please show me the calculations of each:

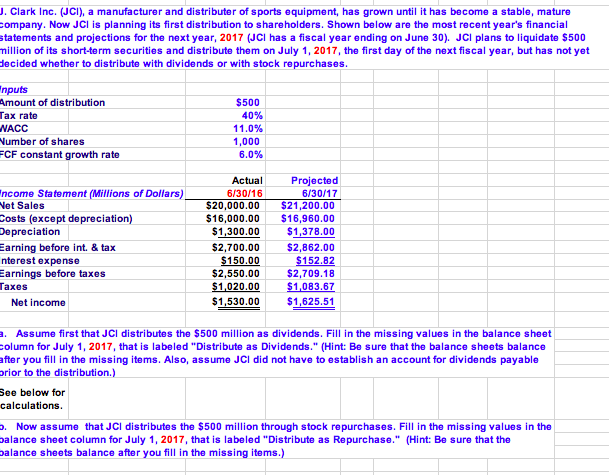

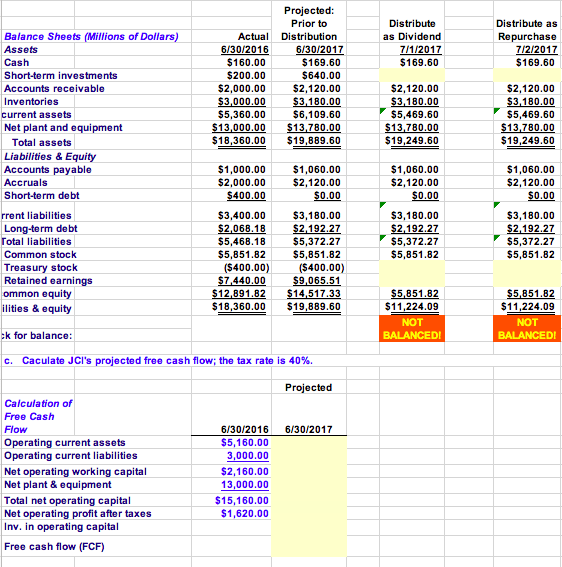

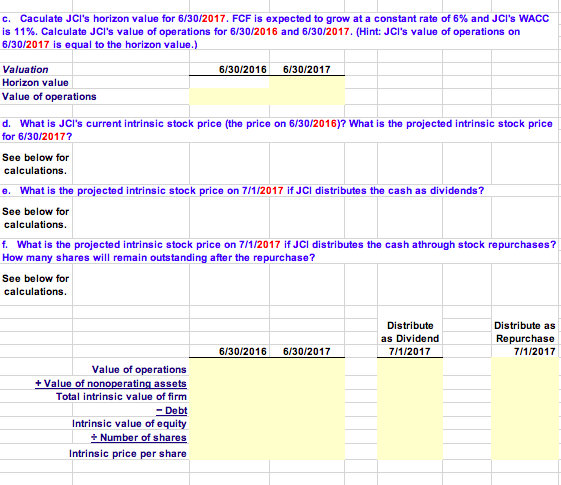

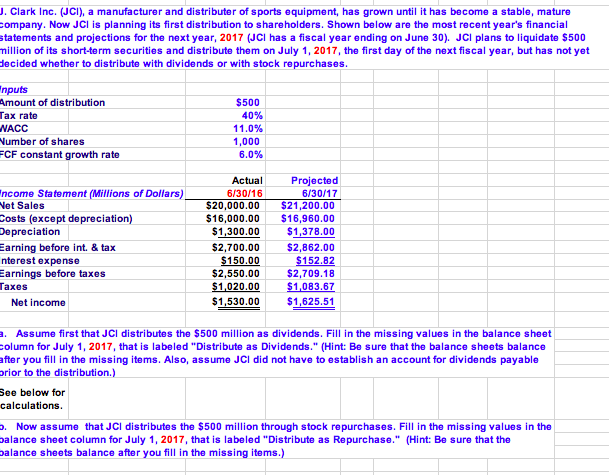

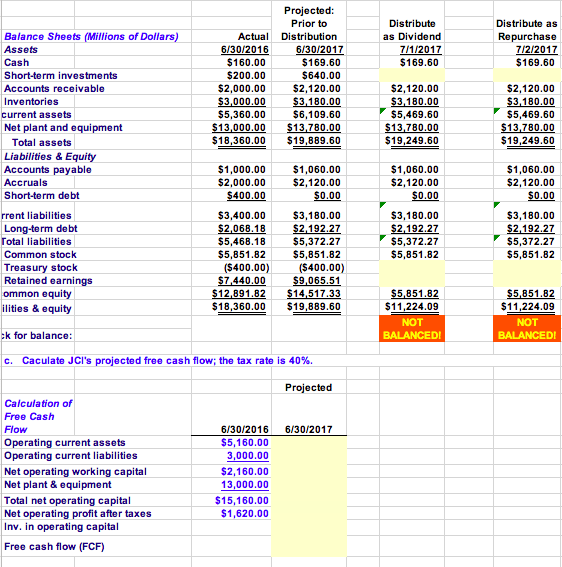

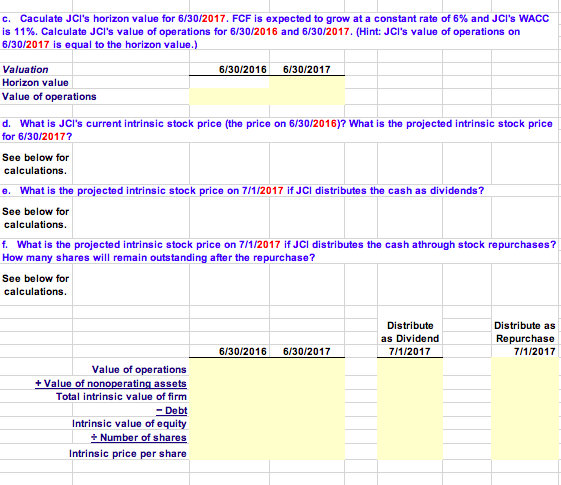

J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become a stable, mature company. Now JCI is planning its first distribution to shareholders. Shown below are the most recent year's financial statements and projections for the next year, 2017 (JCI has a fiscal year ending on June 30). JCI plans to liquidate $500 million of its short-term securities and distribute them on July 1, 2017, the first day of the next fiscal year, but has not yet decided whether to distribute with dividends or with stock repurchases. nputs Amount of distribution Tax rate NACC Number of shares FCF constant growth rate $500 40% 11.0% 1,000 6.0% ncome Statement (Millions of Dollars) Net Sales Costs (except de preciation) Depreciation Earning before int. & tax nterest expense Earnings before taxes Taxes Net income Actual 6/30/16 $20,000.00 $16,000.00 $1,300.00 $2,700.00 $ 150.00 $2,550.00 $1,020.00 $1,530.00 Projected 6/30/17 $21,200.00 $16,960.00 $1,378.00 $2,862.00 $152.82 $2,709.18 $1,083.67 $1,625.51 a. Assume first that JCl distributes the $500 million as dividends. Fill in the missing values in the balance sheet Column for July 1, 2017, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance sheets balance after you fill in the missing items. Also, assume JCI did not have to establish an account for dividends payable orior to the distribution.) See below for calculations. . Now assume that JCI distributes the $500 million through stock re purchases. Fill in the missing values in the balance sheet column for July 1, 2017, that is labeled "Distribute as Repurchase." (Hint: Be sure that the balance sheets balance after you fill in the missing items.) Distribute as Dividend 7/1/2017 $169.60 Distribute as Repurchase 7/2/2017 $169.60 Projected: Prior to Actual Distribution 6/30/2016 6/30/2017 $160.00 $169.60 $200.00 $640.00 $2,000.00 $2,120.00 $3,000.00 $3,180.00 $5,360.00 $6,109.60 $13,000.00 $13,780.00 $18,360.00 $19,889.