Answered step by step

Verified Expert Solution

Question

1 Approved Answer

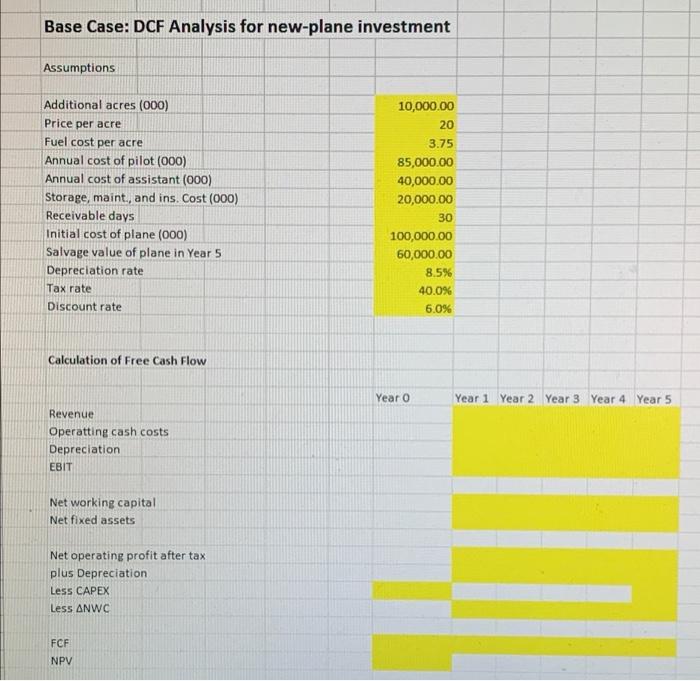

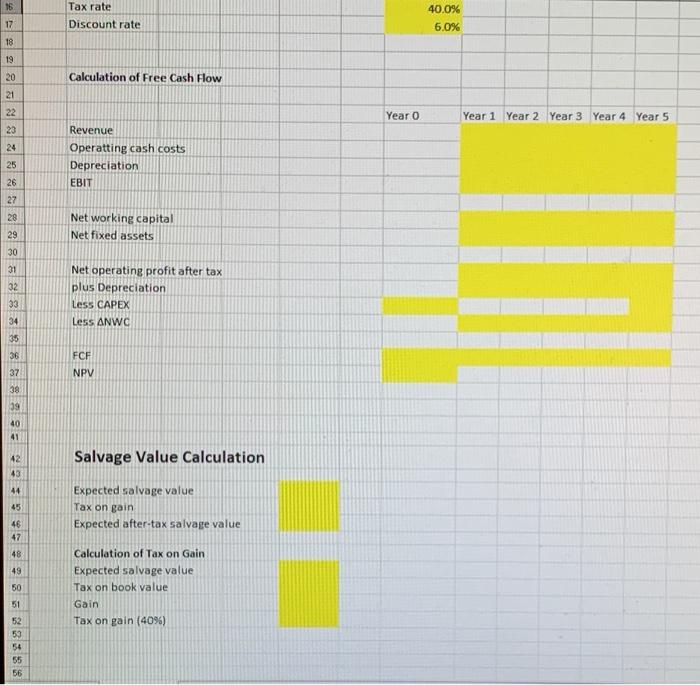

please show formulas. Base Case: DCF Analysis for new-plane investment Assumptions Additional acres (000) Price per acre Fuel cost per acre Annual cost of pilot

please show formulas.

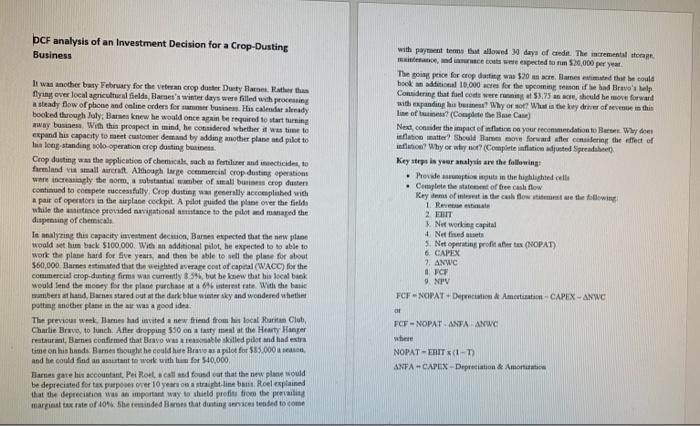

Base Case: DCF Analysis for new-plane investment Assumptions Additional acres (000) Price per acre Fuel cost per acre Annual cost of pilot (000) Annual cost of assistant (000) Storage, maint, and ins. Cost (000) Receivable days Initial cost of plane (000) Salvage value of plane in Year 5 Depreciation rate Tax rate Discount rate 10,000.00 20 3.75 85,000.00 40,000.00 20,000.00 30 100,000.00 60,000.00 8.5% 40.0% 6.0% Calculation of Free Cash Flow Year o Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Operatting cash costs Depreciation EBIT Net working capital Net fixed assets Net operating profit after tax plus Depreciation Less CAPEX Less ANWC FCF NPV 16 Tax rate Discount rate 17 40.0% 6.0% 18 19 20 Calculation of Free Cash Flow Year o Year 1 Year 2 Year 3 Year 4 Year 5 21 22 23 24 25 26 Revenue Operatting cash costs Depreciation EBIT 27 Net working capital Net fixed assets 28 29 30 31 32 33 Net operating profit after tax plus Depreciation Less CAPEX Less ANWC 34 35 36 37 FCF NPV 38 39 40 Salvage Value Calculation 42 43 44 45 Expected salvage value Tax on gain Expected after-tax salvage value 46 47 48 49 Calculation of Tax on Gain Expected salvage value Tax on book value Gain Tax on gain (40%) 50 51 52 53 *8*8398 56 DCF analysis of an Investment Decision for a Crop-Dusting Business It was another bary February for the ver crop die Duty Hon. Rather than flying over local agricultural field Barnes's winter days were filled with processing a steady flow of phone and online orders for business. His calendar already booked through July, Bars knew he would once again be required to start tuning away business. With this prospect in mind be considered whether it was time to expand his capacity to meet customer demand by adding another plane and pilot to a long standing cooperation crep dusting business Crop duting was the application of chemicals, such as fertile and insecticides to emland via small craft Although or general crop dusting operation were increasingly the som, obstantial ber of small buon crop duten continued to compete muccessfully Crop dusting persilly accomplished with A pair of operators in the plane cockpit A pilot unted the plant over the fields while the tice provided writical stance to the pilot weaped the dispensing of chemicals Is analyzing this capacity investment decision, Barnes expected that the new place would set him back $100.000. With an additional pilot be expected to be able to work the plane hard for five years, and the be able to sell the place for about 560,000 Bamestimated that the weighted average cost of capital (WACC) for the commercial crop duting firms will currently but he knew that his locatbuk would lend the money for the plane purchase 6% interest rate. With the basic water at hand, Barnes stared out at the dark blue water sky and wondered whether potting another plant in the air was a good idea. The previouwek, Thames had invited a new friend from his local Raritan Club, Charlie Brave, to lunch. After dropping 550 on a tasty ment at the Hearty Hanger restaurant, Barnes confirmed that Bravo Wescable skilled pilot and had extra time on his hands Bames thought he could be Beave as a pilot for $85.000 a And he could find an assurant to work with him for 540,000 Barnes are his accountant Pol Rol called found out that the new ple would be depreciated for tex pupues er 10 years on right line Roel explained that the depreciation was an important way to shield proti from the prevailing marginal tax rate of 10%. She reminded Bares that during cended to come with payment terms that allowed 30 days of credit. The incrementala In, and more expected to run 50,000 per year The price for crop dat ww 520 sacreBames and the could book dul 10.000 acres for the upcoming mon ifad Bewe's help Considering that fuel code weet 3.75 as should be move forward with expanding his Why or not? What is the key der of severe in this Line of us? (Complete the Bee Cane) Next, consider the impact of fatics a your rection to Be Why does inflation matter? Should Blommor forward utter considering the effect of ? Why wo? (Complete inflation wted Spreadt) key step is yer analysis are the following Provide in tinthebyhlighted ceite Complete the set of bee cash flow Kay of the cash flow time the following 1 R 2. UIT Net working capital 4. Netfied 3. Net operating profiter tax (NOPAT) 6 CAPEX 7. ANWC FCF 9. NPV FCF - NOPAT De Amorti-CAPEX-ANWC FCF - NOPAT ANTA ANWC we NOPAT-ERIT (1) ANTA-CAPEX-Depreciation & Amonti Base Case: