please show formulas used thanks

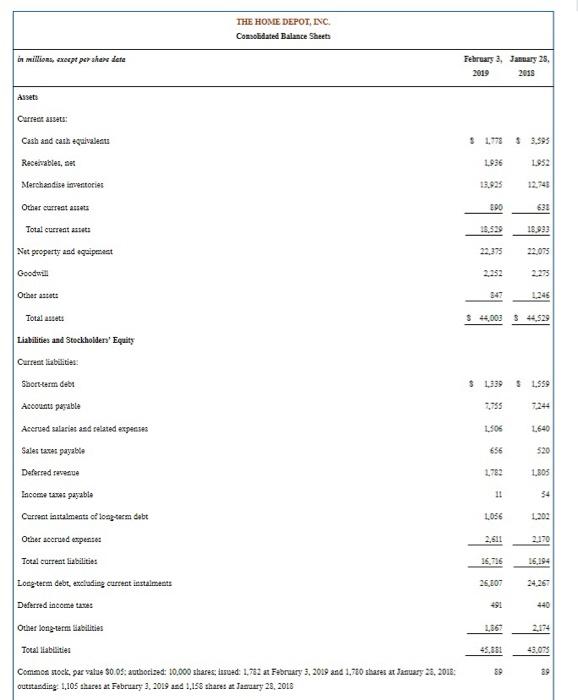

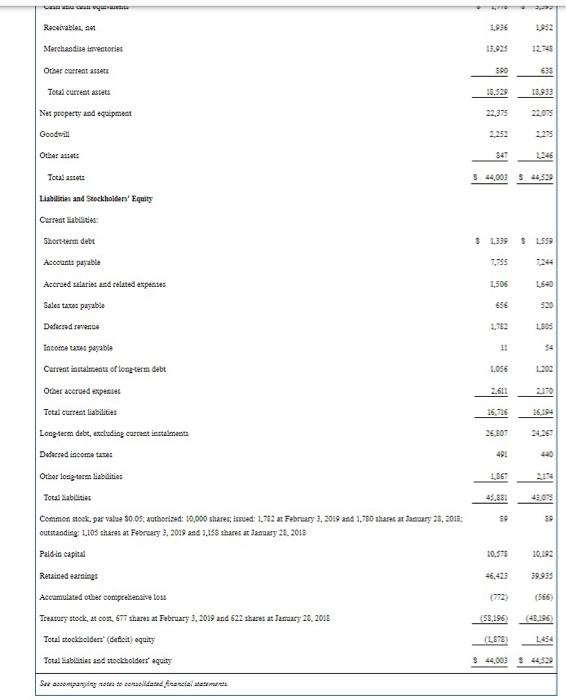

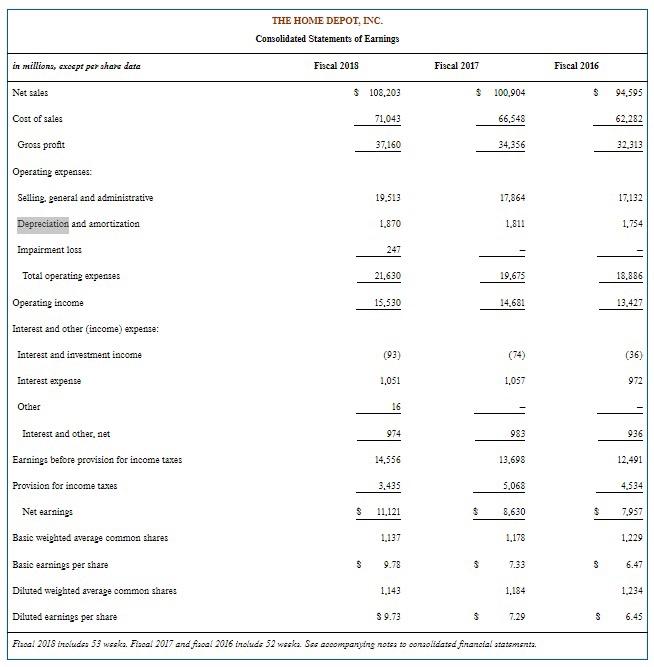

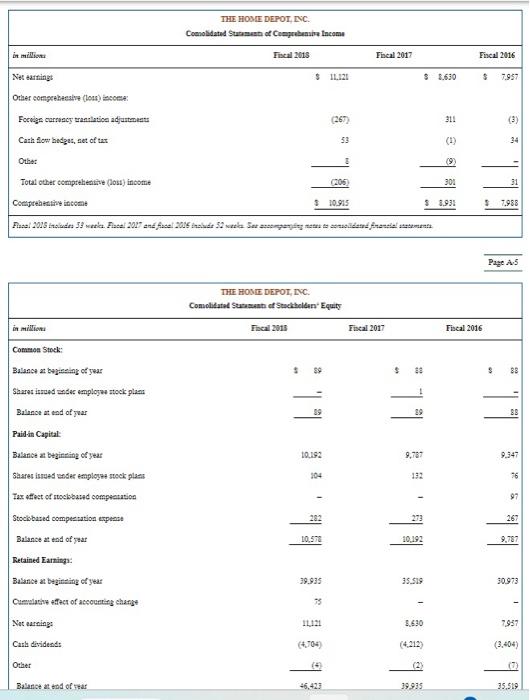

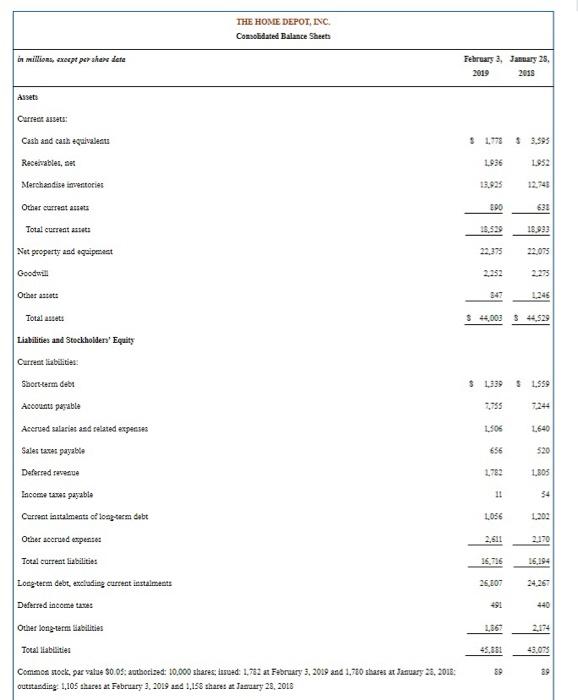

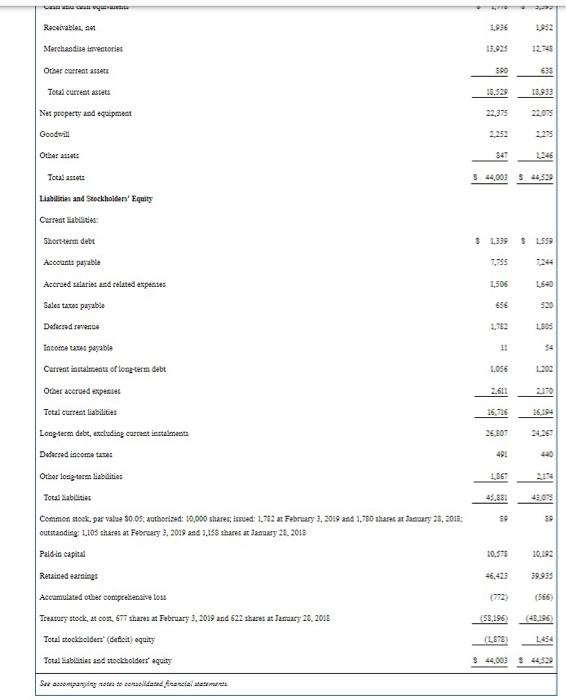

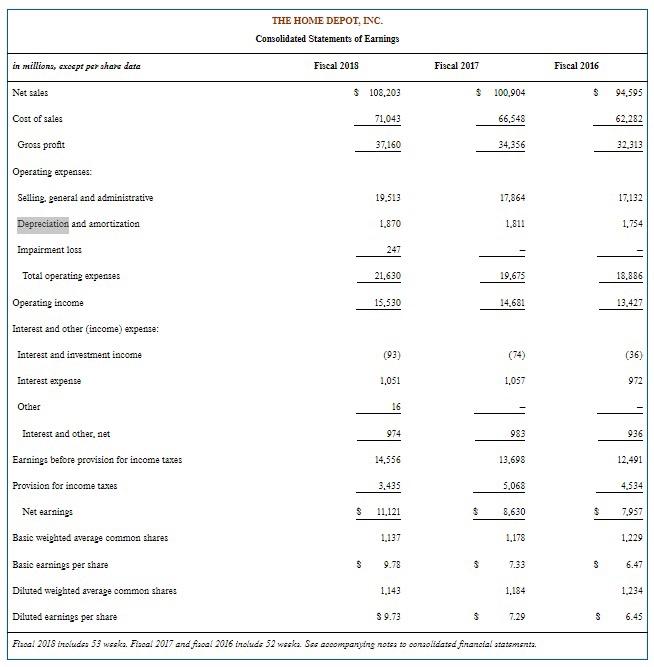

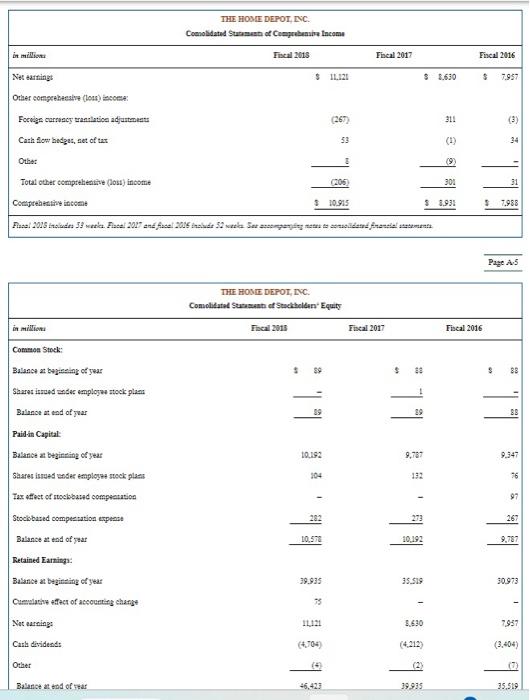

Refer to the summarized financial statements of The Home Depot in Aprendix. A. (Note: The Home Depot, inc. fiscal year 2018, ends on February 3, 2019.) Required: 1. Calculate the company's debt-to-assets ratio for the year ended February 3, 2019. (Round your answer to 2 decimal places.) 2-a. Calculate, the company's times interest earned ratio for the year ended February 3. 2019, (Round your answer to 2 decimal places.) THE HOSE DEPOT, INC. Consobdated Balance Sheets in millions, axocpt perahain lete Assets Carfeter assats: Cash and cank typivaleans Recerables, aet Merchandist inmentoriet Othar carrant assets Totat current amsets Not property and squipenest Goodwill Other astett Total assets Liabilities and Stackholder'' Equity Carten liabtitita: Shorterm dete Accounts pryable Accrued utarias and ralaned expensen Sales taxis payable Doferred renerue lacome taxe: payable Corseat Batalmeats of loagtarm dobt Other accruad etpense: Total current lizbilities Lorgtetan debt, etcladieg curtent iertalments Duferred income taset Other long-tern tiabilities Tocal liabtilitien 51,77853.595 1.9361.952 13,72512,740 Recaivablec, net Merchandise tenentorlat Orkef carreat assetm Total surteat ableth Net ptoperty and tquipmeat