Please show how you got it

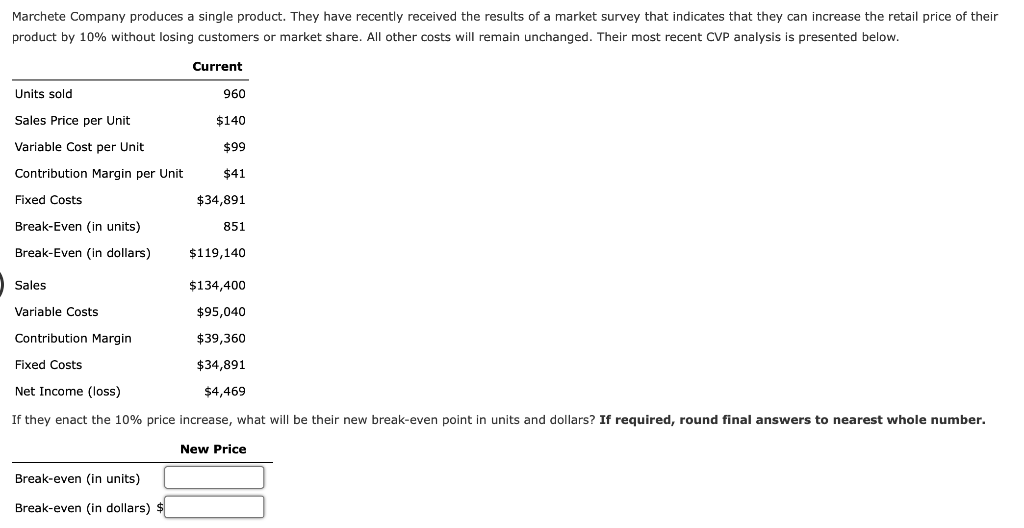

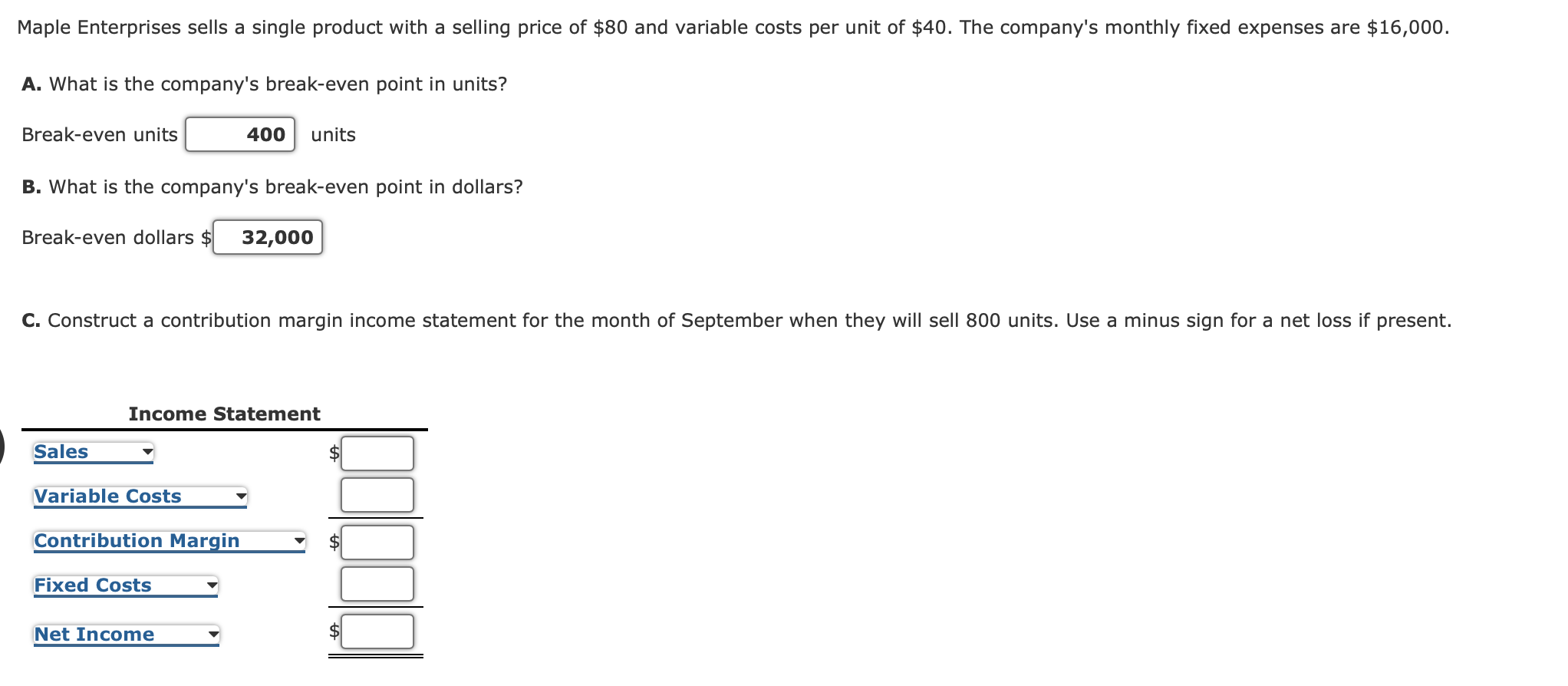

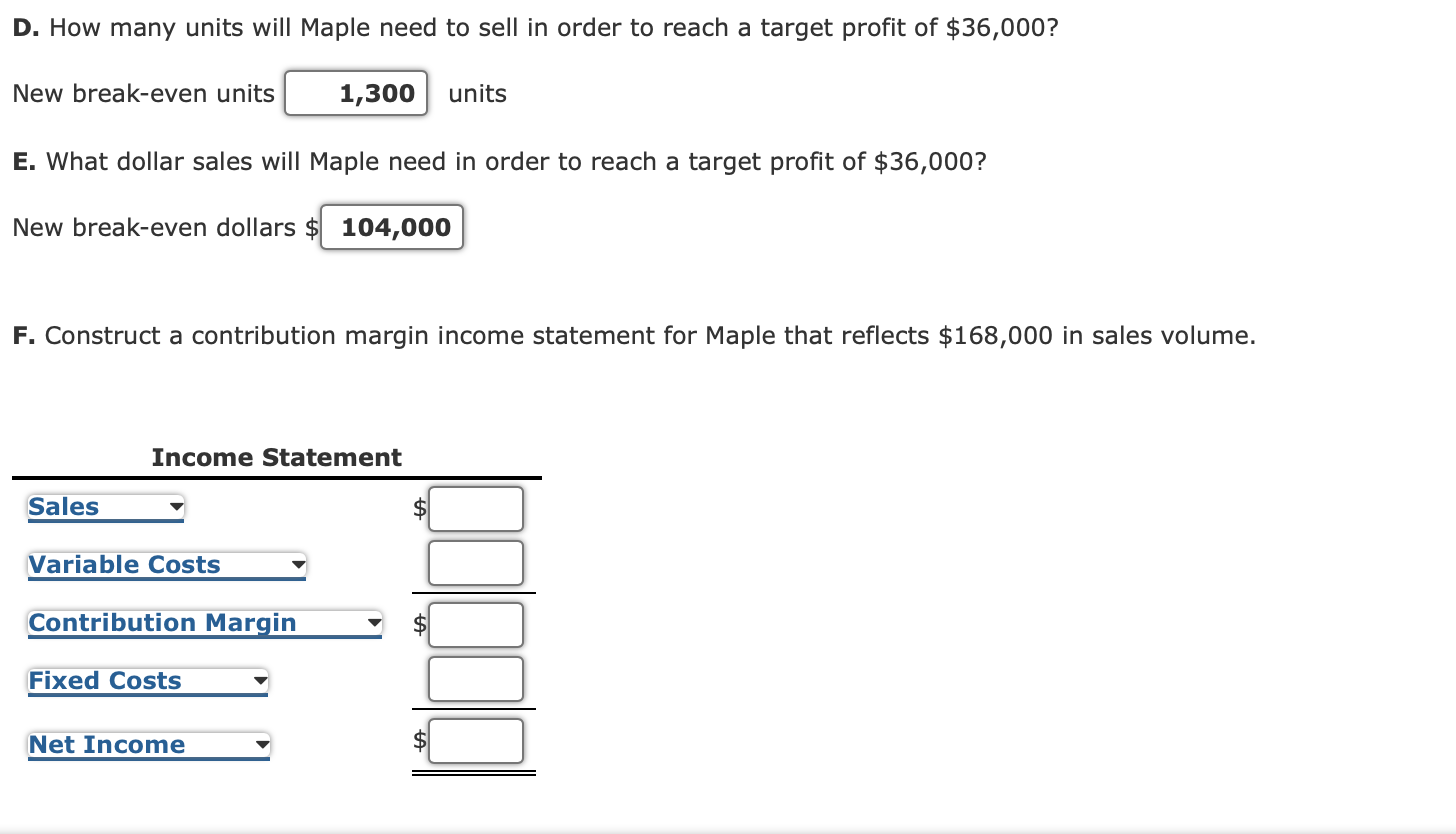

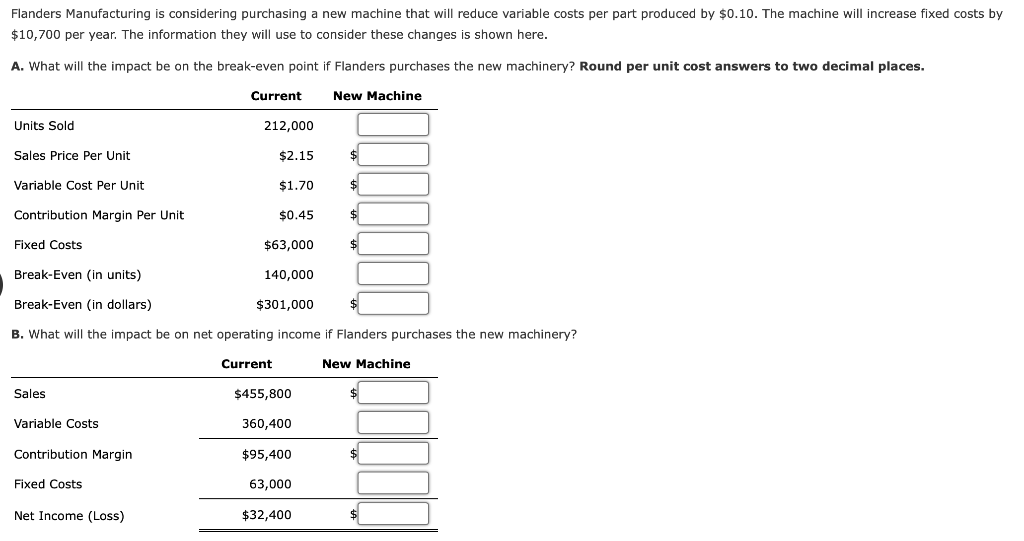

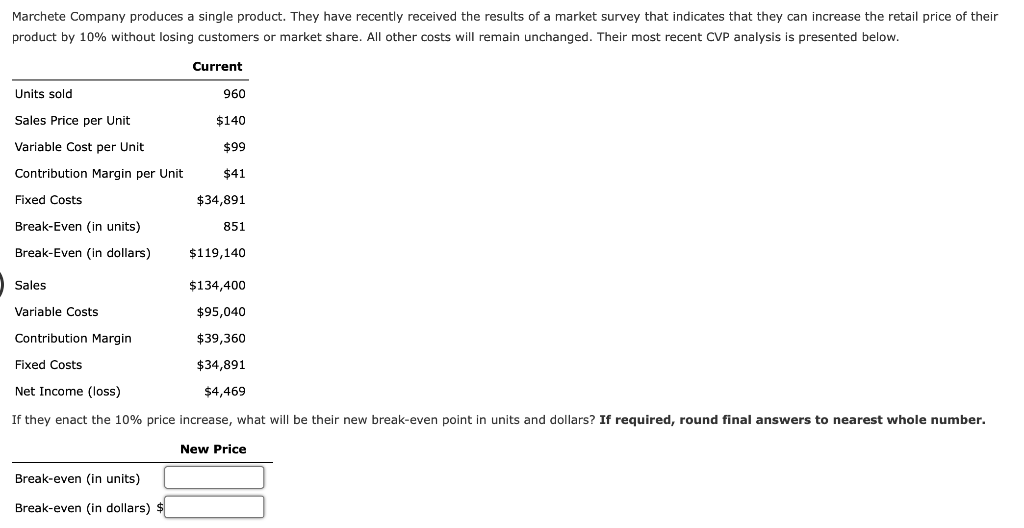

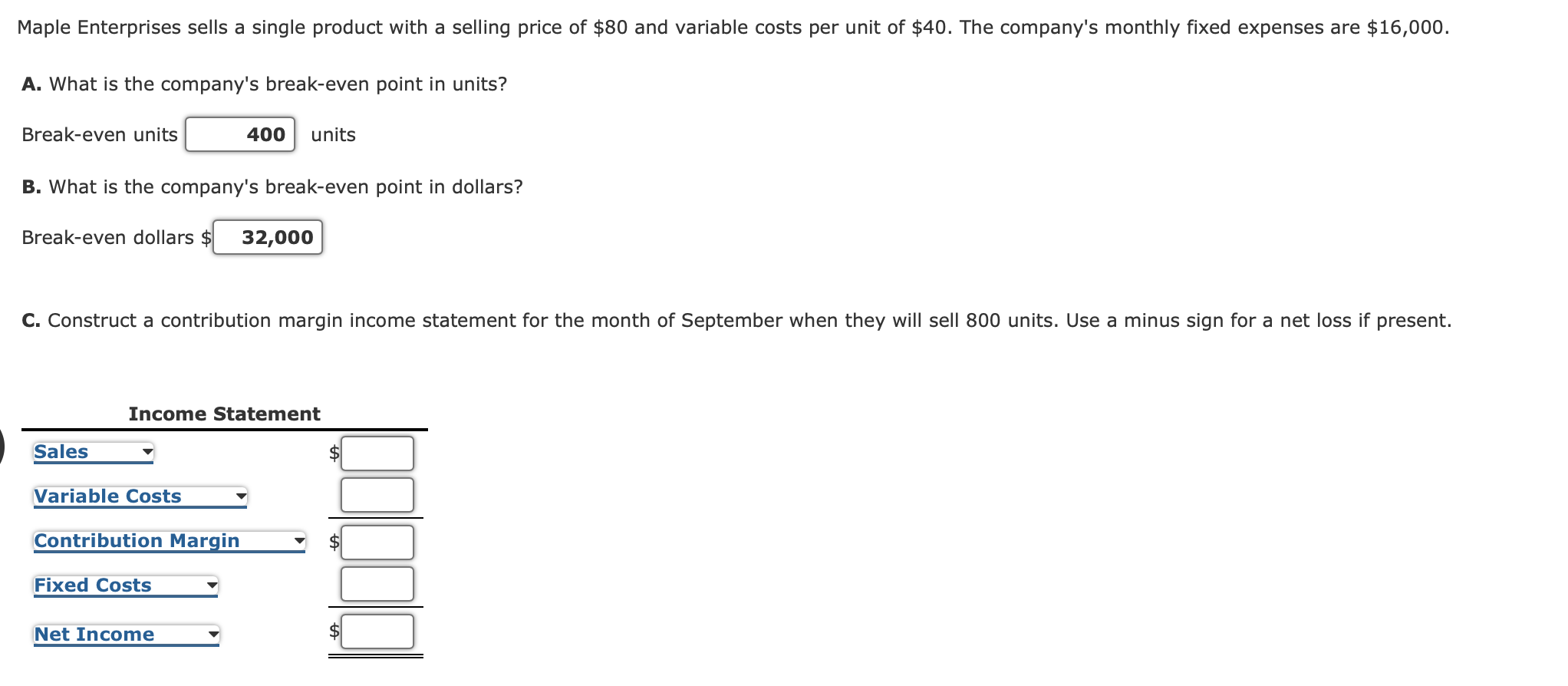

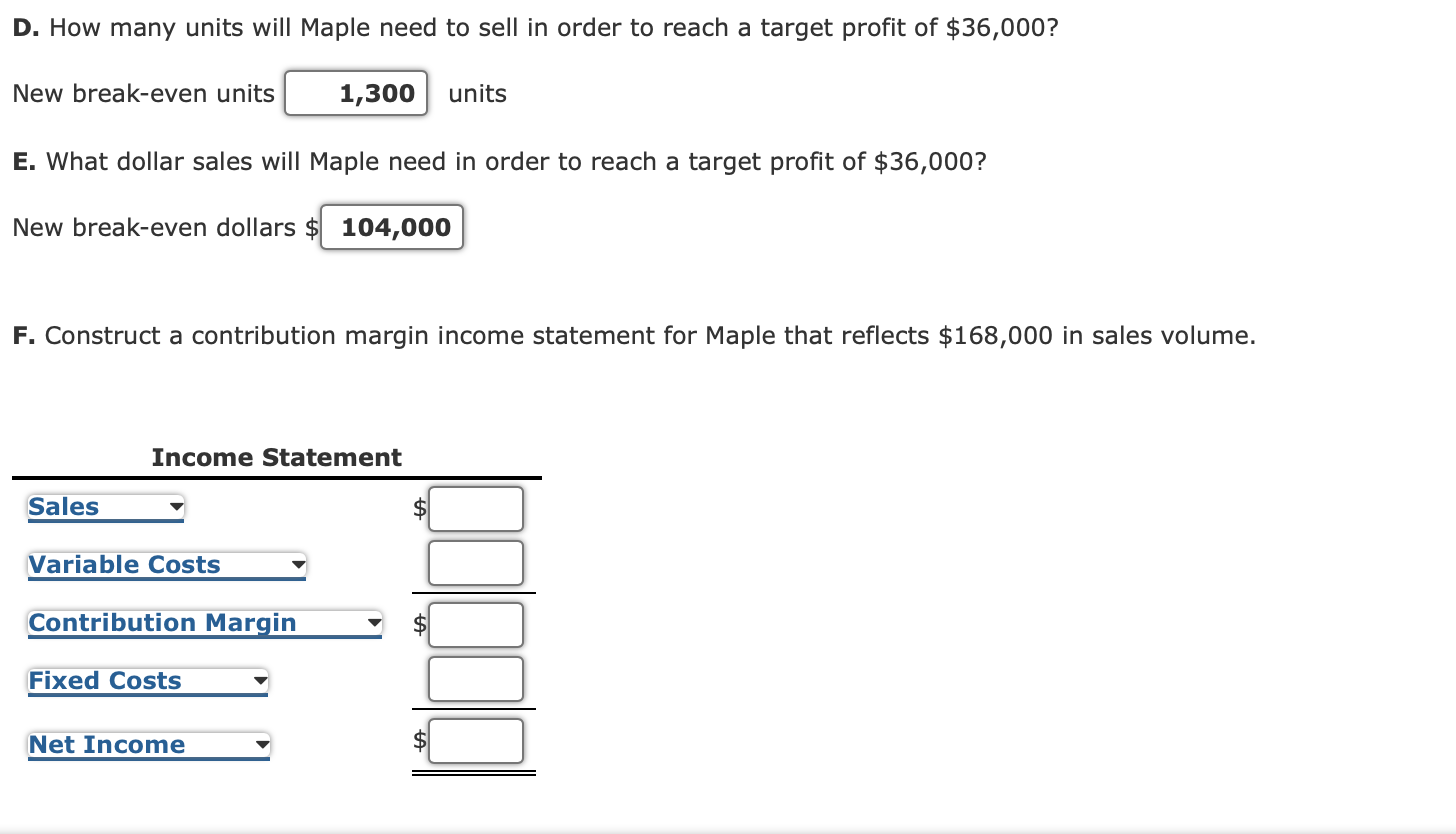

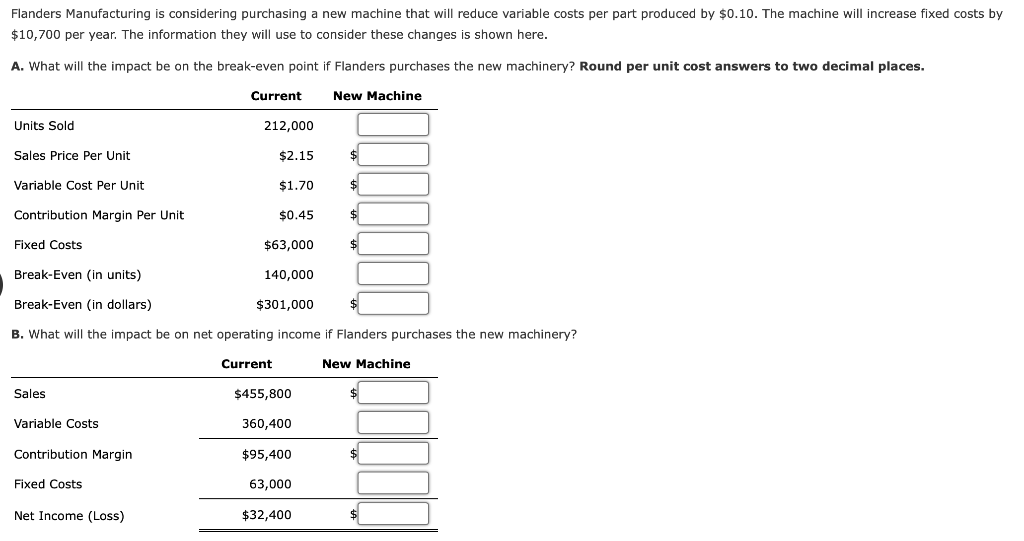

Marchete Company produces a single product. They have recently received the results of a market survey that indicates that