Answered step by step

Verified Expert Solution

Question

1 Approved Answer

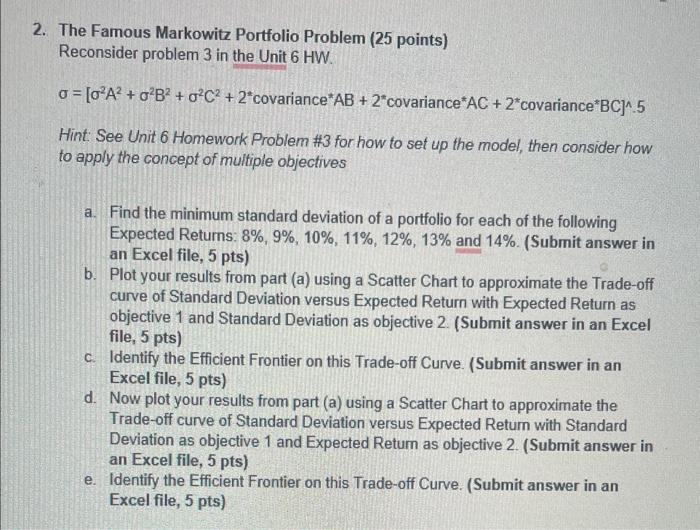

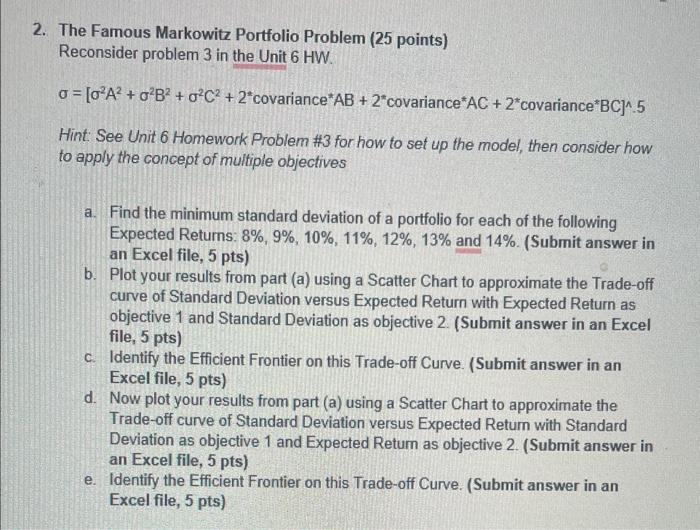

please show excel sheet with formulas 2. The Famous Markowitz Portfolio Problem (25 points) Reconsider problem 3 in the Unit 6HW. =[2A2+2B2+2C2+2covarianceAB+2covarianceAC+2covarianceBC].5 Hint: See Unit

please show excel sheet with formulas

2. The Famous Markowitz Portfolio Problem (25 points) Reconsider problem 3 in the Unit 6HW. =[2A2+2B2+2C2+2covarianceAB+2covarianceAC+2covarianceBC].5 Hint: See Unit 6 Homework Problem \#3 for how to set up the model, then consider how to apply the concept of multiple objectives a. Find the minimum standard deviation of a portfolio for each of the following Expected Returns: 8%,9%,10%,11%,12%,13% and 14%. (Submit answer in an Excel file, 5pts ) b. Plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Expected Return as objective 1 and Standard Deviation as objective 2. (Submit answer in an Excel file, 5pts) c. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) d. Now plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Standard Deviation as objective 1 and Expected Return as objective 2. (Submit answer in an Excel file, 5pts ) e. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) 2. The Famous Markowitz Portfolio Problem (25 points) Reconsider problem 3 in the Unit 6HW. =[2A2+2B2+2C2+2covarianceAB+2covarianceAC+2covarianceBC].5 Hint: See Unit 6 Homework Problem \#3 for how to set up the model, then consider how to apply the concept of multiple objectives a. Find the minimum standard deviation of a portfolio for each of the following Expected Returns: 8%,9%,10%,11%,12%,13% and 14%. (Submit answer in an Excel file, 5pts ) b. Plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Expected Return as objective 1 and Standard Deviation as objective 2. (Submit answer in an Excel file, 5pts) c. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts) d. Now plot your results from part (a) using a Scatter Chart to approximate the Trade-off curve of Standard Deviation versus Expected Return with Standard Deviation as objective 1 and Expected Return as objective 2. (Submit answer in an Excel file, 5pts ) e. Identify the Efficient Frontier on this Trade-off Curve. (Submit answer in an Excel file, 5 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started