Answered step by step

Verified Expert Solution

Question

1 Approved Answer

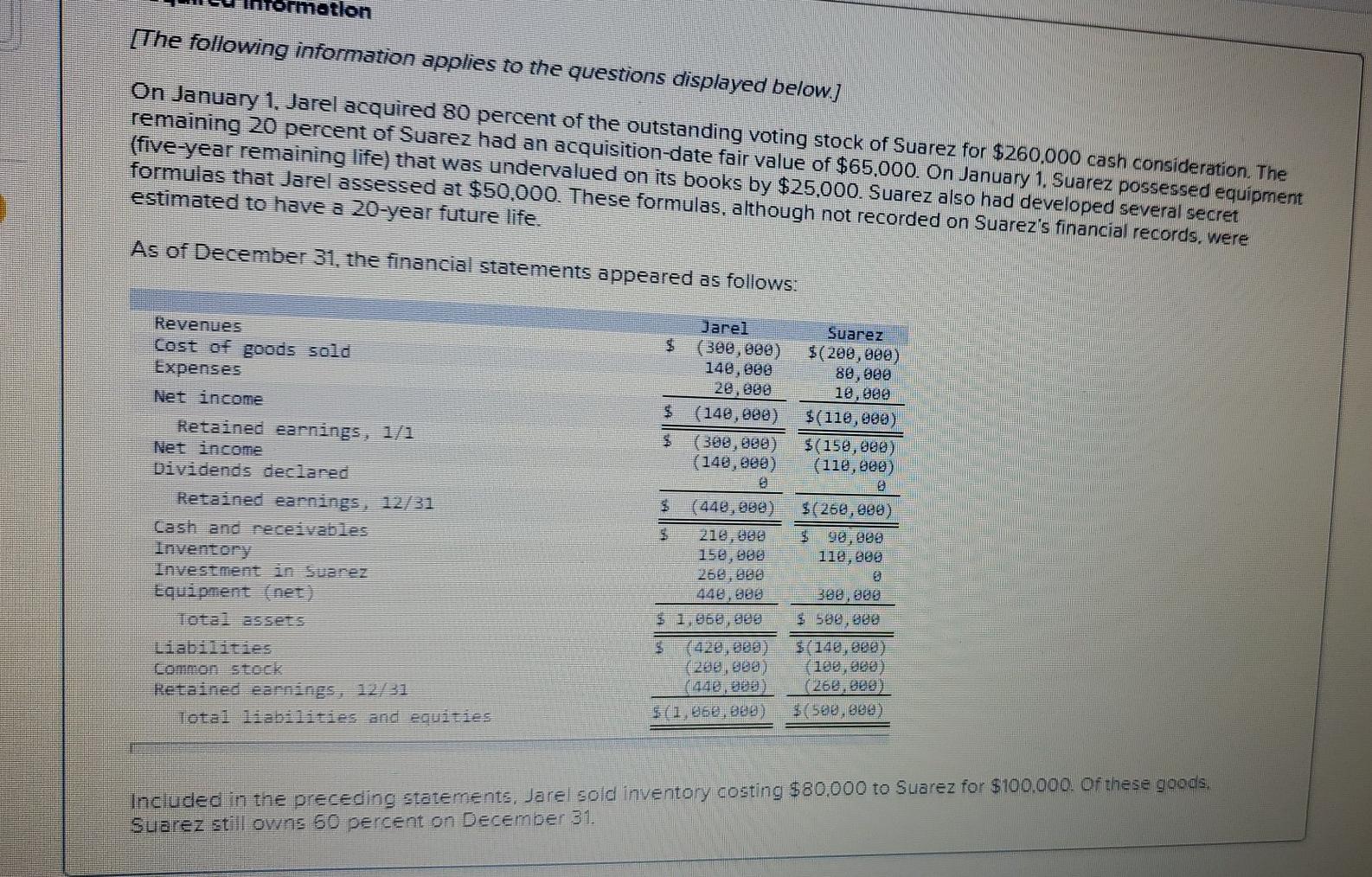

please show how to solve it ormation [The following information applies to the questions displayed below] On January 1, Jarel acquired 80 percent of the