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 Balance Sheets (Millions of Dollars) Assets Cash Short-term investments Accounts receivable Inventories current assets Net plant and equipment Total assets Liabilities & Equity Accounts payable Accruals Short-term debt rrent liabilities Long-term debt Total liabilities Common stock Treasury stock Retained earnings ommon equity ilities & equity $1,000.00 $2,000.00 $400.00 $1,060.00 $2,120.00 $0.00 $1,060.00 $2.120.00 $0.00 $1,060.00 $2,120.00 $0.00 $3,180.00 $2.192.27 $5,372.27 $5.851.82 $3,180.00 $2.192.27 $5,372.27 $5,851.82 $3,400.00 $2,068.18 $5,468.18 $5,851.82 ($400.00) $7,440.00 $12.891.82 426000 $3,180.00 $2.192.27 $5,372.27 $5,851.82 ($400.00) $9,065.51 $14,517.33 $19.889.60 $5.851.82 $11,224.09 $5,851.82 $11,224.09 ck for balance: BALANCEDI BALANCEDI c. Caculate JCI's projected free cash flow; the tax rate is 40%. Projected 6/30/2017 Calculation of Free Cash Flow Operating current assets Operating current liabilities Net operating working capital Net plant & equipment Total net operating capital Net operating profit after taxes Inv. in operating capital 6/30/2016 $5,160.00 3,000.00 $2,160.00 13,000.00 $15,160.00 $1,620.00 Free cash flow (FCF) C. Caculate JCI's horizon value for 6/30/2017. FCF is expected to grow at a constant rate of 6% and JCI's WACC Is 11%. Calculate JCI's value of operations for 6/30/2016 and 6/30/2017. (Hint: JCI's value of operations on 6/30/2017 is equal to the horizon value.) 6/30/2016 6/30/2017 Valuation Horizon value Value of operations d. What is JCI's current intrinsic stock price (the price on 6/30/2016)? What is the projected intrinsic stock price for 6/30/2017? See below for calculations. e. What is the projected intrinsic stock price on 7/1/2017 if JCI distributes the cash as dividends? See below for calculations. f. What is the projected intrinsic stock price on 7/1/2017 if JCl distributes the cash athrough stock repurchases? How many shares will remain outstanding after the repurchase? See below for calculations. Distribute as Dividend 7/1/2017 Distribute as Repurchase 7/1/2017 6/30/2016 6/30/2017 Value of operations + Value of nonoperating assets Total intrinsic value of firm - Debt Intrinsic value of equity + Number of shares Intrinsic price per share