Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show formulas for each step 4 5 In row 14, calculate the total payment made over the duration of each loan In row 16,

Please show formulas for each step

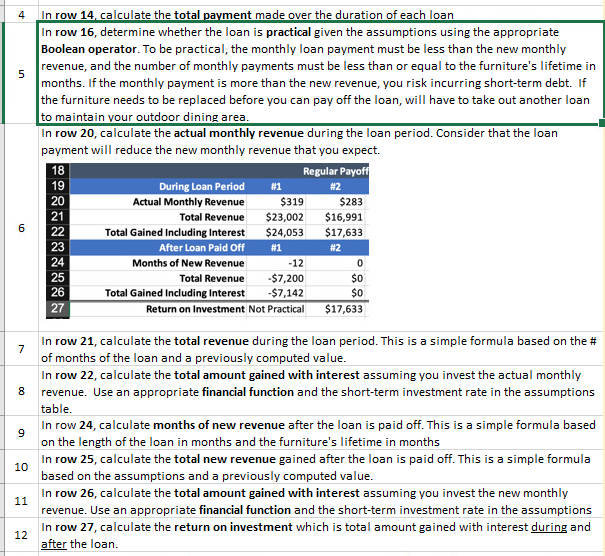

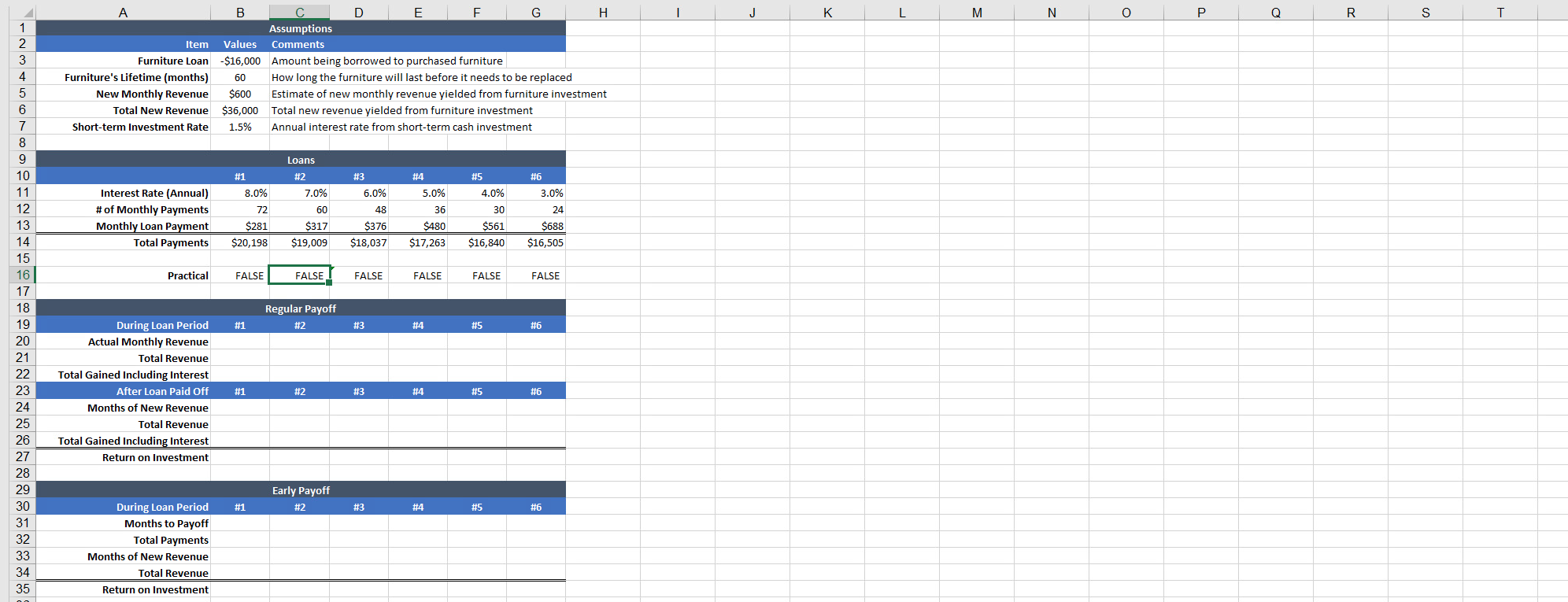

4 5 In row 14, calculate the total payment made over the duration of each loan In row 16, determine whether the loan is practical given the assumptions using the appropriate Boolean operator. To be practical, the monthly loan payment must be less than the new monthly revenue, and the number of monthly payments must be less than or equal to the furniture's lifetime in months. If the monthly payment is more than the new revenue, you risk incurring short-term debt. If the furniture needs to be replaced before you can pay off the loan, will have to take out another loan to maintain your outdoor dining area. In row 20, calculate the actual monthly revenue during the loan period. Consider that the loan payment will reduce the new monthly revenue that you expect. 18 Regular Payoff 19 During Loan Period #2 20 Actual Monthly Revenue $319 $283 21 Total Revenue $23,002 $16,991 22 Total Gained Including interest $24,053 $17,633 23 After Loan Paid Off 24 Months of New Revenue -12 25 Total Revenue -$7,200 $0 26 Total Gained Including Interest -$7,142 $0 27 Return on Investment Not Practical $17,633 #1 #1 #2 0 7 In row 21, calculate the total revenue during the loan period. This is a simple formula based on the # of months of the loan and a previously computed value. In row 22, calculate the total amount gained with interest assuming you invest the actual monthly revenue. Use an appropriate financial function and the short-term investment rate in the assumptions 00 table. 9 10 In row 24, calculate months of new revenue after the loan is paid off. This is a simple formula based on the length of the loan in months and the furniture's lifetime in months In row 25, calculate the total new revenue gained after the loan is paid off. This is a simple formula based on the assumptions and a previously computed value. In row 26, calculate the total amount gained with interest assuming you invest the new monthly revenue. Use an appropriate financial function and the short-term investment rate in the assumptions In row 27, calculate the return on investment which is total amount gained with interest during and after the loan. 11 12 J K L M N o 0 P P b Q R S T 1 2 3 4 5 A B D E F H Assumptions Item Values Comments Furniture Loan $16,000 Amount being borrowed to purchased furniture Furniture's Lifetime (months) 60 How long the furniture will last before it needs to be replaced New Monthly Revenue $600 Estimate of new monthly revenue yielded from furniture investment Total New Revenue $36,000 Total new revenue yielded from furniture investment Short-term Investment Rate 1.5% Annual interest rate from short-term cash investment #3 6.0% #4 5.0% #5 4.0% #6 3.0% Interest Rate (Annual) # of Monthly Payments Monthly Loan Payment Total Payments #1 8.0% 72 $281 $20,198 Loans #2 7.0% 60 $317 $19,009 48 30 $561 $376 $18,037 36 $480 $17,263 24 $688 $16,505 $16,840 Practical FALSE FALSE FALSE FALSE FALSE FALSE Regular Payoff #2 #1 #3 #4 #5 #6 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 During Loan Period Actual Monthly Revenue Total Revenue Total Gained Including Interest After Loan Paid Off Months of New Revenue Total Revenue Total Gained Including Interest Return on Investment #1 #2 #3 #4 #5 #6 Early Payoff #2 #1 #3 #4 #5 #6 During Loan Period Months to Payoff Total Payments Months of New Revenue Total Revenue Return on Investment 4 5 In row 14, calculate the total payment made over the duration of each loan In row 16, determine whether the loan is practical given the assumptions using the appropriate Boolean operator. To be practical, the monthly loan payment must be less than the new monthly revenue, and the number of monthly payments must be less than or equal to the furniture's lifetime in months. If the monthly payment is more than the new revenue, you risk incurring short-term debt. If the furniture needs to be replaced before you can pay off the loan, will have to take out another loan to maintain your outdoor dining area. In row 20, calculate the actual monthly revenue during the loan period. Consider that the loan payment will reduce the new monthly revenue that you expect. 18 Regular Payoff 19 During Loan Period #2 20 Actual Monthly Revenue $319 $283 21 Total Revenue $23,002 $16,991 22 Total Gained Including interest $24,053 $17,633 23 After Loan Paid Off 24 Months of New Revenue -12 25 Total Revenue -$7,200 $0 26 Total Gained Including Interest -$7,142 $0 27 Return on Investment Not Practical $17,633 #1 #1 #2 0 7 In row 21, calculate the total revenue during the loan period. This is a simple formula based on the # of months of the loan and a previously computed value. In row 22, calculate the total amount gained with interest assuming you invest the actual monthly revenue. Use an appropriate financial function and the short-term investment rate in the assumptions 00 table. 9 10 In row 24, calculate months of new revenue after the loan is paid off. This is a simple formula based on the length of the loan in months and the furniture's lifetime in months In row 25, calculate the total new revenue gained after the loan is paid off. This is a simple formula based on the assumptions and a previously computed value. In row 26, calculate the total amount gained with interest assuming you invest the new monthly revenue. Use an appropriate financial function and the short-term investment rate in the assumptions In row 27, calculate the return on investment which is total amount gained with interest during and after the loan. 11 12 J K L M N o 0 P P b Q R S T 1 2 3 4 5 A B D E F H Assumptions Item Values Comments Furniture Loan $16,000 Amount being borrowed to purchased furniture Furniture's Lifetime (months) 60 How long the furniture will last before it needs to be replaced New Monthly Revenue $600 Estimate of new monthly revenue yielded from furniture investment Total New Revenue $36,000 Total new revenue yielded from furniture investment Short-term Investment Rate 1.5% Annual interest rate from short-term cash investment #3 6.0% #4 5.0% #5 4.0% #6 3.0% Interest Rate (Annual) # of Monthly Payments Monthly Loan Payment Total Payments #1 8.0% 72 $281 $20,198 Loans #2 7.0% 60 $317 $19,009 48 30 $561 $376 $18,037 36 $480 $17,263 24 $688 $16,505 $16,840 Practical FALSE FALSE FALSE FALSE FALSE FALSE Regular Payoff #2 #1 #3 #4 #5 #6 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 During Loan Period Actual Monthly Revenue Total Revenue Total Gained Including Interest After Loan Paid Off Months of New Revenue Total Revenue Total Gained Including Interest Return on Investment #1 #2 #3 #4 #5 #6 Early Payoff #2 #1 #3 #4 #5 #6 During Loan Period Months to Payoff Total Payments Months of New Revenue Total Revenue Return on Investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started