Please show full solution it would be greatly appreciated thanks so much have a nice day!

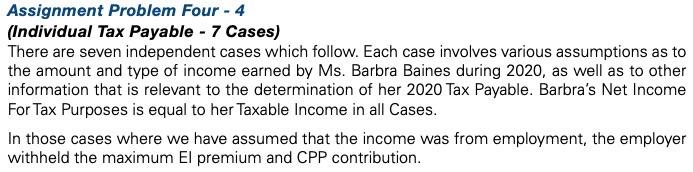

Assignment Problem Four - 4 (Individual Tax Payable - 7 Cases) There are seven independent cases which follow. Each case involves various assumptions as to the amount and type of income earned by Ms. Barbra Baines during 2020, as well as to other information that is relevant to the determination of her 2020 Tax Payable. Barbra's Net Income For Tax Purposes is equal to her Taxable income in all Cases. In those cases where we have assumed that the income was from employment, the employer withheld the maximum El premium and CPP contribution. Case 5 Barbra is 58 years old and has employment income of $93,500. Her common- law partner is 48 years old and has income of $7,260. They have an adopted son who is 19 years old and lives at home. Barbra and her partner have medical expenses of $3,200. Medical expenses for the son total $8,400. The son has Net Income For Tax Purposes of $5,600 Case 6 Barbra is 45 years old and has employment income of $84,600. Her husband, John, is 37 years old and has Net Income For Tax Purposes of $7,200. They have no children. However, they provide in home care for John's father, who is 63 years old, dependent because of a physical infirmity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is Barbra's 67 year old father . He is in good physical and mental health and has Net Income For Tax Purposes of $19,400. Case 7 Barbra is 46 years old and has employment income of $ 163,000. Her husband, Larry, is 41 years old and has Net Income For Tax Purposes of $7,240. They have a 20 year 6 Chapter 4 Assignment Problems old son who lives at home. He is dependent because of a physical infirmity, but it is not severe enough to qualify him for the disability tax credit. However, he was able to attend university on a full time basis for eight months during 2020. Barbra pays his tuition fees of $8,300, as well as $640 for the textbooks that he requires in his program. The son has agreed to transfer the maximum tuition amount allowable to Barbra. The son has Net Income For Tax Purposes of $9,600. Required: In each Case, calculate Barbra Baines' minimum federal Tax Payable for 2020. Indi- cate any carry forwards available to her and her dependants and the carry forward provisions. Ignore any amounts Barbra might have had withheld or paid in instalments and the possibility of pension splitting. Assignment Problem Four - 4 (Individual Tax Payable - 7 Cases) There are seven independent cases which follow. Each case involves various assumptions as to the amount and type of income earned by Ms. Barbra Baines during 2020, as well as to other information that is relevant to the determination of her 2020 Tax Payable. Barbra's Net Income For Tax Purposes is equal to her Taxable income in all Cases. In those cases where we have assumed that the income was from employment, the employer withheld the maximum El premium and CPP contribution. Case 5 Barbra is 58 years old and has employment income of $93,500. Her common- law partner is 48 years old and has income of $7,260. They have an adopted son who is 19 years old and lives at home. Barbra and her partner have medical expenses of $3,200. Medical expenses for the son total $8,400. The son has Net Income For Tax Purposes of $5,600 Case 6 Barbra is 45 years old and has employment income of $84,600. Her husband, John, is 37 years old and has Net Income For Tax Purposes of $7,200. They have no children. However, they provide in home care for John's father, who is 63 years old, dependent because of a physical infirmity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is Barbra's 67 year old father . He is in good physical and mental health and has Net Income For Tax Purposes of $19,400. Case 7 Barbra is 46 years old and has employment income of $ 163,000. Her husband, Larry, is 41 years old and has Net Income For Tax Purposes of $7,240. They have a 20 year 6 Chapter 4 Assignment Problems old son who lives at home. He is dependent because of a physical infirmity, but it is not severe enough to qualify him for the disability tax credit. However, he was able to attend university on a full time basis for eight months during 2020. Barbra pays his tuition fees of $8,300, as well as $640 for the textbooks that he requires in his program. The son has agreed to transfer the maximum tuition amount allowable to Barbra. The son has Net Income For Tax Purposes of $9,600. Required: In each Case, calculate Barbra Baines' minimum federal Tax Payable for 2020. Indi- cate any carry forwards available to her and her dependants and the carry forward provisions. Ignore any amounts Barbra might have had withheld or paid in instalments and the possibility of pension splitting