Answered step by step

Verified Expert Solution

Question

1 Approved Answer

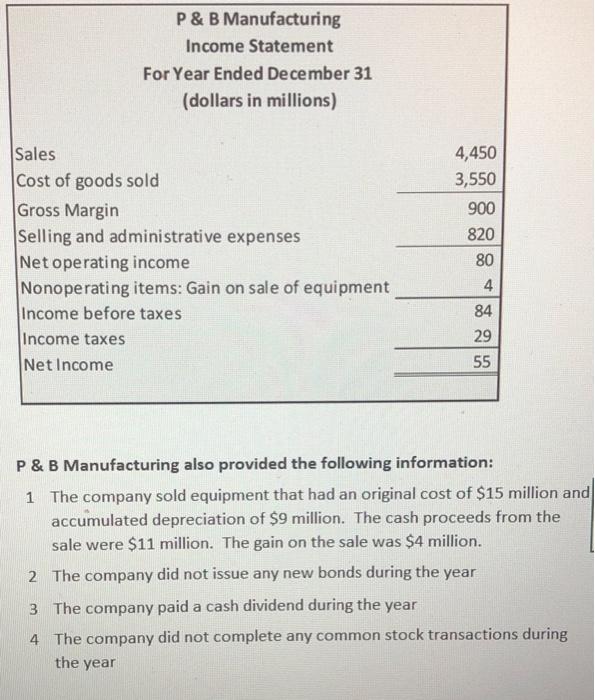

please show formulas/work P & B Manufacturing also provided the following information: 1 The company sold equipment that had an original cost of $15 million

