Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show formula values. Example: For part A, in row seven use VDB function and show value, =vdb(cost, salvagevalue,life,startperiod, endperiod), needed information is listed in

Please show formula values.

Example: For part A, in row seven use VDB function and show value, =vdb(cost, salvagevalue,life,startperiod, endperiod), needed information is listed in initial question and on table on right hand side of excel sheet..

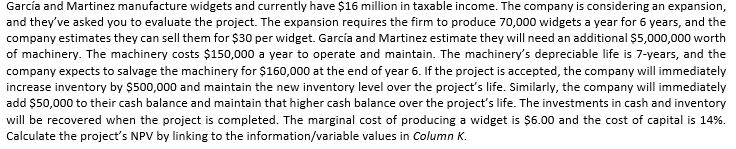

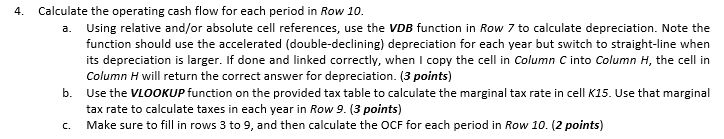

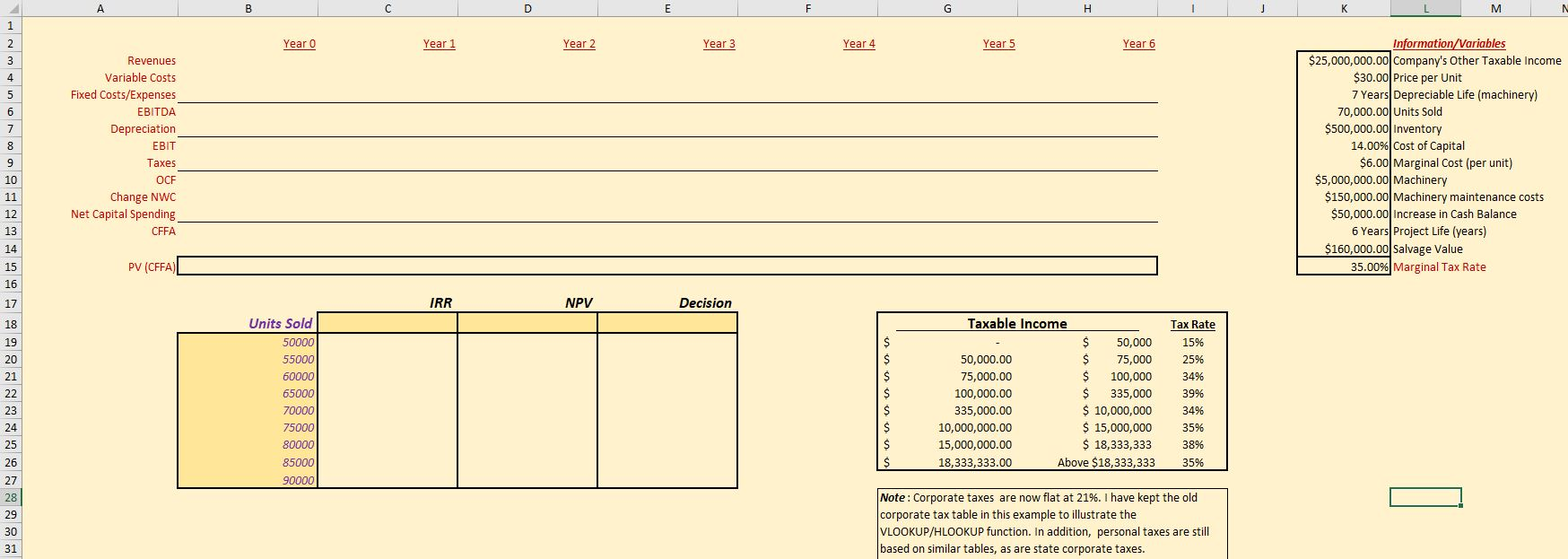

Garca and Martinez manufacture widgets and currently have $16 million in taxable income. The company is considering an expansion, and they've asked you to evaluate the project. The expansion requires the firm to produce 70,000 widgets a year for 6 years, and the company estimates they can sell them for $30 per widget. Garca and Martinez estimate they will need an additional $5,000,000 worth of machinery. The machinery costs $150,000 a year to operate and maintain. The machinery's depreciable life is 7-years, and the company expects to salvage the machinery for $160,000 at the end of year 6. If the project is accepted, the company will immediately increase inventory by $500,000 and maintain the new inventory level over the project's life. Similarly, the company will immediately add $50,000 to their cash balance and maintain that higher cash balance over the project's life. The investments in cash and inventory will be recovered when the project is completed. The marginal cost of producing a widget is $6.00 and the cost of capital is 14%. Calculate the project's NPV by linking to the information/variable values in Column K. 4. Calculate the operating cash flow for each period in Row 10. a. Using relative and/or absolute cell references, use the VDB function in Row 7 to calculate depreciation. Note the function should use the accelerated (double-declining) depreciation for each year but switch to straight-line when its depreciation is larger. If done and linked correctly, when I copy the cell in Column Cinto Column H, the cell in Column H will return the correct answer for depreciation. (3 points) b. Use the VLOOKUP function on the provided tax table to calculate the marginal tax rate in cell K15. Use that marginal tax rate to calculate taxes in each year in Row 9. (3 points) C. Make sure to fill in rows 3 to 9, and then calculate the OCF for each period in Row 10. (2 points) | C | 5 | 6 | E Year 0 year1 Year 1 Year 2 year 2 year3 Year 3 Year 4 Year 5 Year 6 Revenues Variable Costs Fixed Costs/Expenses EBITDA Depreciation EBIT Taxes OCF Change NWC Net Capital Spending CFFA Information/Variables $25,000,000.00 Company's Other Taxable income $30.00 Price per Unit 7 Years Depreciable Life (machinery) 70,000.00 Units Sold $500,000.00 Inventory 14.00% Cost of Capital $6.00 Marginal Cost (per unit) $5,000,000.00 Machinery $150,000.00 Machinery maintenance costs $50,000.00 Increase in Cash Balance 6 Years Project Life (years) $160,000.00 Salvage Value 35.00% Marginal Tax Rate PV (CFFA) IRR NPV Decision Units Sold 50000 55000 60000 65000 70000 75000 80000 85000 90000 Taxable Income $ 50,000 50,000.00 $ 75,000 75,000.00 $ 100,000 100,000.00 $ 335,000 335,000.00 $ 10,000,000 10,000,000.00 $ 15,000,000 15,000,000.00 $ 18,333,333 18,333,333.00 Above $18,333,333 Tax