Please show detail explanation. And what will change if we used a straight line depreciation?

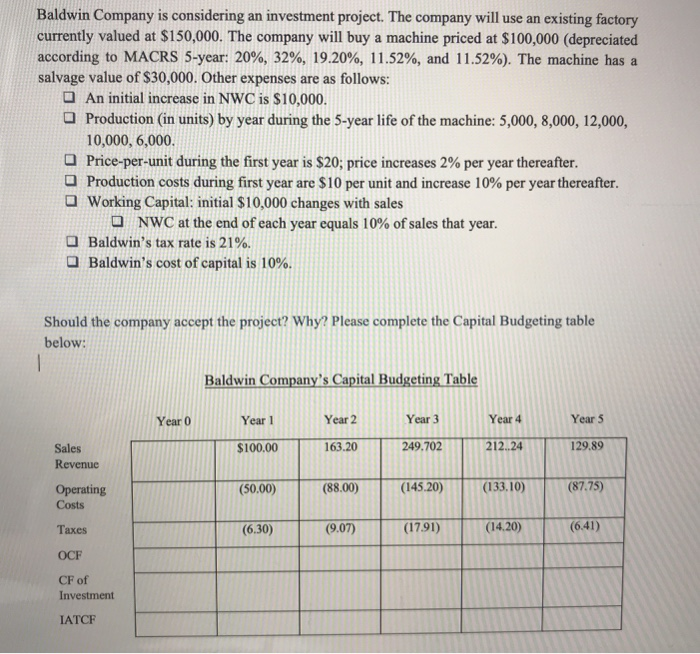

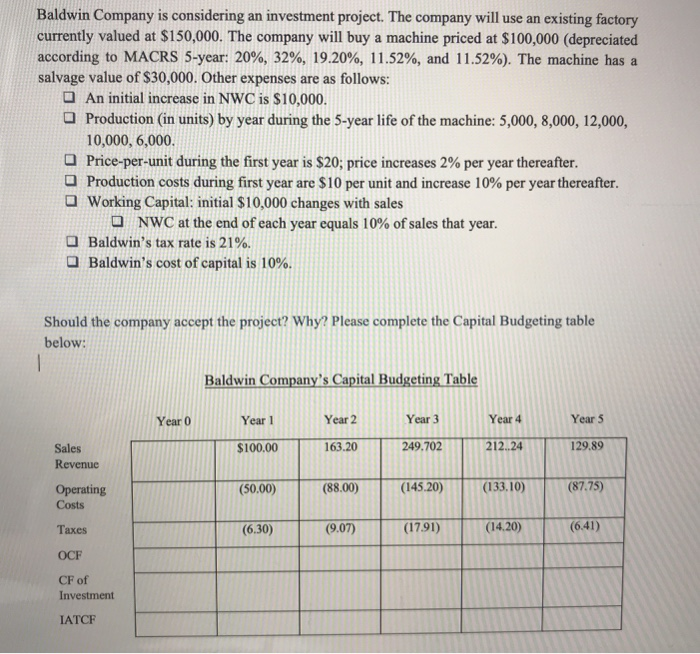

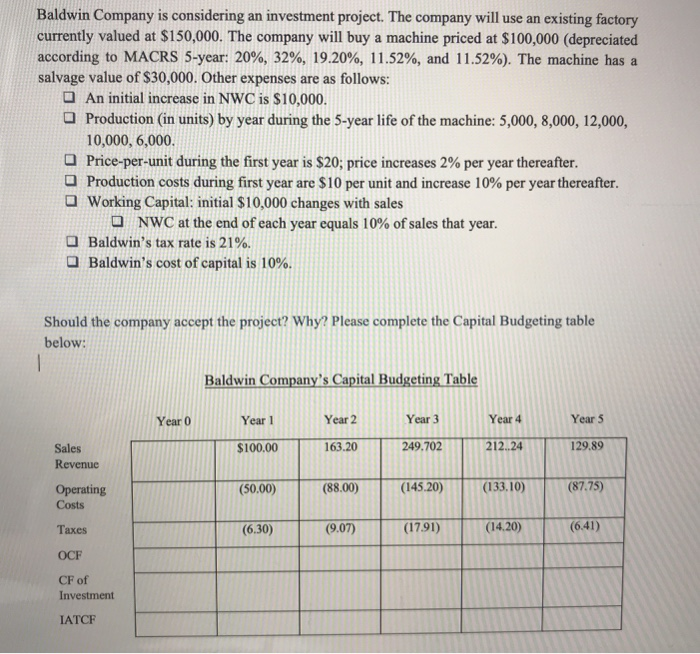

Baldwin Company is considering an investment project. The company will use an existing factory currently valued at $150,000. The company will buy a machine priced at $100,000 (depreciated according to MACRS 5-year: 20%, 32%, 19.20%, 11.52%, and 11.52%). The machine has a salvage value of $30,000. Other expenses are as follows: An initial increase in NWC is $10,000. Production (in units) by year during the 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000. Price-per-unit during the first year is $20; price increases 2% per year thereafter. Production costs during first year are $10 per unit and increase 10% per year thereafter. Working Capital: initial $10,000 changes with sales NWC at the end of each year equals 10% of sales that year. Baldwin's tax rate is 21%. Baldwin's cost of capital is 10%. Should the company accept the project? Why? Please complete the Capital Budgeting table below: Baldwin Company's Capital Budgeting Table Year O Year 1 Year 2 Year 5 $100.00 1163.20 249.702 212.24 129.89 Sales Revenue Operating Costs (50.00) (88.00) (145.20) (133.10) (87.75) Taxes (6.30) (9.07) (1791) (14.20) (6:41) OCF CF of Investment IATCF Baldwin Company is considering an investment project. The company will use an existing factory currently valued at $150,000. The company will buy a machine priced at $100,000 (depreciated according to MACRS 5-year: 20%, 32%, 19.20%, 11.52%, and 11.52%). The machine has a salvage value of $30,000. Other expenses are as follows: An initial increase in NWC is $10,000. Production (in units) by year during the 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000. Price-per-unit during the first year is $20; price increases 2% per year thereafter. Production costs during first year are $10 per unit and increase 10% per year thereafter. Working Capital: initial $10,000 changes with sales NWC at the end of each year equals 10% of sales that year. Baldwin's tax rate is 21%. Baldwin's cost of capital is 10%. Should the company accept the project? Why? Please complete the Capital Budgeting table below: Baldwin Company's Capital Budgeting Table Year O Year 1 Year 2 Year 5 $100.00 1163.20 249.702 212.24 129.89 Sales Revenue Operating Costs (50.00) (88.00) (145.20) (133.10) (87.75) Taxes (6.30) (9.07) (1791) (14.20) (6:41) OCF CF of Investment IATCF