Goodsill Othar atiots Tocal assotr Liahilitian and Stockholder' Equit Curfent abicities: Floriterm debt Accounts payable Accrued talariet and relatbd expetst Sales taxos payable Dodecred ravence lincome uaser gayzble Curfent innalmetnts of long-term dtbt Oriat ascruad erpetidas Tetal curtect liabilitiet Longterm debe, excluding curreat intalmeats Dodacred income tame: Othor long-term liakilitios Tocal Mabilitier 81,33981557 outwandieg 1.105 sharen at Fibreary 5.2019 and 1.158 shares at Jamuay 24.2018 Paidrin caginal Reusifed tafniegs Accumulated othet oompcelenstiv lots \begin{aligned}\( \frac{347}{1.446} \\ 944,605 & \$ 44.599 \\ \)\hline \end{aligned} Ireavury stock, at cost, 677 thares at Iebruary 3, 20:9 and 622 aharet at January 28, 2018 Total ttoclboldern' (defcit) equity Ictal Sibjilitien aed nockholdert' equity THE HOME DEPOT, NC. Consolidated Statements of Earnings in millions, except per shans dota Fiscal 2018 Fiscal 2017 Fiscal 2016 Net sales $108,203 Cost of sales Gross proft 71,04337,160 Operating expenses: Selling. general and administrative 19,513 Depreciation and amortization (93) (7.4) (36) Interest expense 1,051 \begin{tabular}{r} 16 \\ \hline 974 \\ 14,556 \end{tabular} Other Interest and other, net Earnings before prowision for income taxes Provision for income taves Net earnings Basic weighted average common shares Basic earnings per share Diluted weighted average common shares Diluted earnings per share Final 2019 inoiudes 53 wsska. Fisoal 2017 and faoal 2016 inolude 52 waka. Sar acoompaning notsa to conaolidatsd finandial atatomanta. THE HOAII