Rate 15% 25% 34% 39% 34% 35% 38% 35% Note: Corporate taxes are now flat at 21%. I have kept the old corporate tax table in this example to illustrate the VLOOKUP/HLOOKUP function. In addition, personal taxes are still based on similar tables, as are state corporate taxes. Garca and Martinez manufacture widgets and currently have $16 million in taxable income. The company is considering an expansion, and they've asked you to evaluate the project. The expansion requires the firm to produce 70,000 widgets a year for 6 years, and the company estimates they can sell them for $30 per widget. Garca and Martinez estimate they will need an additional $5,000,000 worth of machinery. The machinery costs $150,000 a year to operate and maintain. The machinery's depreciable life is 7-years, and the company expects to salvage the machinery for $160,000 at the end of year 6. If the project is accepted, the company will immediately increase inventory by $500,000 and maintain the new inventory level over the project's life. Similarly, the company will immediately add $50,000 to their cash balance and maintain that higher cash balance over the project's life. The investments in cash and inventory will be recovered when the project is completed. The marginal cost of producing a widget is $6.00 and the cost of capital is 14%. Calculate the project's NPV by linking to the information/variable values in Column K. 4. Calculate the operating cash flow for each period in Row 10. a. Using relative and/or absolute cell references, use the VDB function in Row 7 to calculate depreciation. Note the function should use the accelerated (double-declining) depreciation for each year but switch to straight-line when its depreciation is larger. If done and linked correctly, when I copy the cell in Column Cinto Column H, the cell in Column H will return the correct answer for depreciation. (3 points) b. Use the VLOOKUP function on the provided tax table to calculate the marginal tax rate in cell K15. Use that marginal tax rate to calculate taxes in each year in Row 9. (3 points) C. Make sure to fill in rows 3 to 9, and then calculate the OCF for each period in Row 10. (2 points) | C | 5 | 6 | E Year 0 year1 Year 1 Year 2 year 2 year3 Year 3 Year 4 Year 5 Year 6 Revenues Variable Costs Fixed Costs/Expenses EBITDA Depreciation EBIT Taxes OCF Change NWC Net Capital Spending CFFA Information/Variables $25,000,000.00 Company's Other Taxable income $30.00 Price per Unit 7 Years Depreciable Life (machinery) 70,000.00 Units Sold $500,000.00 Inventory 14.00% Cost of Capital $6.00 Marginal Cost (per unit) $5,000,000.00 Machinery $150,000.00 Machinery maintenance costs $50,000.00 Increase in Cash Balance 6 Years Project Life (years) $160,000.00 Salvage Value 35.00% Marginal Tax Rate PV (CFFA) IRR NPV Decision Units Sold 50000 55000 60000 65000 70000 75000 80000 85000 90000 Taxable Income $ 50,000 50,000.00 $ 75,000 75,000.00 $ 100,000 100,000.00 $ 335,000 335,000.00 $ 10,000,000 10,000,000.00 $ 15,000,000 15,000,000.00 $ 18,333,333 18,333,333.00 Above $18,333,333 Tax Rate 15% 25% 34% 39% 34% 35% 38% 35% Note: Corporate taxes are now flat at 21%. I have kept the old corporate tax table in this example to illustrate the VLOOKUP/HLOOKUP function. In addition, personal taxes are still based on similar tables, as are state corporate taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started