desired ending inventory 10,760 12,360 10,320 Total requirements 63,760 66,160 72,120 Less: Beginning inventory 10,600 10,760 12,360 Raw materials to purchase 53,160 55,400 59,760 Cost per unit of raw materials $ 0.60 $ 0.60 $ 0.60 Raw materials purchase cost $31,896 $33,240 $35,856 d. Direct Labor and Overhead Budget Jan Feb Mar Units of production required 10,600 10,760 12,360 1.25 1.25 1.25 Direct labor hours required per unit Total direct labor hours required 13,250 13,450 15,450 Direct labor cost per hour $16 $16 $ 16 Total direct labor cost 212,000 215,200 247,200 Manufacturing overhead Variable 106,000 107,600 123,600 Fixed 85,450 85,450 85,450 191,450 193,050 209,050 Total manufacturing overhead Total cost of direct labor and manufacturing overhead $403,450 $408,250 $456,250 e. Selling and Administrative Budget Jan Feb Mar Sales in units 10,700 10,200 13,000 Variable $ 3.90 $3.90 $3.90 Shipping per unit Total shipping 41,730 39,780 50,700 Sales commission (%) 8 % 8 % 8 % Total sales commission 53,928 51,408 65,520 Fixed 5,900 5,900 5,900 Total $ 101,558 $ 97,088 $ 122,120 1. Cash budget January February March Cash balance, beginning Cash receipts: Cash sales From previous month sales From 2nd previous month sales Total Operating cash payments: Raw materials purchases Current month Previous month Direct labour Variable overhead Fixed overhead Variable selling and admin Fixed selling and admin Purchase of equipment Total Net Cash inflows(outflows) Interest on notes payable Excess deficiency of cash available Borrowing Repayment Interest on bank loan Ending balance Budgeted Contribution Format Income Statement For January, February and March 2021 January February March Calculation of Unit Variable Cost Sales revenue Less variable expenses: Variable cost of good sold Selling and administrative Total variable expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling and administrative Totalfixed expenses Operating income loss) Less interest expense Net income loss) Garden Manufacturing Budgeted Balance Sheet 31st March 2021 Assets Cash Account receivable Inventory Raw materials Finished goods Property plant and equipment (net) Total assets Liabilities and Shareholders' Equity Accounts payable Bank loan 6% long-term notes payable Common shares Retained earnings Total liabilities and shareholders' equity Retained earnings at March 31: Balance, January 1 Add net incomelloss Budgeted Absoprtion Costing Income Statement For January, February and March 2021 Calculation of Unit Variable Cost DM DL VOH Sales revenue Less: Cost of goods sold Gross Margin Less selling and administrative expenses Operating income (loss) Less interest expense Net income (loss) January February March $ 674,100.00 $ 642,600.00 $ 819,000.00 $ 520,796.00 $ 526,940.00 $ 577,136.00 $ 153,304.00 $ 115,660.00 $ 241,864.00 $ 107,458.00 $102,988.00 $128,020.00 $ 45,846.00 $ 12,672.00 $ 113,844.00 $ (1,873.66) $ (1,873.66) $ (1,266.51) $ 43,972.34 $ 10,798.34 $ 112,577.49 FMOH per unit calculation FMOH Cost Units Produced $ 85,450.00 12,360 $ 6.91 Variable to absorption costing reconciliation Beginning finished goods Ending finished goods Change x Unit FMOH Absorption net income Variable costing net income a. Unit selling price $ 63.00 The 2020 unit prices will not change for the first two quarters of 2021 Estimated sales in units) are as follows: Actual 2020 November 9,800 December 10,700 Estimated 2021 January 10,700 February 10,200 March 13,000 April 9,800 May 12,400 b. The company produced enough units each month to meet the month's sales plus a desired inventory level that is based on the following months estimated sales. Desired finished goods inventory level 20% Finished goods inventory at the end of 2020 Units Price per unit 2,140 33.00 $ c. The company purchases enough raw materials each month for the current month's production requirement and a percentage[below of what will be needed in the following month's production. Desired raw materials inventory 20% Each unit requires: RM Unit cost: 5.00 kgs 0.60 $ Raw Materials inventory at the end of 2020 Units 10,600 kgs Raw materials purchase policies Amount paid in current month Amount paid in following month 40% 60% d. Direct labour hours required for one unit of production Direct labour hours required 1.25 hours Direct labour cost per hour $ 16.00 e. Variable manufacturing overhead is allocated on the basis of direct labour cost. Predetermined Overhead Rate 50% f. The company has the following cash/credit sales policy Proportion of cash sales 10% Proportion of credit sales collected in following month 45% Proportion of credit sales collected 2 months later 55% g. Fixed overhead costs (per month) Factory supervisor salary Factory insurance Factory rent Depreciation of factory equipment $ $ S $ 75,400 1,350 7,550 1,150 ht. Total monthly fixed selling and administrative expenses Advertising $ 1,200 Depreciation $ 1,150 Insurance S 1,150 Salaries $ 1,250 Other S 1,150 i. Variable selling and administrative expenses Shipping costs Commissions $ 3.90 per unit 8% of sales j. The company will acquire the following assets at the end of January Furniture and equipment for the sales office $ 515,000 Monthly depreciation