Question

PLEASE SHOW CALCULATIONS!!! What self-employment/payroll taxes will be paid if Bev operates as a sole proprietorship? (Enter as a positive number) What is Bev's taxable

PLEASE SHOW CALCULATIONS!!!

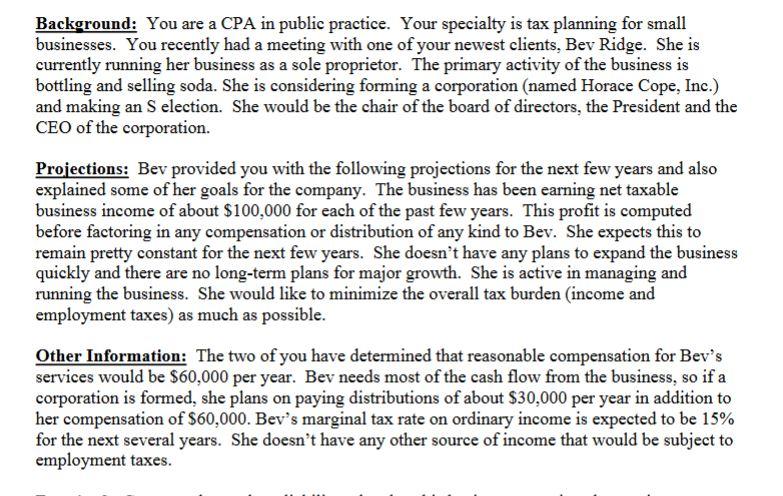

What self-employment/payroll taxes will be paid if Bev operates as a sole proprietorship? (Enter as a positive number)

What is Bev's taxable income before QBI deduction?

What is the QBI deduction if Bev operates a sole proprietorship? (Enter as a positive number)

What self-employment/payroll taxes will be paid (total) if Bev forms a S Corporation? (Enter as a positive number)

What is the QBI deduction if Bev operates form a S corporation? (Enter as a positive number)

What income taxes will Bev's S corporation, Horace Cope, pay? (Enter as a positive number)

What income taxes will Bev pay? (Enter as a positive number)

Background: You are a CPA in public practice. Your specialty is tax planning for small businesses. You recently had a meeting with one of your newest clients, Bev Ridge. She is currently running her business as a sole proprietor. The primary activity of the business is bottling and selling soda. She is considering forming a corporation (named Horace Cope, Inc.) and making an Selection. She would be the chair of the board of directors, the President and the CEO of the corporation. Projections: Bev provided you with the following projections for the next few years and also explained some of her goals for the company. The business has been earning net taxable business income of about $100,000 for each of the past few years. This profit is computed before factoring in any compensation or distribution of any kind to Bev. She expects this to remain pretty constant for the next few years. She doesn't have any plans to expand the business quickly and there are no long-term plans for major growth. She is active in managing and running the business. She would like to minimize the overall tax burden (income and employment taxes) as much as possible. Other Information: The two of you have determined that reasonable compensation for Bev's services would be $60,000 per year. Bev needs most of the cash flow from the business, so if a corporation is formed, she plans on paying distributions of about $30,000 per year in addition to her compensation of $60,000. Bev's marginal tax rate on ordinary income is expected to be 15% for the next several years. She doesn't have any other source of income that would be subject to employment taxes. Background: You are a CPA in public practice. Your specialty is tax planning for small businesses. You recently had a meeting with one of your newest clients, Bev Ridge. She is currently running her business as a sole proprietor. The primary activity of the business is bottling and selling soda. She is considering forming a corporation (named Horace Cope, Inc.) and making an Selection. She would be the chair of the board of directors, the President and the CEO of the corporation. Projections: Bev provided you with the following projections for the next few years and also explained some of her goals for the company. The business has been earning net taxable business income of about $100,000 for each of the past few years. This profit is computed before factoring in any compensation or distribution of any kind to Bev. She expects this to remain pretty constant for the next few years. She doesn't have any plans to expand the business quickly and there are no long-term plans for major growth. She is active in managing and running the business. She would like to minimize the overall tax burden (income and employment taxes) as much as possible. Other Information: The two of you have determined that reasonable compensation for Bev's services would be $60,000 per year. Bev needs most of the cash flow from the business, so if a corporation is formed, she plans on paying distributions of about $30,000 per year in addition to her compensation of $60,000. Bev's marginal tax rate on ordinary income is expected to be 15% for the next several years. She doesn't have any other source of income that would be subject to employment taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started