Answered step by step

Verified Expert Solution

Question

1 Approved Answer

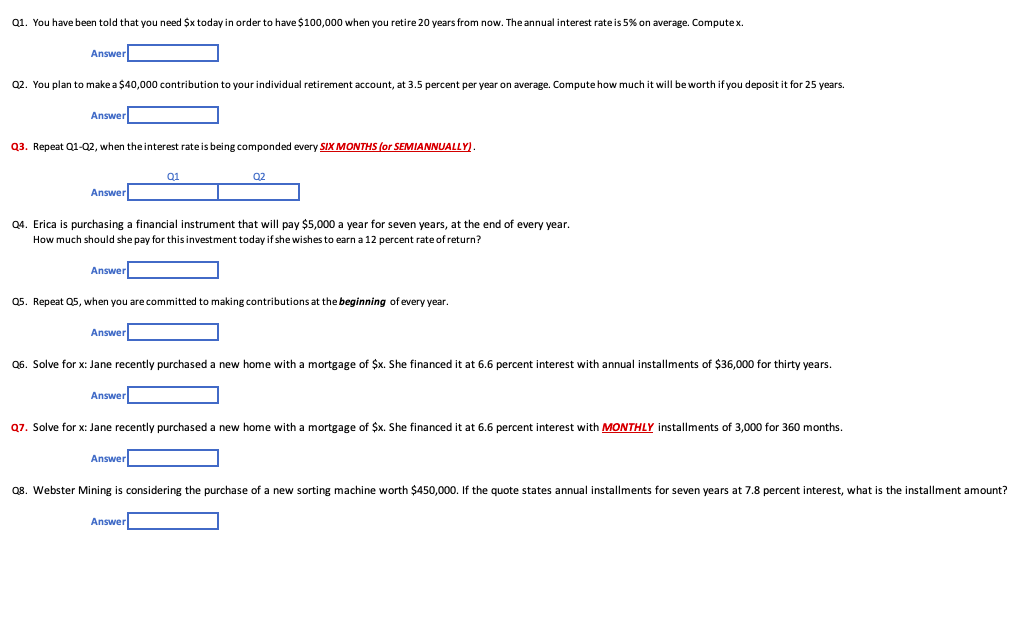

PLEASE SHOW EXCEL FORMULAS, THANK YOU!! Q 1 . You have been told that you need $ x today in order to have $ 1

PLEASE SHOW EXCEL FORMULAS, THANK YOU!!

Q You have been told that you need $ today in order to have $ when you retire years from now. The annual interest rate is on average. Compute

Answer

Q You plan to make a $ contribution to your individual retirement account, at percent per year on average. Compute how much it will be worth if you deposit it for years.

Answer

Q Repeat QQ when the interest rate is being componded every SIX MONTHS or SEMIANNUALLY

Answer

Q Erica is purchasing a financial instrument that will pay $ a year for seven years, at the end of every year.

How much should she pay for this investment today if she wishes to earn a percent rate of return?

Answer

Q Repeat Q when you are committed to making contributions at the beginning of every year.

Answer

Q Solve for : Jane recently purchased a new home with a mortgage of $ She financed it at percent interest with annual installments of $ for thirty years.

Answer

Q Solve for : Jane recently purchased a new home with a mortgage of $ She financed it at percent interest with MONTHLY installments of for months.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started