Answered step by step

Verified Expert Solution

Question

1 Approved Answer

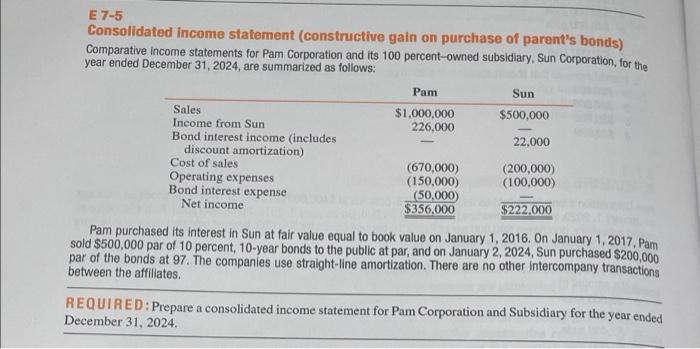

please show clean work E 7-5 Consolidated Income statement (constructive gain on purchase of parent's bonds) Comparative income statements for Pam Corporation and its 100

please show clean work

E 7-5 Consolidated Income statement (constructive gain on purchase of parent's bonds) Comparative income statements for Pam Corporation and its 100 percent-owned subsidiary, Sun Corporation, for the year ended December 31, 2024, are summarized as follows: Pam Sun Sales $1,000,000 $500,000 Income from Sun 226,000 Bond interest income (includes 22,000 discount amortization) Cost of sales (670,000) (200,000) Operating expenses (150,000) (100,000) Bond interest expense (50,000 Net income $356,000 $222,000 Pam purchased its interest in Sun at fair value equal to book value on January 1, 2016. On January 1, 2017. Pam sold $500,000 par of 10 percent, 10-year bonds to the public at par, and on January 2, 2024, Sun purchased $200,000 par of the bonds at 97. The companies use straight-line amortization. There are no other Intercompany transactions between the affiliates. REQUIRED: Prepare a consolidated income statement for Pam Corporation and Subsidiary for the year ended December 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started