Answered step by step

Verified Expert Solution

Question

1 Approved Answer

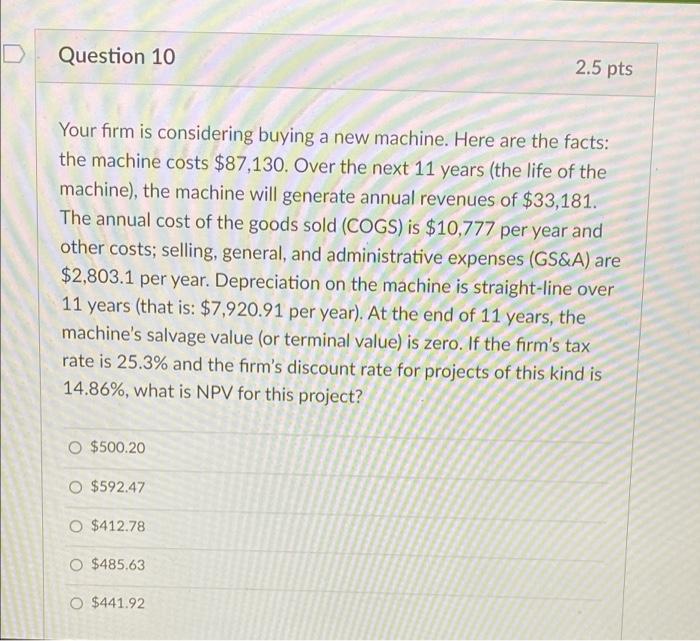

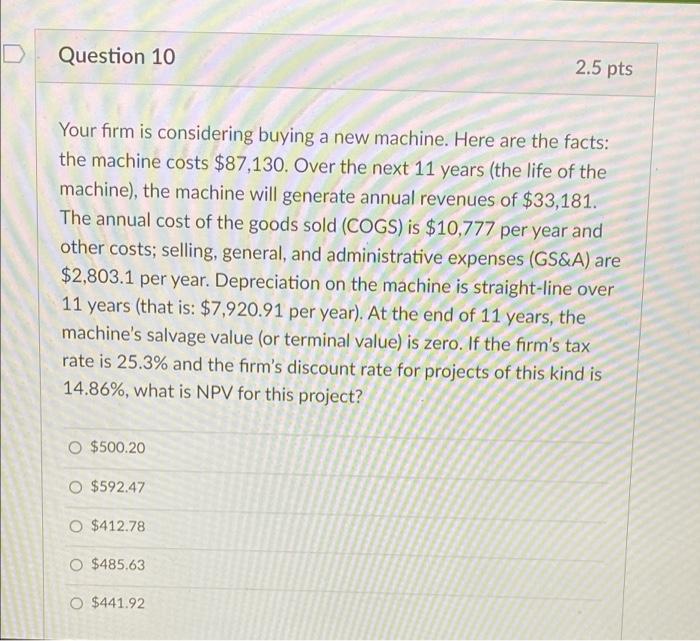

please show how to do in excel as well Question 10 2.5 pts Your firm is considering buying a new machine. Here are the facts:

please show how to do in excel as well

Question 10 2.5 pts Your firm is considering buying a new machine. Here are the facts: the machine costs $87,130. Over the next 11 years (the life of the machine), the machine will generate annual revenues of $33,181. The annual cost of the goods sold (COGS) is $10,777 per year and other costs; selling, general, and administrative expenses (GS&A) are $2,803.1 per year. Depreciation on the machine is straight-line over 11 years (that is: $7,920.91 per year). At the end of 11 years, the machine's salvage value (or terminal value) is zero. If the firm's tax rate is 25.3% and the firm's discount rate for projects of this kind is 14.86%, what is NPV for this project? O $500.20 O $592.47 O $412.78 O $485.63 O $441.92

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started