Please show me how to do this correctly. Below is the original situation:

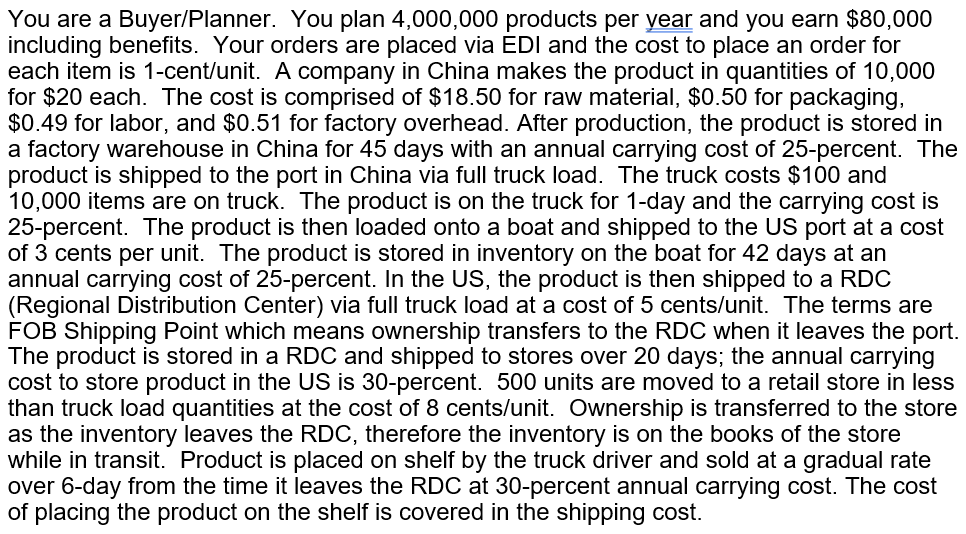

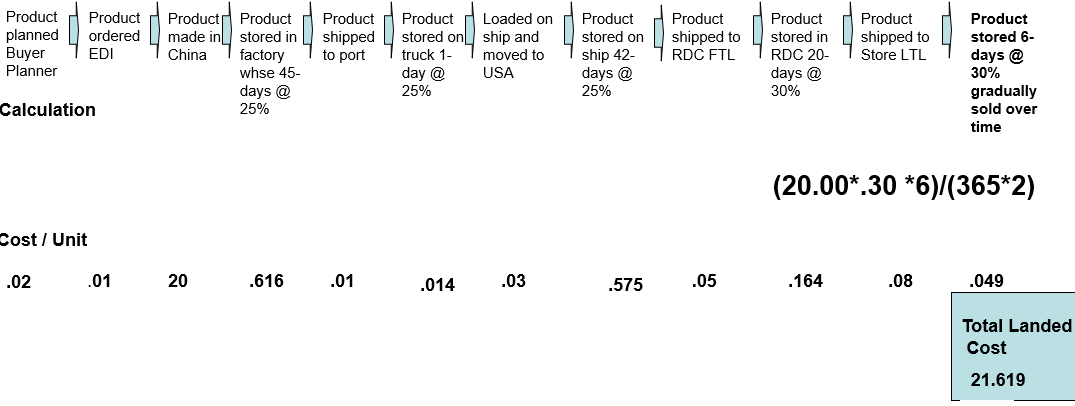

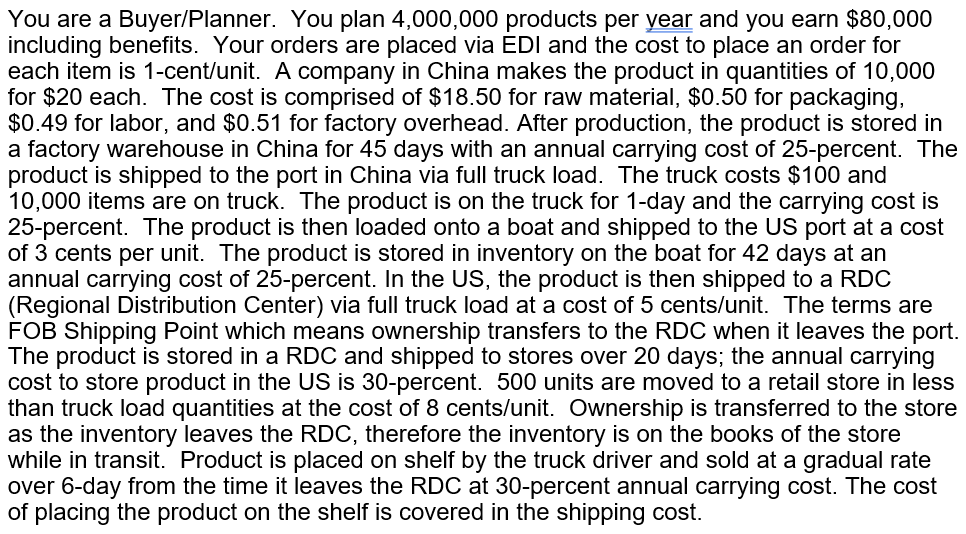

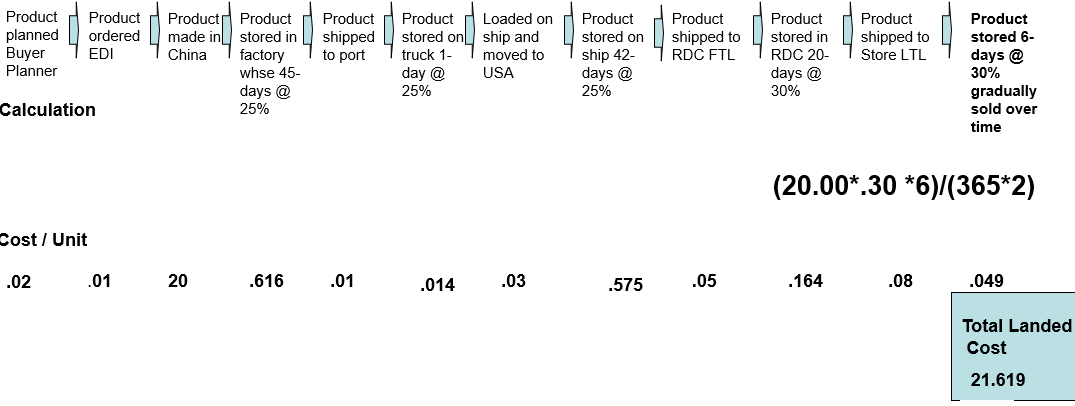

Calculate and analyze Scenario 3. You must do the analysis using the original supply chain configuration to get an apples to apples comparison. - What if we shipped to the store in Full Truck Loads? = Cost of full truck is .06/unit = Annual carrying cost 30-percent 8-days of inventory is supplied and gradually sold over time = You are a Buyer/Planner. You plan 4,000,000 products per year and you earn $80,000 including benefits. Your orders are placed via EDI and the cost to place an order for each item is 1-cent/unit. A company in China makes the product in quantities of 10,000 for $20 each. The cost is comprised of $18.50 for raw material, $0.50 for packaging, $0.49 for labor, and $0.51 for factory overhead. After production, the product is stored in a factory warehouse in China for 45 days with an annual carrying cost of 25-percent. The product is shipped to the port in China via full truck load. The truck costs $100 and 10,000 items are on truck. The product is on the truck for 1-day and the carrying cost is 25-percent. The product is then loaded onto a boat and shipped to the US port at a cost of 3 cents per unit. The product is stored in inventory on the boat for 42 days at an annual carrying cost of 25-percent. In the US, the product is then shipped to a RDC (Regional Distribution Center) via full truck load at a cost of 5 cents/unit. The terms are FOB Shipping Point which means ownership transfers to the RDC when it leaves the port. The product is stored in a RDC and shipped to stores over 20 days; the annual carrying cost to store product in the US is 30-percent. 500 units are moved to a retail store in less than truck load quantities at the cost of 8 cents/unit. Ownership is transferred to the store as the inventory leaves the RDC, therefore the inventory is on the books of the store while in transit. Product is placed on shelf by the truck driver and sold at a gradual rate over 6-day from the time it leaves the RDC at 30-percent annual carrying cost. The cost of placing the product on the shelf is covered in the shipping cost. Product planned Buyer Planner Product ordered EDI Product shipped to port Product Product made in stored in China factory whse 45- days @ 25% Product Loaded on stored on ship and truck 1- moved to day @ USA 25% Product shipped to RDC FTL Product stored on ship 42- days @ 25% O Product shipped to Store LTL Product stored in RDC 20- days @ 30% Product stored 6- days @ 30% Calculation gradually sold