DCF Analysis for new-plane investment Assumptions Additional acres (000) Price per acre Fuel cost per acre Annual cost of pilot (000) Annual cost of assistant (000) Storage, maint, and ins. Cost (000) Receivable days Initial cost of plane (000) Salvage value of plane in Year 5 Depreciation rate Tax rate Discount rate 10,000.00 20 3.75 85,000.00 40,000.00 20,000.00 30 100,000.00 60,000.00 8.5% 40.0% 6.0% Calculation of Free Cash Flow Year o Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Operatting cash costs Depreciation EBIT Net working capital Net fixed assets Net operating profit after tax plus Depreciation Less CAPEX Less ANWC FCF NPV 16 Tax rate Discount rate 17 40.0% 6.0% 18 19 20 Calculation of Free Cash Flow Year o Year 1 Year 2 Year 3 Year 4 Year 5 21 22 23 24 25 26 Revenue Operatting cash costs Depreciation EBIT 27 Net working capital Net fixed assets 28 29 30 31 32 33 Net operating profit after tax plus Depreciation Less CAPEX Less ANWC 34 35 36 37 FCF NPV 38 39 40 Salvage Value Calculation 42 43 44 45 Expected salvage value Tax on gain Expected after-tax salvage value 46 47 48 49 Calculation of Tax on Gain Expected salvage value Tax on book value Gain Tax on gain (40%) 50 51 52 53 *8*8398 56 DCF analysis of an Investment Decision for a Crop-Dusting Business It was another bary February for the ver crop die Duty Hon. Rather than flying over local agricultural field Barnes's winter days were filled with processing a steady flow of phone and online orders for business. His calendar already booked through July, Bars knew he would once again be required to start tuning away business. With this prospect in mind be considered whether it was time to expand his capacity to meet customer demand by adding another plane and pilot to a long standing cooperation crep dusting business Crop duting was the application of chemicals, such as fertile and insecticides to emland via small craft Although or general crop dusting operation were increasingly the som, obstantial ber of small buon crop duten continued to compete muccessfully Crop dusting persilly accomplished with A pair of operators in the plane cockpit A pilot unted the plant over the fields while the tice provided writical stance to the pilot weaped the dispensing of chemicals Is analyzing this capacity investment decision, Barnes expected that the new place would set him back $100.000. With an additional pilot be expected to be able to work the plane hard for five years, and the be able to sell the place for about 560,000 Bamestimated that the weighted average cost of capital (WACC) for the commercial crop duting firms will currently but he knew that his locatbuk would lend the money for the plane purchase 6% interest rate. With the basic water at hand, Barnes stared out at the dark blue water sky and wondered whether potting another plant in the air was a good idea. The previouwek, Thames had invited a new friend from his local Raritan Club, Charlie Brave, to lunch. After dropping 550 on a tasty ment at the Hearty Hanger restaurant, Barnes confirmed that Bravo Wescable skilled pilot and had extra time on his hands Bames thought he could be Beave as a pilot for $85.000 a And he could find an assurant to work with him for 540,000 Barnes are his accountant Pol Rol called found out that the new ple would be depreciated for tex pupues er 10 years on right line Roel explained that the depreciation was an important way to shield proti from the prevailing marginal tax rate of 10%. She reminded Bares that during cended to come with payment terms that allowed 30 days of credit. The incrementala In, and more expected to run 50,000 per year The price for crop dat ww 520 sacreBames and the could book dul 10.000 acres for the upcoming mon ifad Bewe's help Considering that fuel code weet 3.75 as should be move forward with expanding his Why or not? What is the key der of severe in this Line of us? (Complete the Bee Cane) Next, consider the impact of fatics a your rection to Be Why does inflation matter? Should Blommor forward utter considering the effect of ? Why wo? (Complete inflation wted Spreadt) key step is yer analysis are the following Provide in tinthebyhlighted ceite Complete the set of bee cash flow Kay of the cash flow time the following 1 R 2. UIT Net working capital 4. Netfied 3. Net operating profiter tax (NOPAT) 6 CAPEX 7. ANWC FCF 9. NPV FCF - NOPAT De Amorti-CAPEX-ANWC FCF - NOPAT ANTA ANWC we NOPAT-ERIT (1) ANTA-CAPEX-Depreciation & Amonti Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started