please show formulas/work

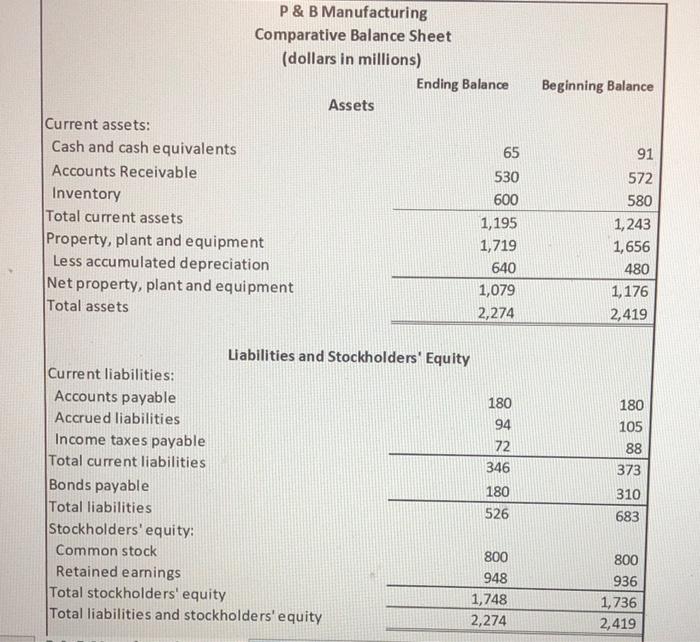

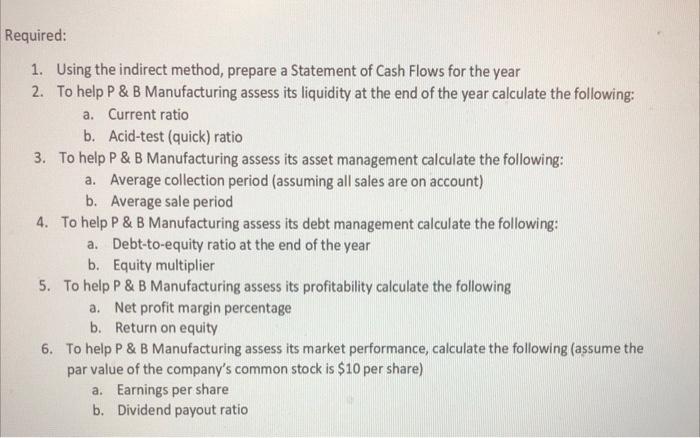

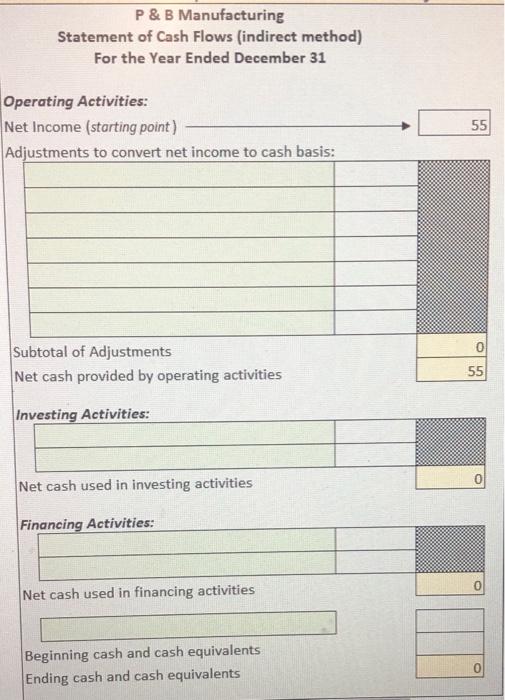

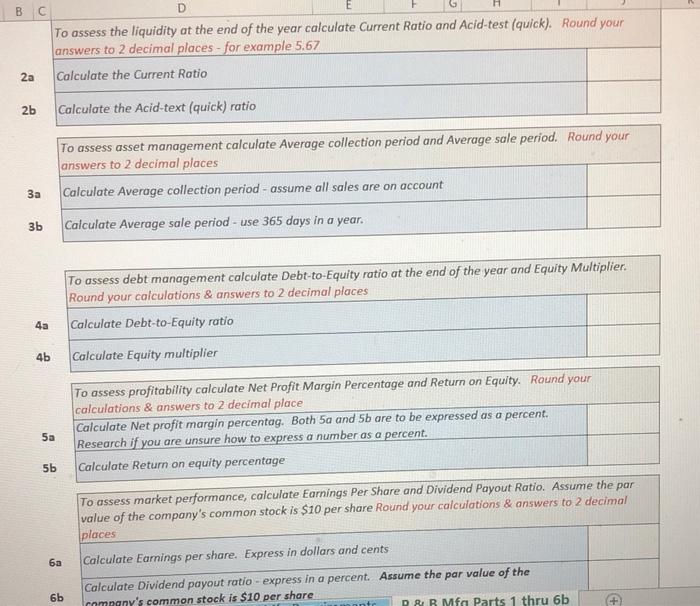

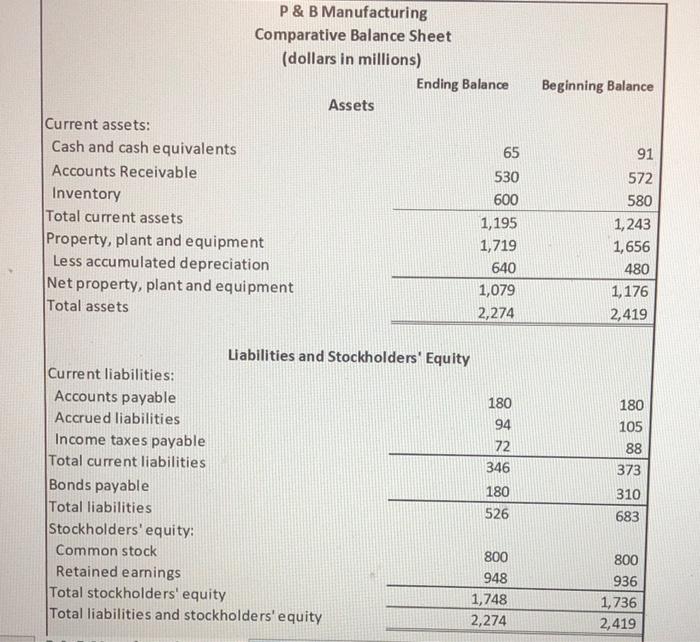

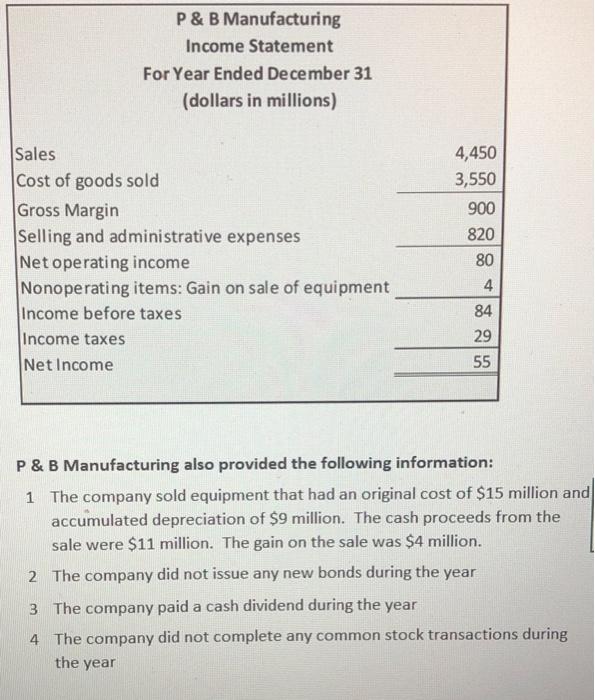

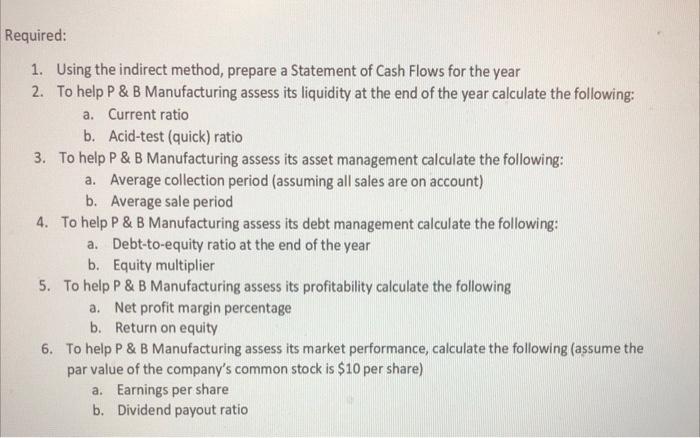

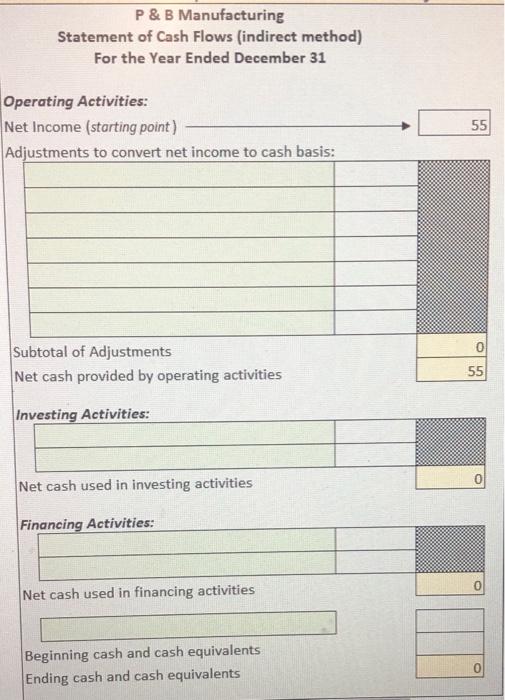

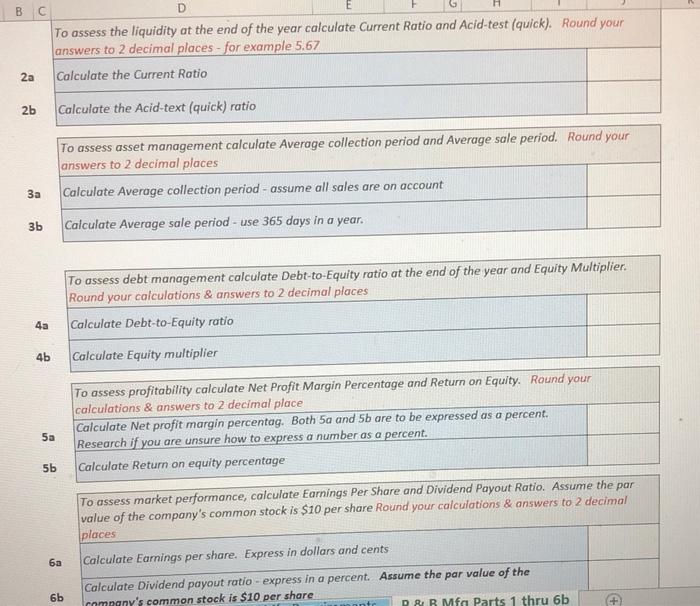

P \& B Manufacturing also provided the following information: 1 The company sold equipment that had an original cost of $15 million and accumulated depreciation of $9 million. The cash proceeds from the sale were $11 million. The gain on the sale was $4 million. 2 The company did not issue any new bonds during the year 3 The company paid a cash dividend during the year 4 The company did not complete any common stock transactions during the year 1. Using the indirect method, prepare a Statement of Cash Flows for the year 2. To help P \& B Manufacturing assess its liquidity at the end of the year calculate the following: a. Current ratio b. Acid-test (quick) ratio 3. To help P \& B Manufacturing assess its asset management calculate the following: a. Average collection period (assuming all sales are on