Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show formulas in the cells if any. Thank you!!! b. Enter the effects of the following items for Year 1. (1) At the beginning

Please show formulas in the cells if any. Thank you!!!

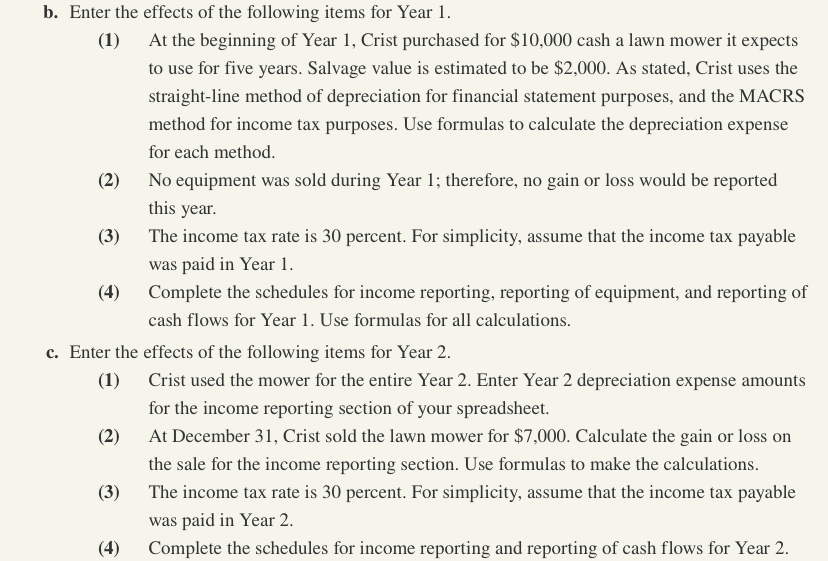

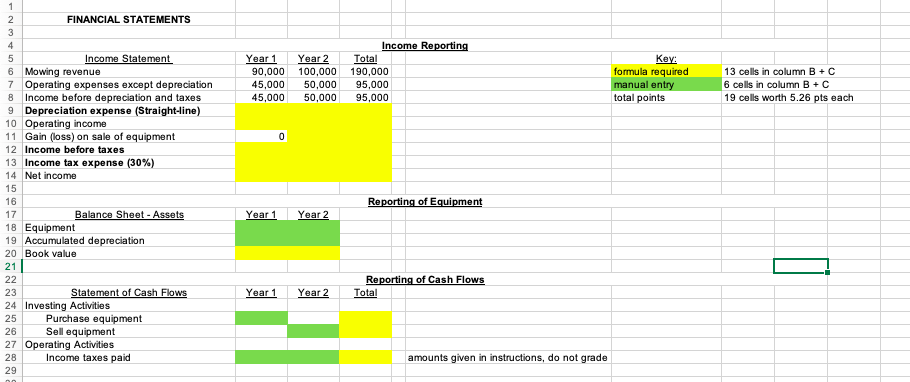

b. Enter the effects of the following items for Year 1. (1) At the beginning of Year 1, Crist purchased for $10,000 cash a lawn mower it expects to use for five years. Salvage value is estimated to be $2,000. As stated, Crist uses the straight-line method of depreciation for financial statement purposes, and the MACRS method for income tax purposes. Use formulas to calculate the depreciation expense for each method. No equipment was sold during Year 1; therefore, no gain or loss would be reported this year. The income tax rate is 30 percent. For simplicity, assume that the income tax payable was paid in Year 1. Complete the schedules for income reporting, reporting of equipment, and reporting of cash flows for Year 1. Use formulas for all calculations. c. Enter the effects of the following items for Year 2. (1) Crist used the mower for the entire Year 2. Enter Year 2 depreciation expense amounts for the income reporting section of your spreadsheet. At December 31, Crist sold the lawn mower for $7,000. Calculate the gain or loss on the sale for the income reporting section. Use formulas to make the calculations. The income tax rate is 30 percent. For simplicity, assume that the income tax payable was paid in Year 2 (4) Complete the schedules for income reporting and reporting of cash flows for Year 2. (3) FINANCIAL STATEMENTS Year 1 90.000 45,000 45,000 Year 2 100.000 50,000 50,000 Income Reporting Total 190,000 95,000 95,000 formula required manual entry total points 13 cells in column B+C 6 cells in column B +C 19 cells worth 5.26 pts each Income Statement 6 Mowing revenue Operating expenses except depreciation Income before depreciation and taxes 9 Depreciation expense (Straight-line) 10 Operating income 11 Gain (loss) on sale of equipment 12 Income before taxes 13 Income tax expense (30%) 14 Net income Reporting of Equipment Year 1 Year 2 Balance Sheet - Assets 18 Equipment 19 Accumulated depreciation 20 Book value 21 22 Year 1 Year 2 Reporting of Cash Flows Total 25 23 Statement of Cash Flows 24 Investing Activities Purchase equipment 26 Sell equipment 27 Operating Activities 28 Income taxes paid amounts given in instructions, do not grade 29Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started