DEPOT, INC. Orher songetheasive (long) inconen: Focolge carroacy tranctavise adjusteneats (267) Cath flow hadgus, aet of tar 53 (1) Othat Total other cempteltestite (loss) income Page A.5 Refer to the summarized financial statements of The Home Depot in Aprendix. A. (Note: The Home Depot, inc. fiscal year 2018, ends on February 3, 2019.) Required: 1. Calculate the company's debt-to-assets ratio for the year ended February 3, 2019. (Round your answer to 2 decimal places.) 2-a. Calculate, the company's times interest earned ratio for the year ended February 3. 2019, (Round your answer to 2 decimal places.) THE HOSE DEPOT, INC. Consobdated Balance Sheets in millions, axocpt perahain lete Assets Carfeter assats: Cash and cank typivaleans Recerables, aet Merchandist inmentoriet Othar carrant assets Totat current amsets Not property and squipenest Goodwill Other astett Total assets Liabilities and Stackholder'' Equity Carten liabtitita: Shorterm dete Accounts pryable Accrued utarias and ralaned expensen Sales taxis payable Doferred renerue lacome taxe: payable Corseat Batalmeats of loagtarm dobt Other accruad etpense: Total current lizbilities Lorgtetan debt, etcladieg curtent iertalments Duferred income taset Other long-tern tiabilities Tocal liabtilitien 51,77853.595 1.9361.952 13,72512,740 Recaivablec, net Merchandise tenentorlat Orkef carreat assetm Total surteat ableth Net ptoperty and tquipmeat Goodsill Othar atiots Tocal assotr Liahilitian and Stockholder' Equit Curfent abicities: Floriterm debt Accounts payable Accrued talariet and relatbd expetst Sales taxos payable