Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show full solution so that I can understand each steps. No computer generated answers please. 11. Golden Construction Plc is a national construction company

Please show full solution so that I can understand each steps. No computer generated answers please.

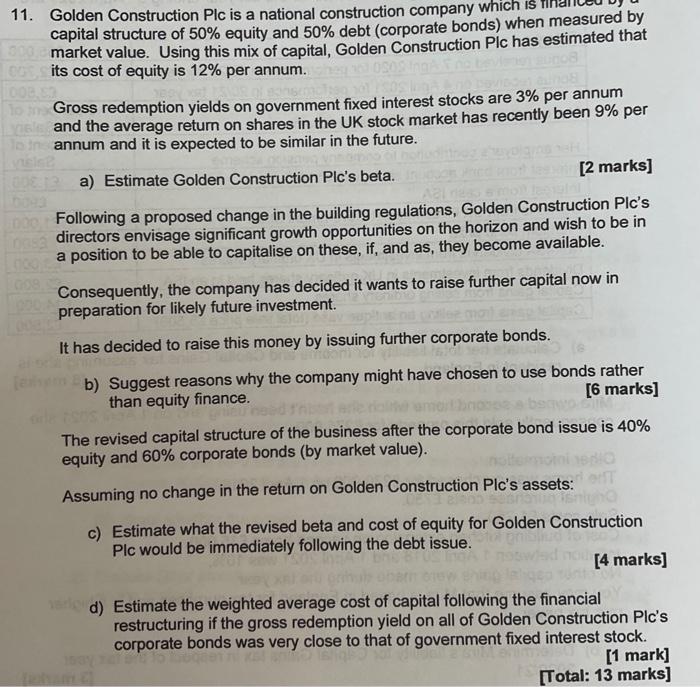

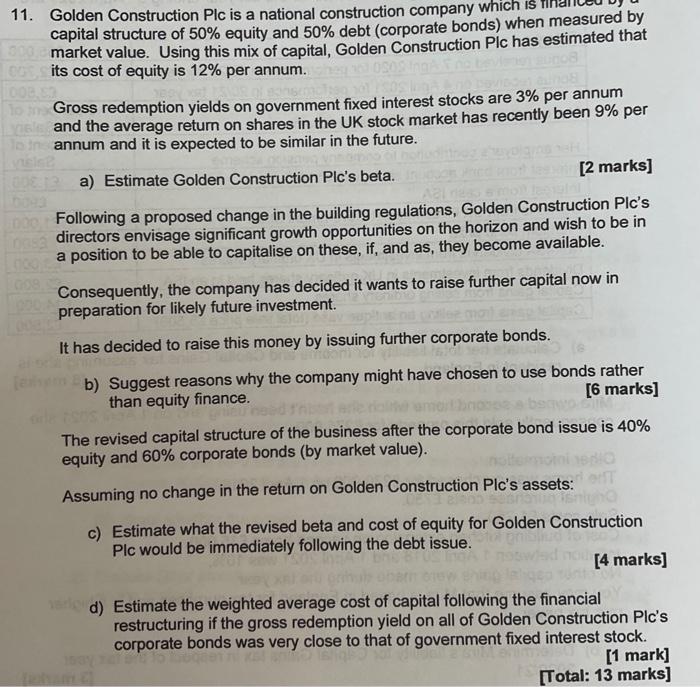

11. Golden Construction Plc is a national construction company which is capital structure of 50% equity and 50% debt (corporate bonds) when measured by market value. Using this mix of capital, Golden Construction Pic has estimated that CEE its cost of equity is 12% per annum. Gross redemption yields on government fixed interest stocks are 3% per annum and the average return on shares in the UK stock market has recently been 9% per In annum and it is expected to be similar in the future. a) Estimate Golden Construction Plc's beta. [2 marks] Following a proposed change in the building regulations, Golden Construction Plc's directors envisage significant growth opportunities on the horizon and wish to be in a position to be able to capitalise on these, if, and as, they become available. Consequently, the company has decided it wants to raise further capital now in preparation for likely future investment. It has decided to raise this money by issuing further corporate bonds. b) Suggest reasons why the company might have chosen to use bonds rather than equity finance. [6 marks] The revised capital structure of the business after the corporate bond issue is 40% equity and 60% corporate bonds (by market value). Assuming no change in the return on Golden Construction Plc's assets: AT c) Estimate what the revised beta and cost of equity for Golden Construction Plc would be immediately following the debt issue. [4 marks] d) Estimate the weighted average cost of capital following the financial restructuring if the gross redemption yield on all of Golden Construction Pic's corporate bonds was very close to that of government fixed interest stock. [1 mark] [Total: 13 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started