Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show key strokes has to be one BAII Plus Calculator 1. (15 points) Famed psychiatrist Lucy Van Pelt is 40 years old today. She

Please show key strokes has to be one BAII Plus Calculator

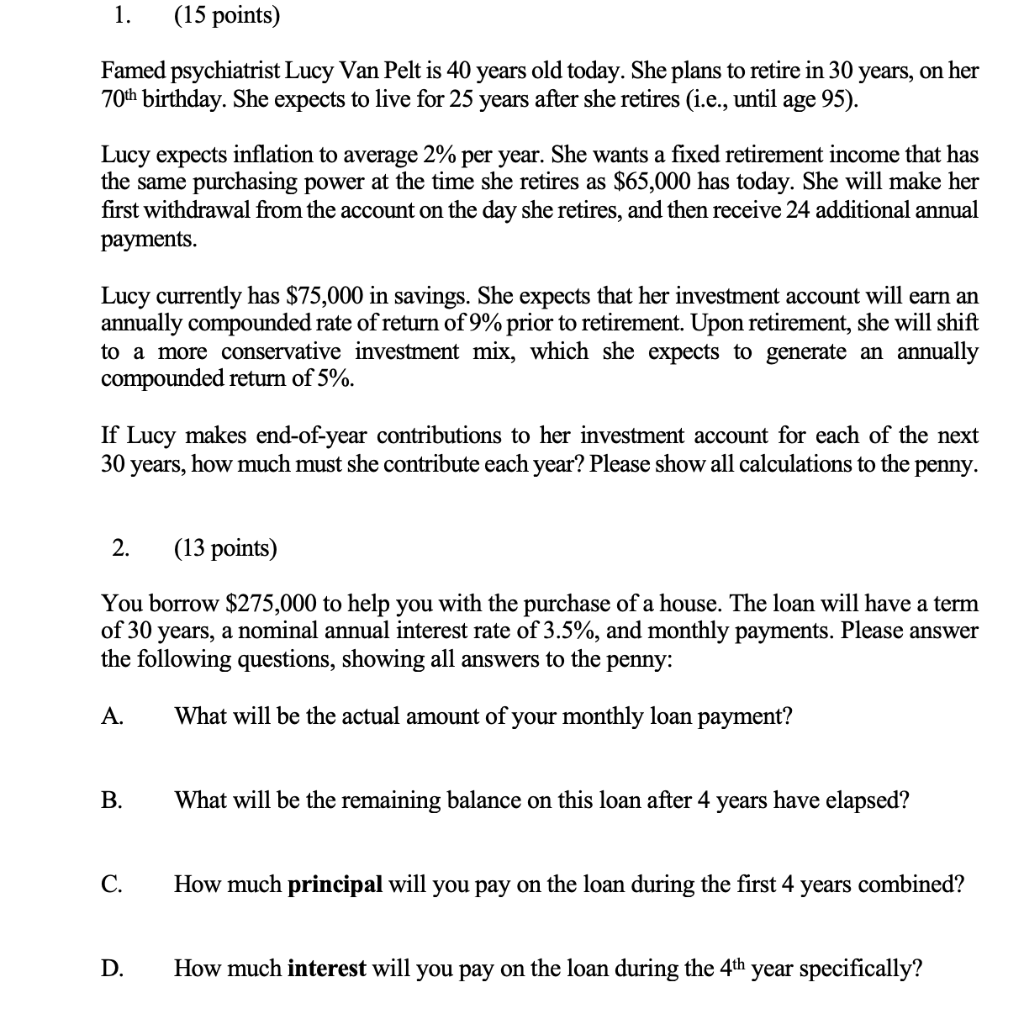

1. (15 points) Famed psychiatrist Lucy Van Pelt is 40 years old today. She plans to retire in 30 years, on her 70th birthday. She expects to live for 25 years after she retires (i.e., until age 95). Lucy expects inflation to average 2% per year. She wants a fixed retirement income that has the same purchasing power at the time she retires as $65,000 has today. She will make her first withdrawal from the account on the day she retires, and then receive 24 additional annual payments. Lucy currently has $75,000 in savings. She expects that her investment account will earn an annually compounded rate of return of 9% prior to retirement. Upon retirement, she will shift to a more conservative investment mix, which she expects to generate an annually compounded return of 5%. If Lucy makes end-of-year contributions to her investment account for each of the next 30 years, how much must she contribute each year? Please show all calculations to the penny. 2. (13 points) You borrow $275,000 to help you with the purchase of a house. The loan will have a term of 30 years, a nominal annual interest rate of 3.5%, and monthly payments. Please answer the following questions, showing all answers to the penny: A. What will be the actual amount of your monthly loan payment? B. What will be the remaining balance on this loan after 4 years have elapsed? C. How much principal will you pay on the loan during the first 4 years combined? D. How much interest will you pay on the loan during the 4th year specificallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started