Please show me how to solve this step by step without the help of excel. Thank you!

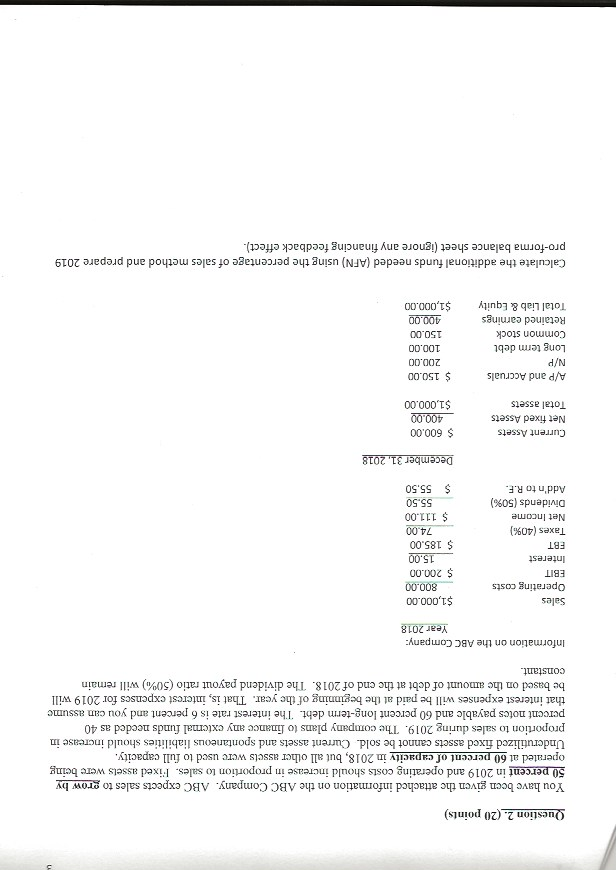

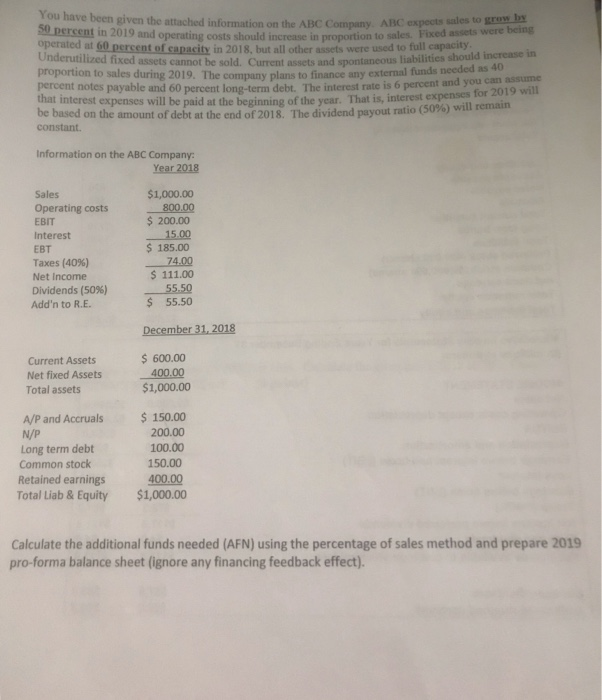

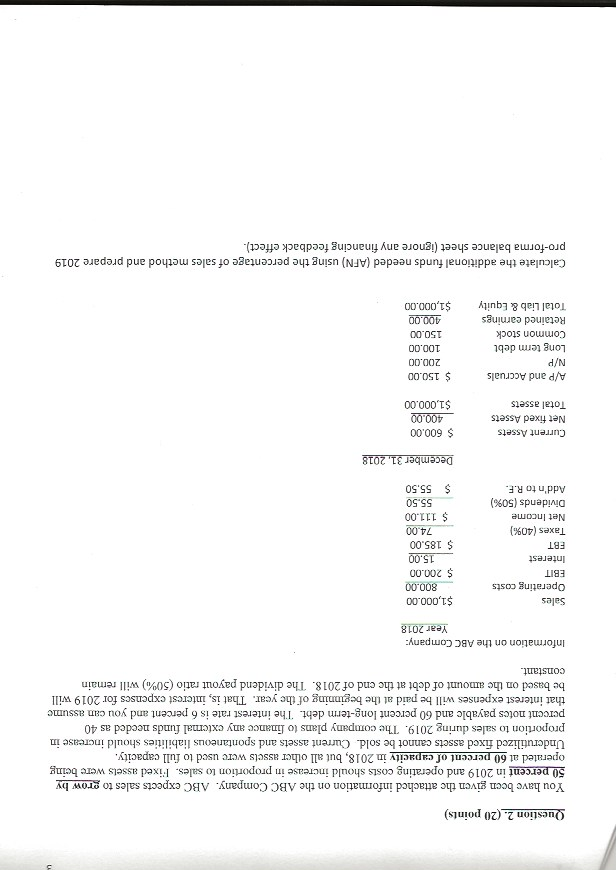

Question 2. (20 points) You have been given the attached information on the ABC Company. ABC expects sales to grow by ating costs should increase in proportion to sales. Fixed assels were being operated at 60 percent of capacity in 2018, but all other assets were used to full capacity. Underutilized fixed assets cannot be sold. Current assets and spontaneous liabilities should increase in proportion to sales during 2019. The company plans to finance any external funds needed as 40 percent notes payable and 60 percent long-term debt. The interest rate is 6 percent and you can assume that interest expenses will be paid at the beginning of the year. That is, interest expenses for 2019 will be based on the amount of debt at the end of 2018. The dividend payout ratio (50%) will remain constant. Information on the ABC Company: Year 2018 Sales Operating costs EBIT Interest EBT Taxes (40%) Net Income Dividends (50%) Add'n to R.F. $1,000.00 800.00 $ 200.00 15.00 $ 185.00 74.00 $ 111.00 55.50 $ 55.50 December 31, 2018 Current Assets Net fixed Assets Total assets $ 600.00 400.00 $1,000.00 A/P and Accruals N/P Long term debt Common stock Retained earnings Total Liab & Equity $ 150.00 200.00 100.00 150.00 400.00 $1,000.00 Calculate the additional funds needed (AFN) using the percentage of sales method and prepare 2019 pro-forma balance sheet (ignore any financing feedback effect). You have been given the attached information on the ve the attached information on the ABC Company ABC expects des to grow 50 percent in 2019 and operating costs should increase in proport and operating costs should increase in roportion to sales. Fixed assets were bem operated at 60 percent of capacity in 2018 but all others were used to full capacity assets cannot be sold. Current assets and spontaneous liabilities should proportion to sales during 2019. The company plan to finance any external funds need percent notes payable and 60 percent long-term debt. The interest rate is 6 percent and you erst expenses will be paid at the beginning of the year. That is interest expenses be based on the amount of debt at the end of 2018 The dividend payout ratio (50%) will remain constant. Information on the ABC Company: Year 2018 Sales Operating costs EBIT Interest EBT Taxes (40%) Net Income Dividends (50%) Add 'n to R.E. $1,000.00 800.00 $ 200.00 15.00 $ 185.00 74.00 $ 111.00 55.50 $ 55.50 December 31, 2018 Current Assets Net fixed Assets Total assets $ 600.00 400.00 $1,000.00 A/P and Accruals N/P Long term debt Common stock Retained earnings Total Liab & Equity $ 150.00 200.00 100.00 150.00 400.00 $1,000.00 Calculate the additional funds needed (AFN) using the