they can increase the retail price of their product by 10% without losing customers or market share. All other costs will remain unchanged. Their most recent CVP analysis is presented below. Current Units sold 960 Sales Price per Unit $140 Variable Cost per Unit $99 Contribution Margin per Unit $41 Fixed Costs $34,891 Break-Even (in units) 851 Break-Even (in dollars) $119,140 Sales $134,400 Variable Costs $95,040 Contribution Margin $39,360 Fixed Costs $34,891 Net Income (loss) $4,469 If they enact the 10% price increase, what will be their new break-even point in units and dollars? If required, round final answers to nearest whole number. New Price Break-even (in units) Break-even (in dollars) Maple Enterprises sells a single product with a selling price of $80 and variable costs per unit of $40. The company's monthly fixed expenses are $16,000. A. What is the company's break-even point in units? Break-even units 400 units B. What is the company's break-even point in dollars? Break-even dollars $ 32,000 C. Construct a contribution margin income statement for the month of September when they will sell 800 units. Use a minus sign for a net loss if present. Income Statement Sales Variable Costs Contribution Margin Fixed Costs Net Income D. How many units will Maple need to sell in order to reach a target profit of $36,000? New break-even units 1,300 units E. What dollar sales will Maple need in order to reach a target profit of $36,000? New break-even dollars $ 104,000 F. Construct a contribution margin income statement for Maple that reflects $168,000 in sales volume. Income Statement Sales Variable Costs Contribution Margin Fixed Costs Net Income Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.10. The machine will increase fixed costs by $10,700 per year. The information they will use to consider these changes is shown here. A. What will the impact be on the break-even point if Flanders purchases the new machinery? Round per unit cost answers to two decimal places. Current New Machine Units Sold 212,000 Sales Price Per Unit $2.15 $ Variable Cost Per Unit $1.70 $ Contribution Margin Per Unit $0.45 $ Fixed Costs $63,000 $ Break-Even (in units) 140,000 Break-Even (in dollars) $301,000 B. What will the impact be on net operating income Flanders purchases the new machinery? Current New Machine Sales $455,800 Variable Costs 360,400 Contribution Margin $95,400 $ Fixed Costs 63,000 Net Income (Loss) $32,400