please show me how to solve those problems in steps !!

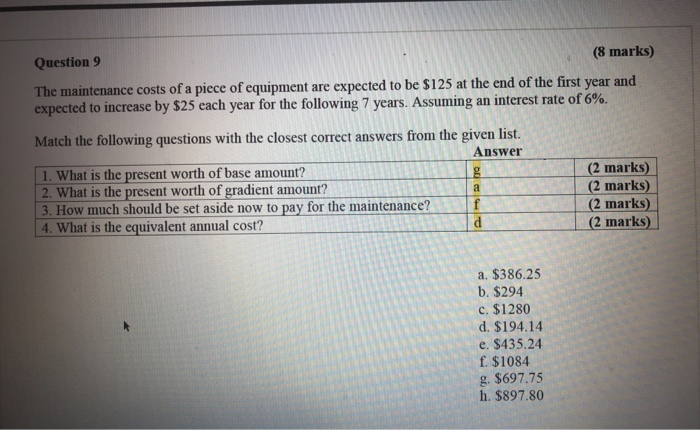

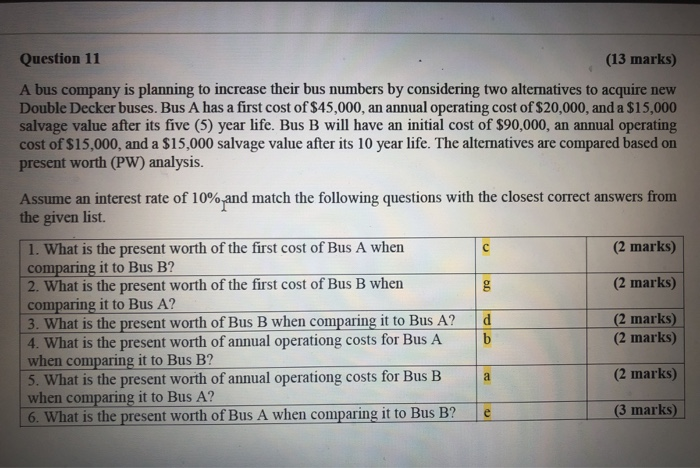

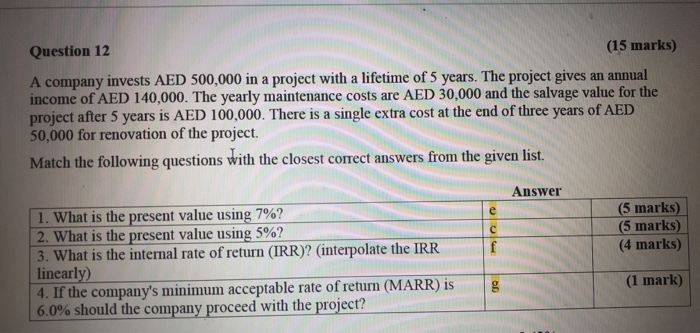

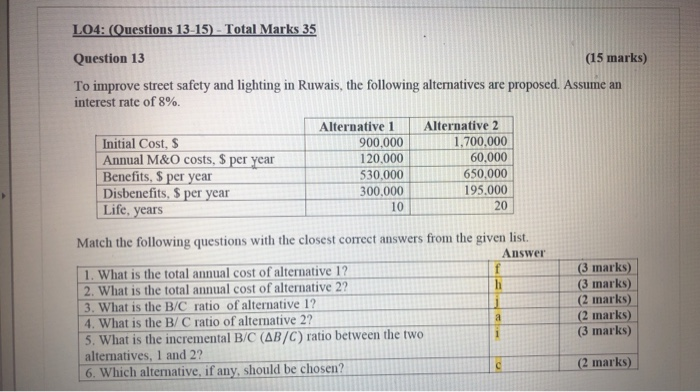

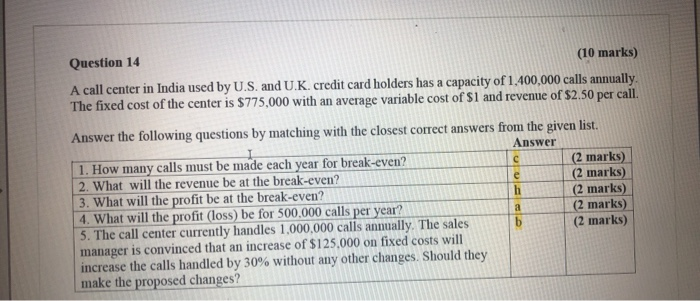

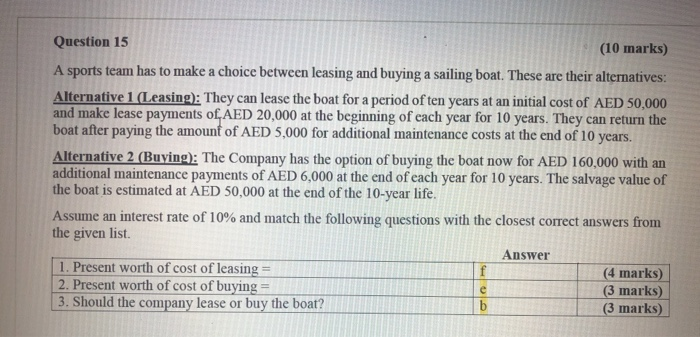

Question 9 (8 marks) The maintenance costs of a piece of equipment are expected to be $125 at the end of the first year and expected to increase by $25 each year for the following 7 years. Assuming an interest rate of 6%. Match the following questions with the closest correct answers from the given list. Answer 1. What is the present worth of base amount? 2. What is the present worth of gradient amount? 3. How much should be set aside now to pay for the maintenance? 4. What is the equivalent annual cost? (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) a. $386.25 b. $294 c. $1280 d. $194.14 e. $435.24 f. $1084 g. $697.75 h. $897.80 Question 11 (13 marks) A bus company is planning to increase their bus numbers by considering two alternatives to acquire new Double Decker buses. Bus A has a first cost of $45,000, an annual operating cost of $20,000, and a $15,000 salvage value after its five (5) year life. Bus B will have an initial cost of $90,000, an annual operating cost of $15,000, and a $15,000 salvage value after its 10 year life. The alternatives are compared based on present worth (PW) analysis. Assume an interest rate of 10% and match the following questions with the closest correct answers from the given list. (2 marks) g (2 marks) d 1. What is the present worth of the first cost of Bus A when comparing it to Bus B? 2. What is the present worth of the first cost of Bus B when comparing it to Bus A? 3. What is the present worth of Bus B when comparing it to Bus A7 4. What is the present worth of annual operationg costs for Bus A when comparing it to Bus B? 5. What is the present worth of annual operationg costs for Bus B when comparing it to Bus A? 6. What is the present worth of Bus A when comparing it to Bus B? (2 marks) (2 marks) (2 marks) e (3 marks) Question 12 (15 marks) A company invests AED 500,000 in a project with a lifetime of 5 years. The project gives an annual income of AED 140,000. The yearly maintenance costs are AED 30,000 and the salvage value for the project after 5 years is AED 100,000. There is a single extra cost at the end of three years of AED 50,000 for renovation of the project. Match the following questions with the closest correct answers from the given list. Answer (5 marks) (5 marks) (4 marks) 1. What is the present value using 7%? 2. What is the present value using 5%? 