over time (20.00*.30 *6)/(365*2) Cost / Unit .02 .01 20 .616 .01 .014 .03 .575 .05 .164 .08 .049 Total Landed Cost 21.619 Calculate and analyze Scenario 3. You must do the analysis using the original supply chain configuration to get an apples to apples comparison. - What if we shipped to the store in Full Truck Loads? = Cost of full truck is .06/unit = Annual carrying cost 30-percent 8-days of inventory is supplied and gradually sold over time = You are a Buyer/Planner. You plan 4,000,000 products per year and you earn $80,000 including benefits. Your orders are placed via EDI and the cost to place an order for each item is 1-cent/unit. A company in China makes the product in quantities of 10,000 for $20 each. The cost is comprised of $18.50 for raw material, $0.50 for packaging, $0.49 for labor, and $0.51 for factory overhead. After production, the product is stored in a factory warehouse in China for 45 days with an annual carrying cost of 25-percent. The product is shipped to the port in China via full truck load. The truck costs $100 and 10,000 items are on truck. The product is on the truck for 1-day and the carrying cost is 25-percent. The product is then loaded onto a boat and shipped to the US port at a cost of 3 cents per unit. The product is stored in inventory on the boat for 42 days at an annual carrying cost of 25-percent. In the US, the product is then shipped to a RDC (Regional Distribution Center) via full truck load at a cost of 5 cents/unit. The terms are FOB Shipping Point which means ownership transfers to the RDC when it leaves the port. The product is stored in a RDC and shipped to stores over 20 days; the annual carrying cost to store product in the US is 30-percent. 500 units are moved to a retail store in less than truck load quantities at the cost of 8 cents/unit. Ownership is transferred to the store as the inventory leaves the RDC, therefore the inventory is on the books of the store while in transit. Product is placed on shelf by the truck driver and sold at a gradual rate over 6-day from the time it leaves the RDC at 30-percent annual carrying cost. The cost of placing the product on the shelf is covered in the shipping cost. Product planned Buyer Planner Product ordered EDI Product shipped to port Product Product made in stored in China factory whse 45- days @ 25% Product Loaded on stored on ship and truck 1- moved to day @ USA 25% Product shipped to RDC FTL Product stored on ship 42- days @ 25% O Product shipped to Store LTL Product stored in RDC 20- days @ 30% Product stored 6- days @ 30% Calculation gradually sold over time (20.00*.30 *6)/(365*2) Cost / Unit .02 .01 20 .616 .01 .014 .03 .575 .05 .164 .08 .049 Total Landed Cost 21.619