please show how to solve it

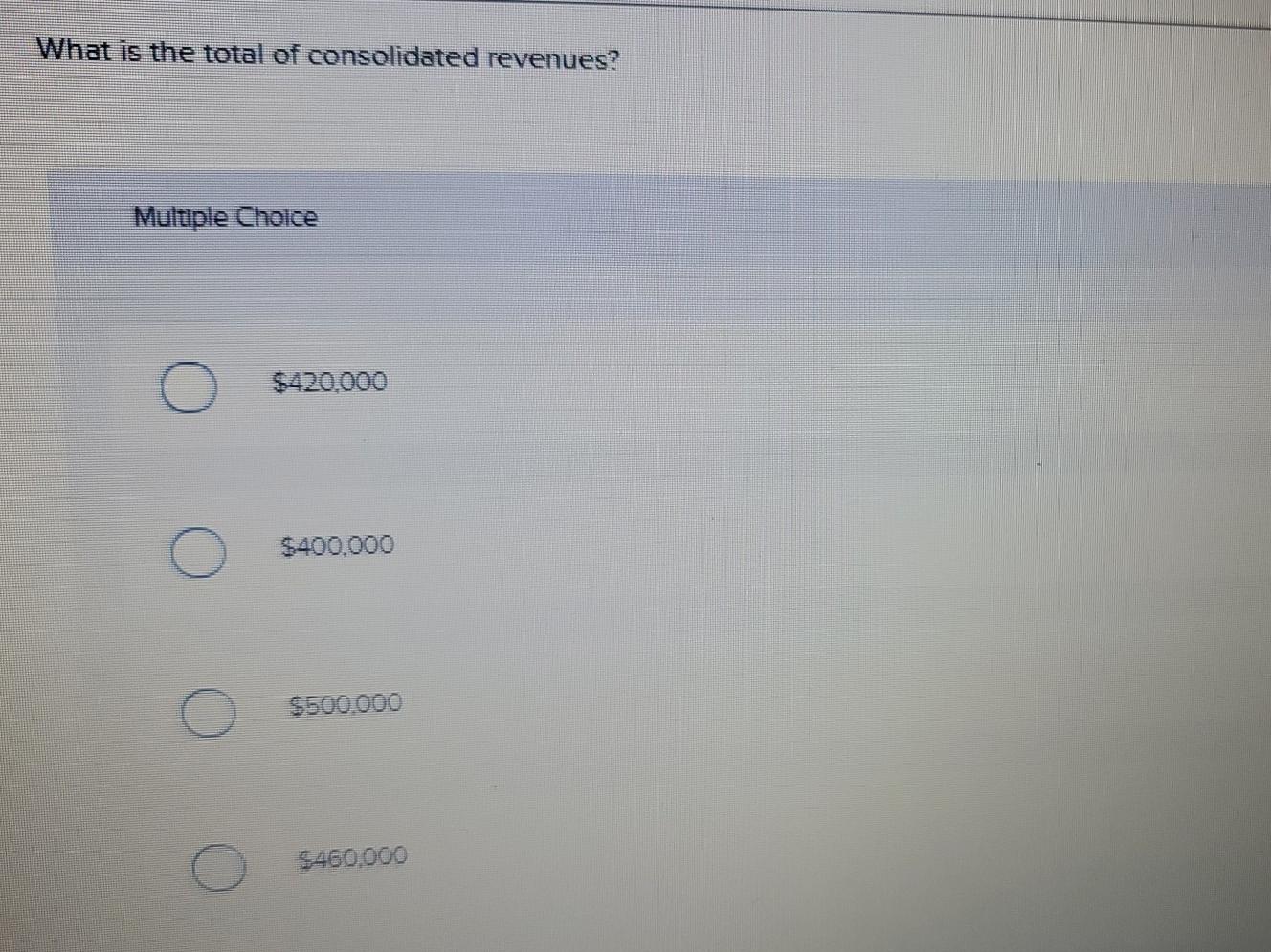

ormation [The following information applies to the questions displayed below] On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260.000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remaining life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez's financial records, were estimated to have a 20-year future life. As of December 31, the financial statements appeared as follows: Jarel (392, 880) 140,000 20,000 (148,000) (308, 980) (148,089) $ Revenues Cost of goods sold Expenses Net income Retained earnings, 1/1 Net income Dividends declared Retained earnings, 12/31 Cash and receivables Inventory Investment in Suarez Equipment (net) Tota assets Liabilities Suarez $(209,900) 80,000 18,000 $(110,000) $(150,000) (119,900) @ $(260, 980) 99,999 112, 800 $ (448,982) 218,990 268, 980 448,000 $ 1,968,800 308,800 $ 500,000 $ (288,888 ( 100,000) Retained earnings, 12/31 Total liabilities and equities Included in the preceding statements, Jarel sold inventory costing $80,000 to Suarez for $100.000. Of these goods. Suarez still owns 60 percent on December 31. What is the total of consolidated revenues? Multiple Choice $420.000 $400.000 $500.000 $460.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started