Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show complete work. Thank you. Pls answer 19 and 20. Thanks. Part 3: Case Questions (5 Questions /2 points each) Direction: Please answer following

Please show complete work. Thank you.

Pls answer 19 and 20. Thanks.

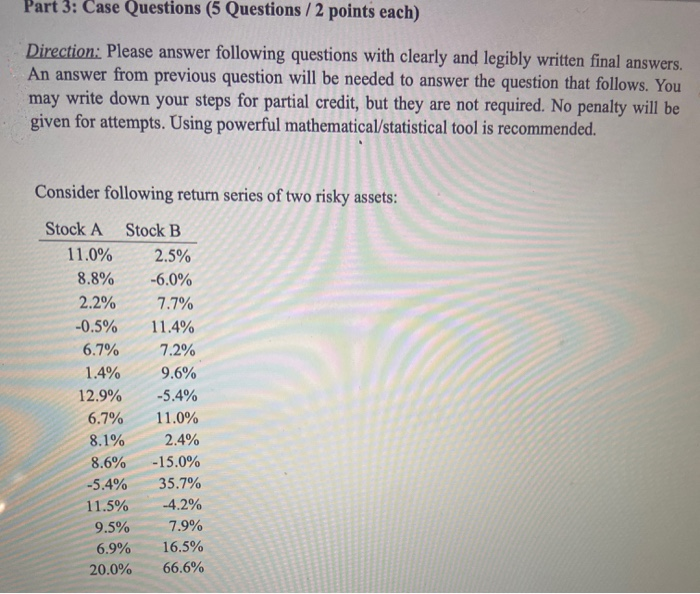

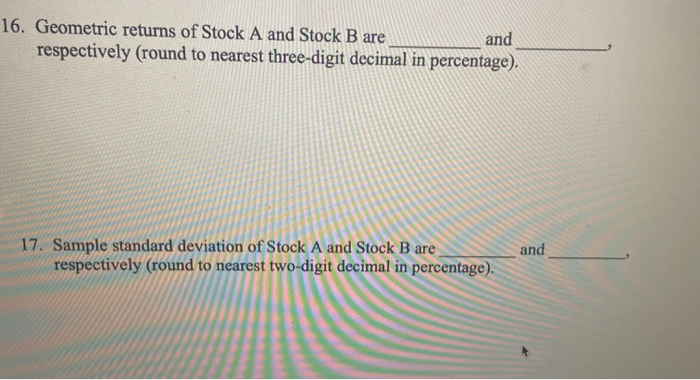

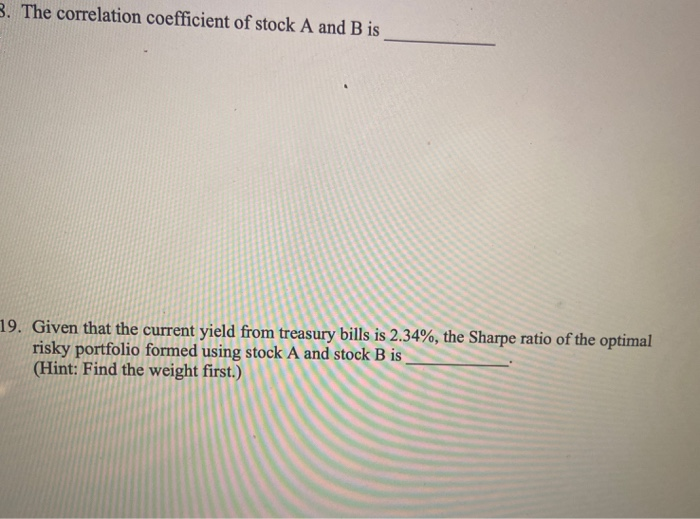

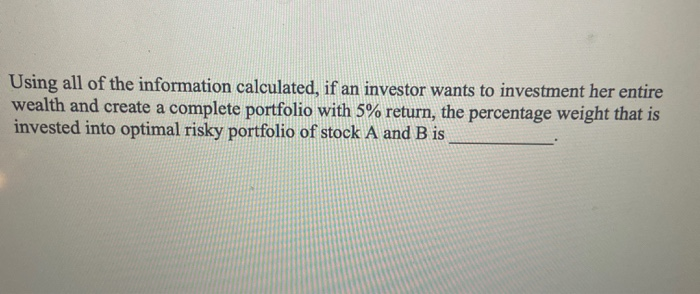

Part 3: Case Questions (5 Questions /2 points each) Direction: Please answer following questions with clearly and legibly written final answers. An answer from previous question will be needed to answer the question that follows. You may write down your steps for partial credit, but they are not required. No penalty will be given for attempts. Using powerful mathematical/statistical tool is recommended. Consider following return series of two risky assets: Stock A Stock B 11.0% 2.5% 8.8% -6.0% 2.2% 7.7% -0.5% 11.4% 6.7% 7.2% 1.4% 9.6% 12.9% -5.4% 6.7% 11.0% 8.1% 2.4% 8.6% -15.0% -5.4% 35.7% 11.5% -4.2% 9.5% 7.9% 6.9% 16.5% 20.0% 66.6% 16. Geometric returns of Stock A and Stock B are and respectively (round to nearest three-digit decimal in percentage). 17. Sample standard deviation of Stock A and Stock B are respectively (round to nearest two-digit decimal in percentage). and B. The correlation coefficient of stock A and B is 19. Given that the current yield from treasury bills is 2.34%, the Sharpe ratio of the optimal risky portfolio formed using stock A and stock B is (Hint: Find the weight first.) Using all of the information calculated, if an investor wants to investment her entire wealth and create a complete portfolio with 5% return, the percentage weight that is invested into optimal risky portfolio of stock A and B is Part 3: Case Questions (5 Questions /2 points each) Direction: Please answer following questions with clearly and legibly written final answers. An answer from previous question will be needed to answer the question that follows. You may write down your steps for partial credit, but they are not required. No penalty will be given for attempts. Using powerful mathematical/statistical tool is recommended. Consider following return series of two risky assets: Stock A Stock B 11.0% 2.5% 8.8% -6.0% 2.2% 7.7% -0.5% 11.4% 6.7% 7.2% 1.4% 9.6% 12.9% -5.4% 6.7% 11.0% 8.1% 2.4% 8.6% -15.0% -5.4% 35.7% 11.5% -4.2% 9.5% 7.9% 6.9% 16.5% 20.0% 66.6% 16. Geometric returns of Stock A and Stock B are and respectively (round to nearest three-digit decimal in percentage). 17. Sample standard deviation of Stock A and Stock B are respectively (round to nearest two-digit decimal in percentage). and B. The correlation coefficient of stock A and B is 19. Given that the current yield from treasury bills is 2.34%, the Sharpe ratio of the optimal risky portfolio formed using stock A and stock B is (Hint: Find the weight first.) Using all of the information calculated, if an investor wants to investment her entire wealth and create a complete portfolio with 5% return, the percentage weight that is invested into optimal risky portfolio of stock A and B is Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started