percentage of sales method and prepare 2019 pro-forma balance sheet (ignore any financing feedback effect). Question 2. (20 points) You have been given the attached information on the ABC Company. ABC expects sales to grow by ating costs should increase in proportion to sales. Fixed assels were being operated at 60 percent of capacity in 2018, but all other assets were used to full capacity. Underutilized fixed assets cannot be sold. Current assets and spontaneous liabilities should increase in proportion to sales during 2019. The company plans to finance any external funds needed as 40 percent notes payable and 60 percent long-term debt. The interest rate is 6 percent and you can assume that interest expenses will be paid at the beginning of the year. That is, interest expenses for 2019 will be based on the amount of debt at the end of 2018. The dividend payout ratio (50%) will remain constant. Information on the ABC Company: Year 2018 Sales Operating costs EBIT Interest EBT Taxes (40%) Net Income Dividends (50%) Add'n to R.F. $1,000.00 800.00 $ 200.00 15.00 $ 185.00 74.00 $ 111.00 55.50 $ 55.50 December 31, 2018 Current Assets Net fixed Assets Total assets $ 600.00 400.00 $1,000.00 A/P and Accruals N/P Long term debt Common stock Retained earnings Total Liab & Equity $ 150.00 200.00 100.00 150.00 400.00 $1,000.00 Calculate the additional funds needed (AFN) using the percentage of sales method and prepare 2019 pro-forma balance sheet (ignore any financing feedback effect). You have been given the attached information on the ve the attached information on the ABC Company ABC expects des to grow 50 percent in 2019 and operating costs should increase in proport and operating costs should increase in roportion to sales. Fixed assets were bem operated at 60 percent of capacity in 2018 but all others were used to full capacity assets cannot be sold. Current assets and spontaneous liabilities should proportion to sales during 2019. The company plan to finance any external funds need percent notes payable and 60 percent long-term debt. The interest rate is 6 percent and you erst expenses will be paid at the beginning of the year. That is interest expenses be based on the amount of debt at the end of 2018 The dividend payout ratio (50%) will remain constant. Information on the ABC Company: Year 2018 Sales Operating costs EBIT Interest EBT Taxes (40%) Net Income Dividends (50%) Add 'n to R.E. $1,000.00 800.00 $ 200.00 15.00 $ 185.00 74.00 $ 111.00 55.50 $ 55.50 December 31, 2018 Current Assets Net fixed Assets Total assets $ 600.00 400.00 $1,000.00 A/P and Accruals N/P Long term debt Common stock Retained earnings Total Liab & Equity $ 150.00 200.00 100.00 150.00 400.00 $1,000.00 Calculate the additional funds needed (AFN) using the percentage of sales method and prepare 2019 pro-forma balance sheet (ignore any financing feedback effect)