Dodecred ravence lincome uaser gayzble Curfent innalmetnts of long-term dtbt Oriat ascruad erpetidas Tetal curtect liabilitiet Longterm debe, excluding curreat intalmeats Dodacred income tame: Othor long-term liakilitios Tocal Mabilitier 81,33981557 outwandieg 1.105 sharen at Fibreary 5.2019 and 1.158 shares at Jamuay 24.2018 Paidrin caginal Reusifed tafniegs Accumulated othet oompcelenstiv lots \begin{aligned}\( \frac{347}{1.446} \\ 944,605 & \$ 44.599 \\ \)\hline \end{aligned} Ireavury stock, at cost, 677 thares at Iebruary 3, 20:9 and 622 aharet at January 28, 2018 Total ttoclboldern' (defcit) equity Ictal Sibjilitien aed nockholdert' equity THE HOME DEPOT, NC. Consolidated Statements of Earnings in millions, except per shans dota Fiscal 2018 Fiscal 2017 Fiscal 2016 Net sales $108,203 Cost of sales Gross proft 71,04337,160 Operating expenses: Selling. general and administrative 19,513 Depreciation and amortization (93) (7.4) (36) Interest expense 1,051 \begin{tabular}{r} 16 \\ \hline 974 \\ 14,556 \end{tabular} Other Interest and other, net Earnings before prowision for income taxes Provision for income taves Net earnings Basic weighted average common shares Basic earnings per share Diluted weighted average common shares Diluted earnings per share Final 2019 inoiudes 53 wsska. Fisoal 2017 and faoal 2016 inolude 52 waka. Sar acoompaning notsa to conaolidatsd finandial atatomanta. THE HOAII DEPOT, INC. Orher songetheasive (long) inconen: Focolge carroacy tranctavise adjusteneats (267) Cath flow hadgus, aet of tar 53 (1) Othat Total other cempteltestite (loss) income Page A.5