expense $ 10,300 "The acquisition of this furniture and equipment was contracted a year earlier and was in a contractual obligation to proceed with the purchase k. The balance sheet as at December 31, 2020 S 75,000 $ 912,303 Assets Cash Accounts receivable Inventory: Raw materials Finished goods Plant and equipment Less: Accumulated Depreciation Total Assets $ 76,980 $ 6,360 $ 70,620 $ 965,000 $ 96,500 $ 868,500 $ 1,932,783 Liabilities and Equity Accounts payable 6% long-term notes payable Common shares Retained earnings Total liabilities and shareholders' equity S 25,000 $ 880,000 $ 710,000 $317,783 $ 1,932,783 L Interest rate on debt monthly, simple interes Minimum cash balance 0.50% $30,000 Additional information * All cash payments except purchases of raw materials are made monthly as incurred. * All borrowings occur at the beginning of each month and all repayments occur at the end of the month. Borrowings and repayments may occur in any amount * All interest on borrowed funds is paid at the end of each month at a rate of 0.5% per month * A minimum cash balance of $30,000 is required at the end of each month. * All accounts payable is from the purchase of raw materials, all other payments are made in cash. a. Sales Budget Jan Feb Mar Apr. Sales in units 10,700 10,200 13,000 9,800 Unit sales $ 63 $63 $ 63 $ 63 Sales in dollars $674,100 $ 642,600 $ 819,000 $ 617,400 b. Production Budget Jan Feb Mar Apr Sales in units 10,700 10,200 13,000 9,800 2,040 2,600 1,960 2,480 Add: Desired ending finished goods Finished goods requirements Less: Beginning finished goods 12,740 12,800 14,960 12,280 2,140 2,040 2,600 1,960 Production requirements 10,600 10,760 12,360 10,320 C. Raw Materials Purchases Budget Jan Feb Mar Apr 10,600 10,760 12,360 10,320 Units of production required Units of raw materials required per unit 5 5 5 5 Total units of raw materials required 53,000 53,800 61,800 51,600 Add: Desired ending inventory 10,760 12,360 10,320 Total requirements 63,760 66,160 72,120 Less: Beginning inventory 10,600 10,760 12,360 Raw materials to purchase 53,160 55,400 59,760 Cost per unit of raw materials $ 0.60 $ 0.60 $ 0.60 Raw materials purchase cost $31,896 $33,240 $35,856 d. Direct Labor and Overhead Budget Jan Feb Mar Units of production required 10,600 10,760 12,360 1.25 1.25 1.25 Direct labor hours required per unit Total direct labor hours required 13,250 13,450 15,450 Direct labor cost per hour $16 $16 $ 16 Total direct labor cost 212,000 215,200 247,200 Manufacturing overhead Variable 106,000 107,600 123,600 Fixed 85,450 85,450 85,450 191,450 193,050 209,050 Total manufacturing overhead Total cost of direct labor and manufacturing overhead $403,450 $408,250 $456,250 e. Selling and Administrative Budget Jan Feb Mar Sales in units 10,700 10,200 13,000 Variable $ 3.90 $3.90 $3.90 Shipping per unit Total shipping 41,730 39,780 50,700 Sales commission (%) 8 % 8 % 8 % Total sales commission 53,928 51,408 65,520 Fixed 5,900 5,900 5,900 Total $ 101,558 $ 97,088 $ 122,120 1. Cash budget January February March Cash balance, beginning Cash receipts: Cash sales From previous month sales From 2nd previous month sales Total Operating cash payments: Raw materials purchases Current month Previous month Direct labour Variable overhead Fixed overhead Variable selling and admin Fixed selling and admin Purchase of equipment Total Net Cash inflows(outflows) Interest on notes payable Excess deficiency of cash available Borrowing Repayment Interest on bank loan Ending balance Budgeted Contribution Format Income Statement For January, February and March 2021 January February March Calculation of Unit Variable Cost Sales revenue Less variable expenses: Variable cost of good sold Selling and administrative Total variable expenses Contribution margin Less fixed expenses: Manufacturing overhead Selling and administrative Totalfixed expenses Operating income loss) Less interest expense Net income loss) Garden Manufacturing Budgeted Balance Sheet 31st March 2021 Assets Cash Account receivable Inventory Raw materials Finished goods Property plant and equipment (net) Total assets Liabilities and Shareholders' Equity Accounts payable Bank loan 6% long-term notes payable Common shares Retained earnings Total liabilities and shareholders' equity Retained earnings at March 31: Balance, January 1 Add net incomelloss Budgeted Absoprtion Costing Income Statement For January, February and March 2021 Calculation of Unit Variable Cost DM DL VOH Sales revenue Less: Cost of goods sold Gross Margin Less selling and administrative expenses Operating income (loss) Less interest expense Net income (loss) January February March $ 674,100.00 $ 642,600.00 $ 819,000.00 $ 520,796.00 $ 526,940.00 $ 577,136.00 $ 153,304.00 $ 115,660.00 $ 241,864.00 $ 107,458.00 $102,988.00 $128,020.00 $ 45,846.00 $ 12,672.00 $ 113,844.00 $ (1,873.66) $ (1,873.66) $ (1,266.51) $ 43,972.34 $ 10,798.34 $ 112,577.49 FMOH per unit calculation FMOH Cost Units Produced $ 85,450.00 12,360 $ 6.91 Variable to absorption costing reconciliation Beginning finished goods Ending finished goods Change x Unit FMOH Absorption net income Variable costing net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started