account) b. Average sale period 4. To help P \& B Manufacturing assess its debt management calculate the following: a. Debt-to-equity ratio at the end of the year b. Equity multiplier 5. To help P \& B Manufacturing assess its profitability calculate the following a. Net profit margin percentage b. Return on equity 6. To help P \& B Manufacturing assess its market performance, calculate the following (assume the par value of the company's common stock is $10 per share) a. Earnings per share b. Dividend payout ratio P \& B Manufacturing Statement of Cash Flows (indirect method) For the Year Ended December 31 Operating Activities: Net Income (storting point) Adiustments to convert net income to cash basis: Net cash provided by operating activities fet casn used in uvesuing auvitucs Net cash used in financing activities \begin{tabular}{|l|l|l|l|} B Co assess the liquidity at the end of the year calculate Current Ratio and Acid-test (quick). Round your \\ answers to 2 decimal places - for example 5.67 \\ \hline Calculate the Current Ratio \\ \hline 2b & Calculate the Acid-text (quick) ratio \\ \hline \end{tabular} \begin{tabular}{l} To assess asset management calculate Average collection period and Average sale period. Round your \\ 3a \begin{tabular}{|l|l|} \hline answers to 2 decimal places \end{tabular} \\ \hline Calculate Average collection period - assume all sales are on account \\ \hline Calculate Average sale period - use 365 days in a year. \\ \hline \end{tabular} \begin{tabular}{l} To assess debt management calculate Debt-to-Equity ratio at the end of the year and Equity Multiplier. \\ Round your calculations \& answers to 2 decimal places \\ 4alculate Debt-to-Equity ratio \\ 4b Calculate Equity multiplier \\ \hline \end{tabular} To assess profitability calculate Net Profit Margin Percentage and Return on Equity. Round your calculations \& answers to 2 decimal place 5a Calculate Net profit margin percentag. Both 5a and 5b are to be expressed as a percent. 5b Calculate Return on equity percentage To assess market performance, calculate Earnings Per Share and Dividend Payout Ratio. Assume the par value of the company's common stock is $10 per share Round your calculations \& answers to 2 decimal 6a Calculate Earnings per share. Express in dollars and cents 6b Calculate Dividend payout ratio - express in a percent. Assume the par value of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started