3. What is the internal rate of return (IRR)? (interpolate the IRR linearly) 4. If the company's minimum acceptable rate of return (MARR) is 6.0% should the company proceed with the project? (1 mark) LO4: (Questions 13-15) - Total Marks 35 Question 13 (15 marks) To improve street safety and lighting in Ruwais, the following alternatives are proposed. Assume an interest rate of 8% Alternative 1 Alternative 2 Initial Cost, S 900,000 1,700,000 Annual M&O costs, $ per year 120,000 60,000 Benefits, $ per year 530,000 650,000 Disbenefits, S per year 300,000 195.000 Life, years 20 Match the following questions with the closest correct answers from the given list. Answer 1. What is the total annual cost of alternative 1? 2. What is the total annual cost of alternative 2? 3. What is the B/C ratio of alternative 1? 4. What is the B/C ratio of alternative 2? 5. What is the incremental B/C (AB/C ratio between the two alternatives, 1 and 2? 6. Which alternative, if any, should be chosen? (3 marks) (3 marks) (2 marks) (2 marks) (3 marks) (2 marks) Question 14 (10 marks) A call center in India used by U.S. and U.K. credit card holders has a capacity of 1.400,000 calls annually. The fixed cost of the center is 5775,000 with an average variable cost of S1 and revenue of $2.50 per call. Answer the following questions by matching with the closest correct answers from the given list. Answer 1. How many calls must be made each year for break-even? (2 marks) 2. What will the revenue be at the break-even? (2 marks) 3. What will the profit be at the break-even? (2 marks) 4. What will the profit (loss) be for 500,000 calls per year? (2 marks) 5. The call center currently handles 1,000,000 calls annually. The sales (2 marks) manager is convinced that an increase of $125,000 on fixed costs will increase the calls handled by 30% without any other changes. Should they make the proposed changes? Question 15 (10 marks) A sports team has to make a choice between leasing and buying a sailing boat. These are their alternatives: Alternative 1 (Leasing): They can lease the boat for a period of ten years at an initial cost of AED 50,000 and make lease payments of AED 20,000 at the beginning of each year for 10 years. They can return the boat after paying the amount of AED 5,000 for additional maintenance costs at the end of 10 years. Alternative 2 (Buying): The Company has the option of buying the boat now for AED 160,000 with an additional maintenance payments of AED 6,000 at the end of each year for 10 years. The salvage value of the boat is estimated at AED 50,000 at the end of the 10-year life. Assume an interest rate of 10% and match the following questions with the closest correct answers from the given list Answer 1. Present worth of cost of leasing = (4 marks) 2. Present worth of cost of buying = (3 marks) 3. Should the company lease or buy the boat