Answered step by step

Verified Expert Solution

Question

1 Approved Answer

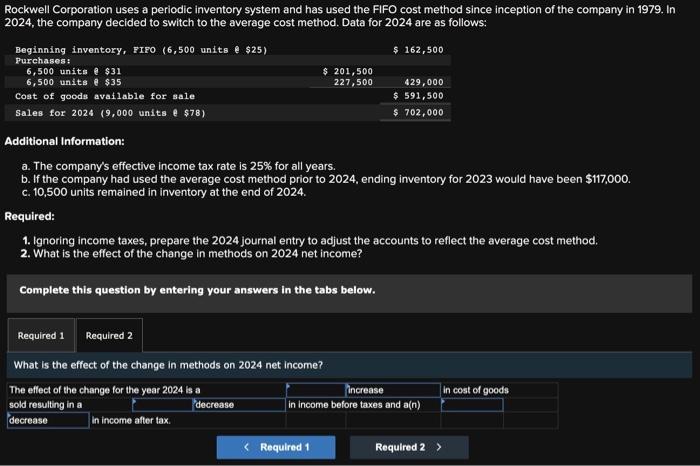

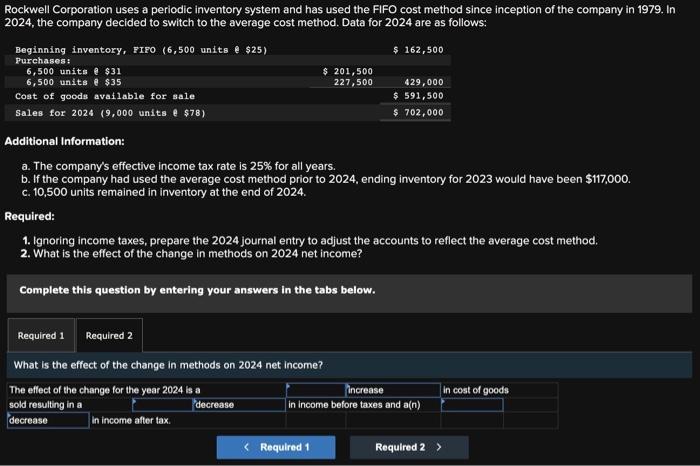

please show methodology Rockwell Corporation uses a periodic inventory system and has used the FIFO cost methcx3 since inception of the cornpany in 1979. In

please show methodology

Rockwell Corporation uses a periodic inventory system and has used the FIFO cost methcx3 since inception of the cornpany in 1979. In 2024, the company decided to switch to the average cost method. Data for 2024 are as follows: ,500 s,soo 6,500 of goods Sal" 20*' (9,000 Additional Information: (6,500 $25) gale $ 162,500 429,000 $ S", 500 $ 102,000 a. The company's effective income tax rate IS 25% for all years. b. If the company had used the average Cost method prior to 2024. ending inventory for 2023 would have been $117,000 c. 10.500 units remained in inventory at the end Of 2024. Required: 1. Ignoring income taxes, prepare the 2024 journal entry to adjust the accounts to reflect the average Cost method. 2. What is the effect of the change in methods on 2024 net income? Compiete this by your in the Requ 1 Required 2 What is the effect Of the change in methods on 2024 net income? The Of 2024 a tax. in Income and a(n) Required 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started