Please SHOW COMPLETE SOLUTIONS and with label.

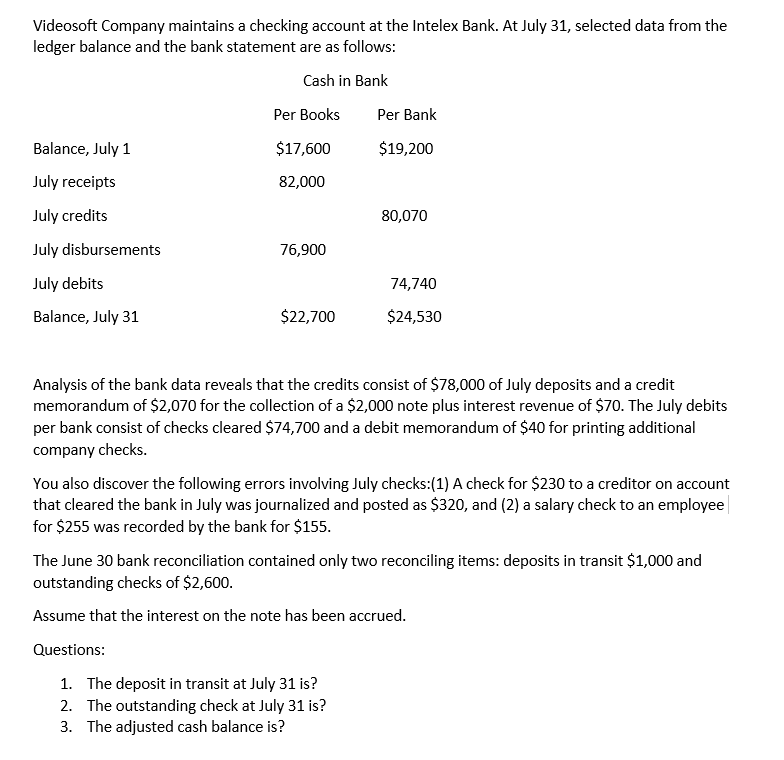

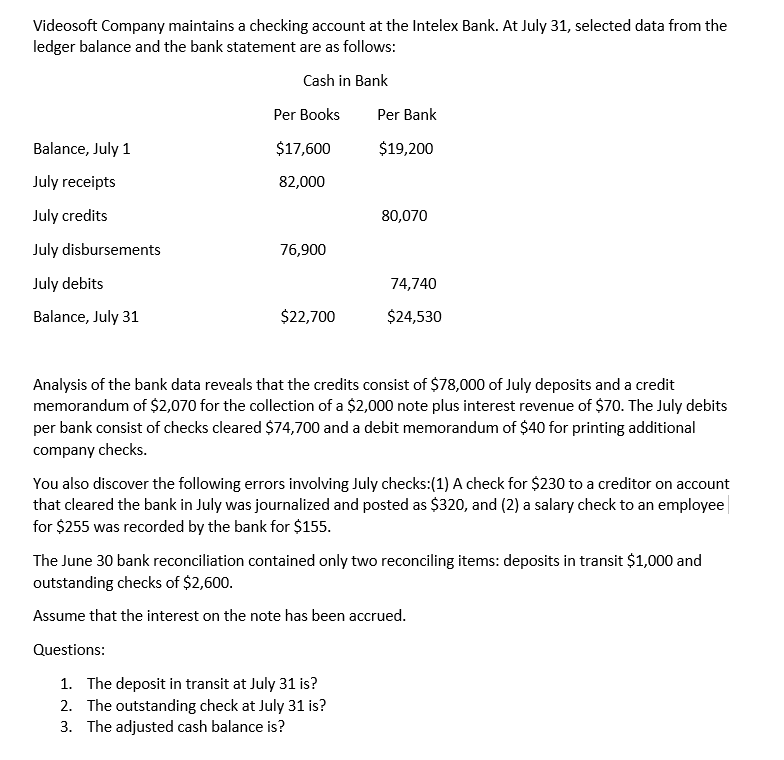

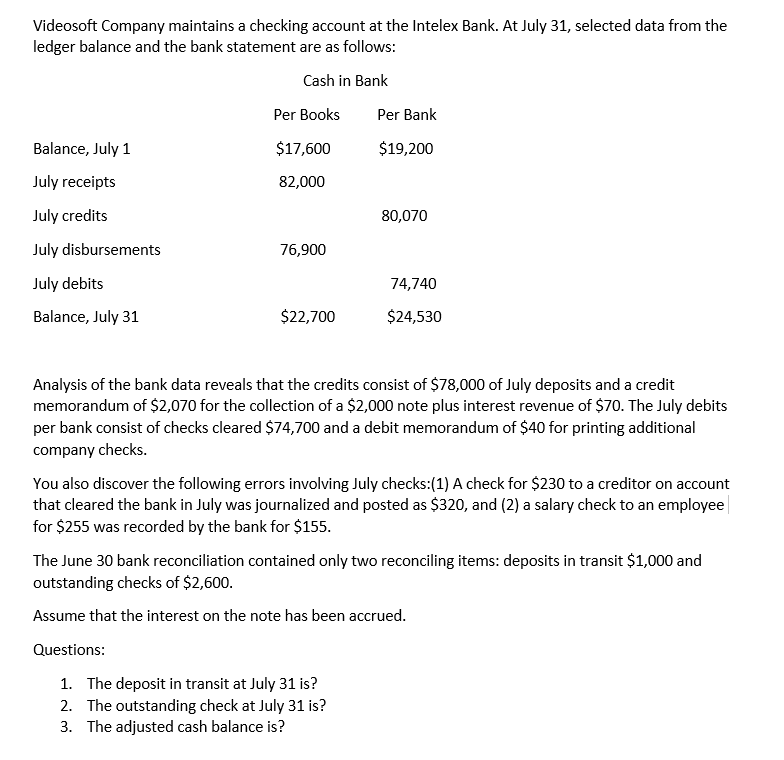

1.)

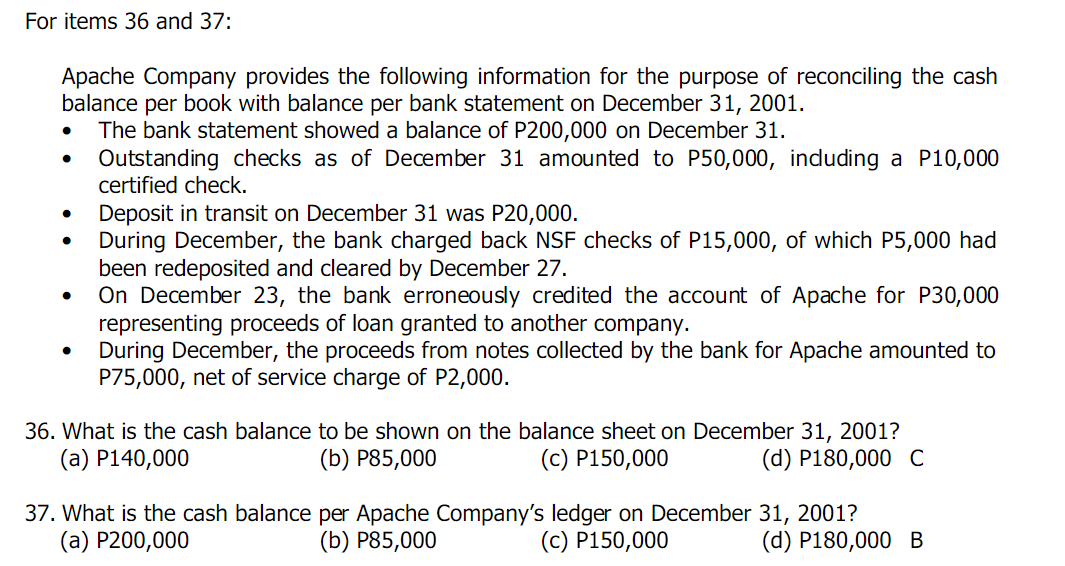

For items 36 and 37: Apache Company provides the following information for the purpose of reconciling the cash balance per book with balance per bank statement on December 31, 2001. The bank statement showed a balance of P200,000 on December 31. Outstanding checks as of December 31 amounted to P50,000, induding a P10,000 certified check. . Deposit in transit on December 31 was P20,000. During December, the bank charged back NSF checks of P15,000, of which P5,000 had been redeposited and cleared by December 27. On December 23, the bank erroneously credited the account of Apache for P30,000 representing proceeds of loan granted to another company. During December, the proceeds from notes collected by the bank for Apache amounted to P75,000, net of service charge of P2,000. 36. What is the cash balance to be shown on the balance sheet on December 31, 2001? (a) P140,000 (b) P85,000 (c) P150,000 (d) P180,000 C 37. What is the cash balance per Apache Company's ledger on December 31, 2001? (a) P200,000 (b) P85,000 (c) P150,000 (d) P180,000 BVideosoft Company maintains a checking account at the Intelex Bank. At July 31, selected data from the ledger balance and the bank statement are as follows: Cash in Bank Per Books Per Bank Balance, July 1 $17,600 $19,200 July receipts 82,000 July credits 80,070 July disbursements 76,900 July debits 74,740 Balance, July 31 $22,700 $24,530 Analysis of the bank data reveals that the credits consist of $78,000 of July deposits and a credit memorandum of $2,070 for the collection of a $2,000 note plus interest revenue of $70. The July debits per bank consist of checks cleared $74,700 and a debit memorandum of $40 for printing additional company checks. You also discover the following errors involving July checks:(1) A check for $230 to a creditor on account that cleared the bank in July was journalized and posted as $320, and (2) a salary check to an employee for $255 was recorded by the bank for $155. The June 30 bank reconciliation contained only two reconciling items: deposits in transit $1,000 and outstanding checks of $2,600. Assume that the interest on the note has been accrued. Questions: 1. The deposit in transit at July 31 is? 2. The outstanding check at July 31 is? 3. The adjusted cash balance is