Question: Please show how to calculate this using excel formulas? According to the value-based management model, what is the stock price per share given the following

Please show how to calculate this using excel formulas?

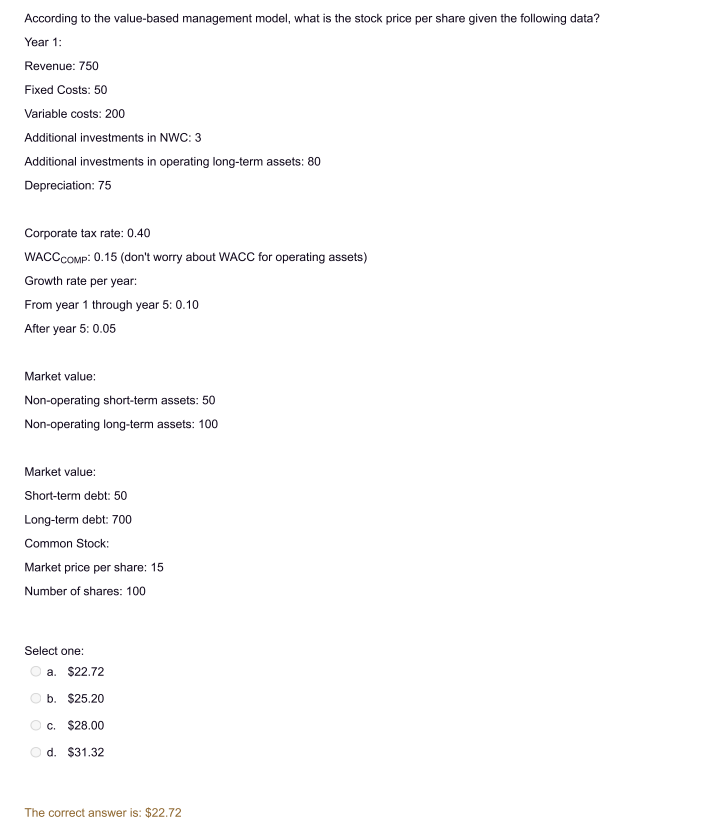

According to the value-based management model, what is the stock price per share given the following data? Year 1: Revenue: 750 Fixed Costs: 50 Variable costs: 200 Additional investments in NWC: 3 Additional investments in operating long-term assets: 80 Depreciation: 75 Corporate tax rate: 0.40 WACC COMP: 0.15 (don't worry about WACC for operating assets) Growth rate per year: From year 1 through year 5:0.10 After year 5: 0.05 Market value: Non-operating short-term assets: 50 Non-operating long-term assets: 100 Market value: Short-term debt: 50 Long-term debt: 700 Common Stock: Market price per share: 15 Number of shares: 100 Select one: a. $22.72 b. $25.20 c. $28.00 d. $31.32 The correct answer is: $22.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts