Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show full calculations in Excel. Q5 (Target Beta): An investment management firm wishes to decrease the beta of one of its portfolios under management

Please show full calculations in Excel.

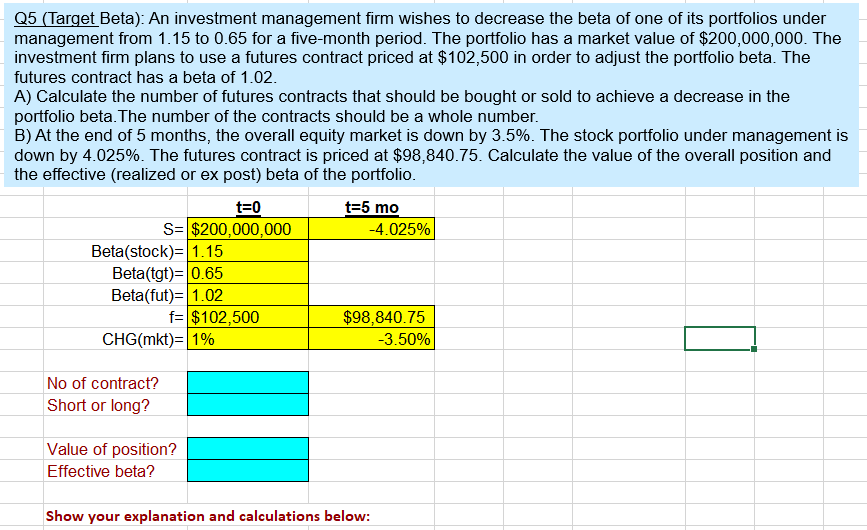

Q5 (Target Beta): An investment management firm wishes to decrease the beta of one of its portfolios under management from 1.15 to 0.65 for a five-month period. The portfolio has a market value of $200,000,000. The investment firm plans to use a futures contract priced at $102,500 in order to adjust the portfolio beta. The futures contract has a beta of 1.02. A) Calculate the number of futures contracts that should be bought or sold to achieve a decrease in the portfolio beta. The number of the contracts should be a whole number. B) At the end of 5 months, the overall equity market is down by 3.5%. The stock portfolio under management is down by 4.025%. The futures contract is priced at $98,840.75. Calculate the value of the overall position and the effective realized or ex post) beta of the portfolio. t=5 mo -4.025% t=0 S=$200,000,000 Beta(stock)=1.15 Beta(tgt)=0.65 Beta(fut)=1.02 f= $102,500 CHG(mkt)= 1% $98,840.75 -3.50% No of contract? Short or long? Value of position? Effective beta? Show your explanation and calculations below: Q5 (Target Beta): An investment management firm wishes to decrease the beta of one of its portfolios under management from 1.15 to 0.65 for a five-month period. The portfolio has a market value of $200,000,000. The investment firm plans to use a futures contract priced at $102,500 in order to adjust the portfolio beta. The futures contract has a beta of 1.02. A) Calculate the number of futures contracts that should be bought or sold to achieve a decrease in the portfolio beta. The number of the contracts should be a whole number. B) At the end of 5 months, the overall equity market is down by 3.5%. The stock portfolio under management is down by 4.025%. The futures contract is priced at $98,840.75. Calculate the value of the overall position and the effective realized or ex post) beta of the portfolio. t=5 mo -4.025% t=0 S=$200,000,000 Beta(stock)=1.15 Beta(tgt)=0.65 Beta(fut)=1.02 f= $102,500 CHG(mkt)= 1% $98,840.75 -3.50% No of contract? Short or long? Value of position? Effective beta? Show your explanation and calculations belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started