Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show in the excel function process. Thanks. Section C: Compulsory (to be done on excel) 10 marks Practical questions Assume a commercial property is

Please show in the excel function process. Thanks.

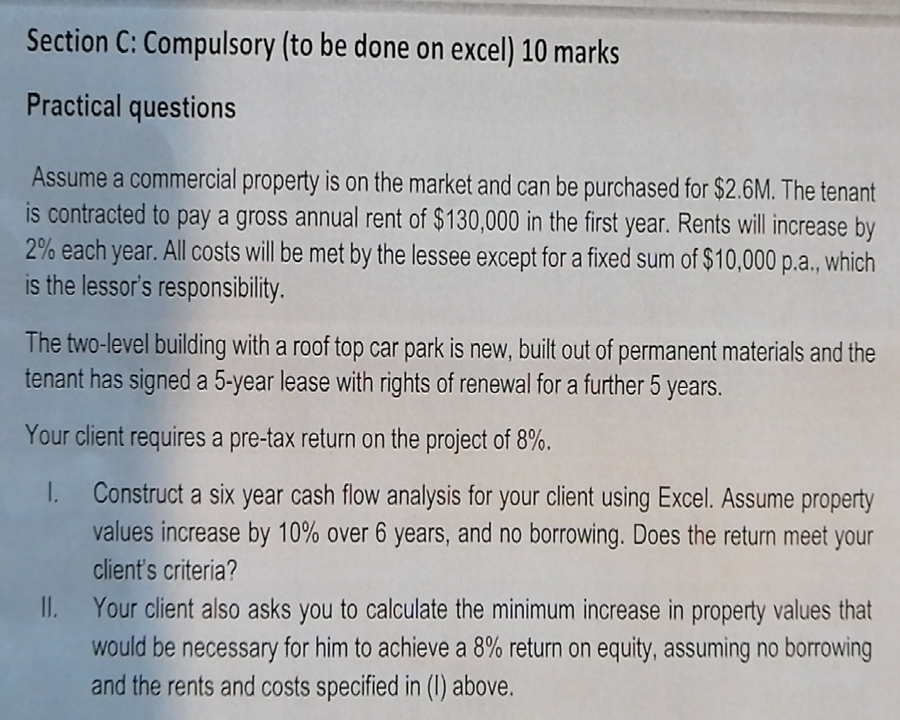

Section C: Compulsory (to be done on excel) 10 marks Practical questions Assume a commercial property is on the market and can be purchased for $2.6M. The tenant is contracted to pay a gross annual rent of $130,000 in the first year. Rents will increase by 2% each year. All costs will be met by the lessee except for a fixed sum of $10,000 p.a., which is the lessor's responsibility. The two-level building with a roof top car park is new, built out of permanent materials and the tenant has signed a 5-year lease with rights of renewal for a further 5 years. Your client requires a pre-tax return on the project of 8%. I. Construct a six year cash flow analysis for your client using Excel. Assume property values increase by 10% over 6 years, and no borrowing. Does the return meet your client's criteria? II. Your client also asks you to calculate the minimum increase in property values that would be necessary for him to achieve a 8% return on equity, assuming no borrowing and the rents and costs specified in (1) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started