please show excel formulas

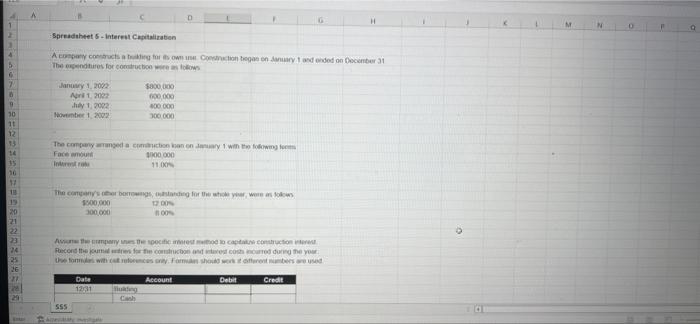

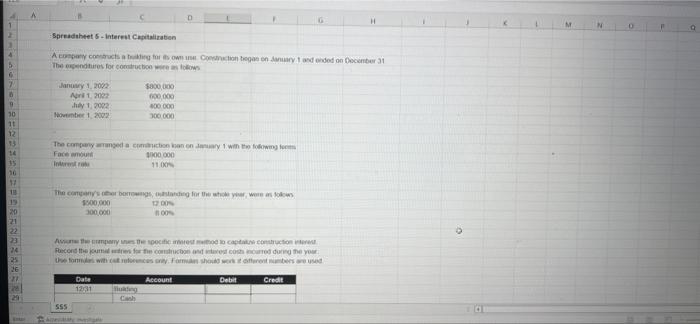

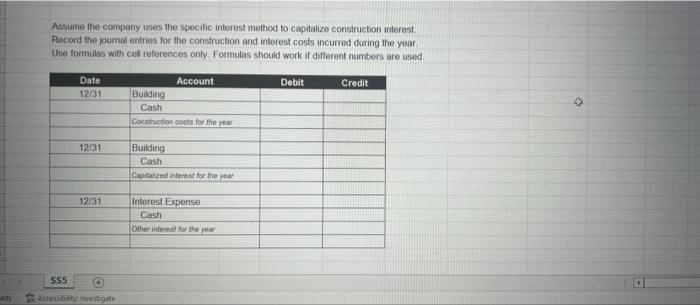

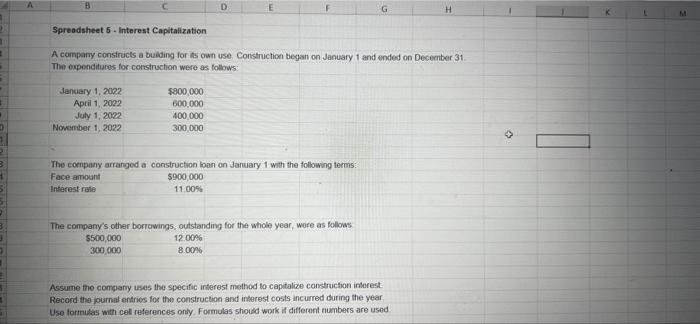

1 2 4 5 6 7 B 9 10 11 12 13 14 15 30 17 118 19 20 21 22 23 24 35 26 27 29 A D Spreadsheet 6-Interest Capitalization A company constructs a bukting for its own us Construction began on January 1 and ended on December 31 The expenditures for construction were as follows January 1, 2002 $800,000 Apr 1, 2022 600,000 July 1, 2002 400.000 November 1, 2002 300,000 The company arranged a contruction loan on January 1 with the following fo Face amount $900,000 11.00% Interest ra The company's other borrowings, outstanding for the whole year, were as follows $500,000 12.00% 300,000 As the company unes the specific interest method to captate construction inst Record the journal entries for the construction and starest costs incurred during the your Use forms with cat reforences only. Forman should work it different numbers are used Account Debit Credit Date 12/31 Cash 555 Aperity megele 0 Q dy Assume the company uses the specific interest method to capitalize construction interest. Record the journal entries for the construction and interest costs incurred during the year. Use formulas with cell references only. Formulas should work if different numbers are used. Account Debit Credit Date 12/31 Building Cash Construction costs for the year 12/31 Building Cash Capitalized interest for the year 12/31 Interest Expense Cash Other interest for the year $55 Accessibility: Investigate 2 T B # 0 D G Spreadsheet 5-Interest Capitalization A company constructs a building for its own use. Construction began on January 1 and ended on December 31. The expenditures for construction were as follows: January 1, 2022 $800,000 600,000 April 1, 2022 July 1, 2022 400,000 November 1, 2022 300,000 The company arranged a construction loan on January 1 with the following terms: Face amount $900,000 Interest rate 11.00% The company's other borrowings, outstanding for the whole year, wore as follows 12.00% $500,000 300,000 8.00% Assume the company uses the specific interest method to capitalize construction interest Record the journal entries for the construction and interest costs incurred during the year Use formulas with cell references only. Formulas should work if different numbers are used