Please show on excel formulas and and answers.

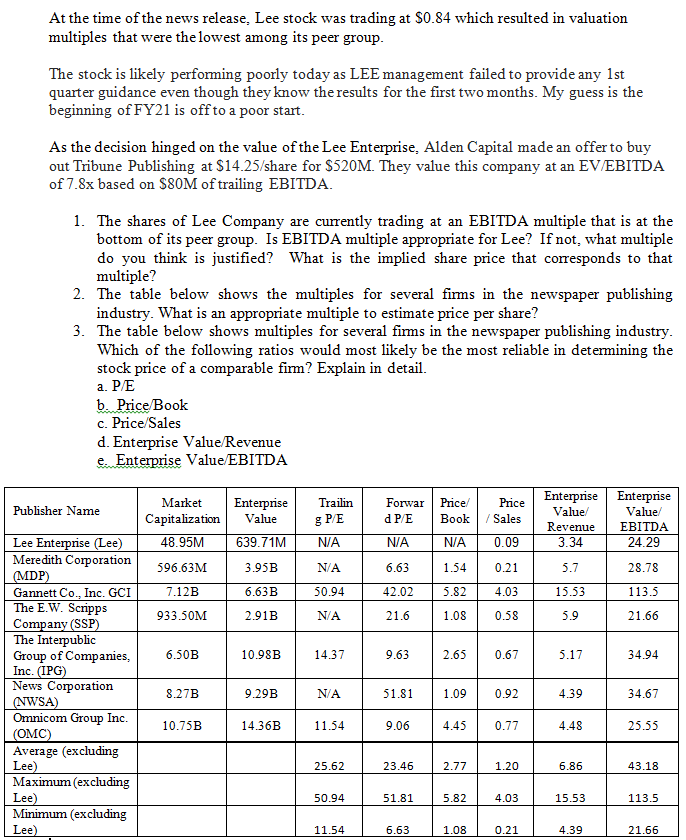

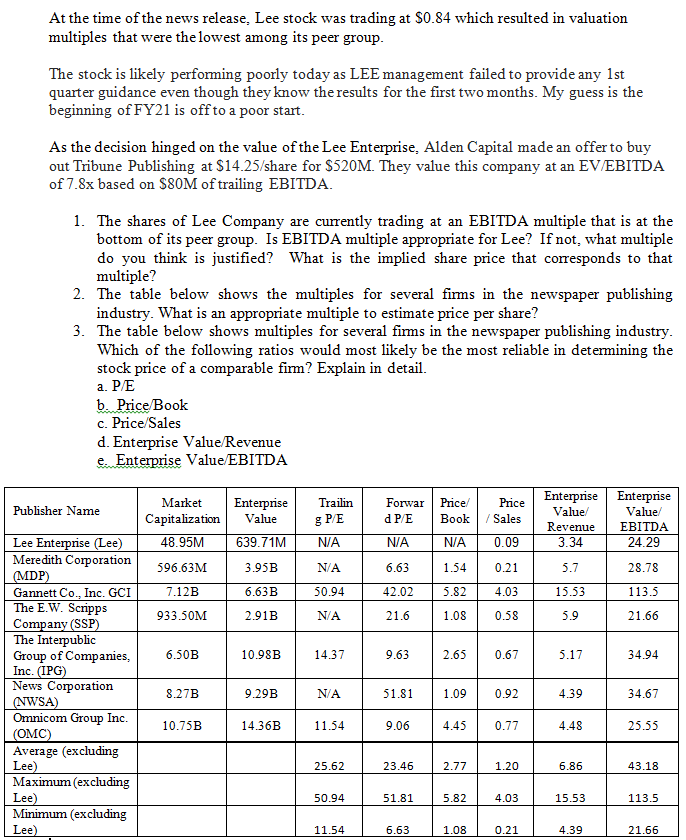

At the time of the news release. Lee stock was trading at $0.84 which resulted in valuation multiples that were the lowest among its peer group. The stock is likely performing poorly today as LEE management failed to provide any 1st quarter guidance even though they know the results for the first two months. My guess is the beginning of FY21 is off to a poor start. As the decision hinged on the value of the Lee Enterprise, Alden Capital made an offer to buy out Tribune Publishing at $14.25/share for $520M. They value this company at an EV/EBITDA of 7.8x based on $80M of trailing EBITDA. 1. The shares of Lee Company are currently trading at an EBITDA multiple that is at the bottom of its peer group. Is EBITDA multiple appropriate for Lee? If not, what multiple do you think is justified? What is the implied share price that corresponds to that multiple? 2. The table below shows the multiples for several fimms in the newspaper publishing industry. What is an appropriate multiple to estimate price per share? 3. The table below shows multiples for several fims in the newspaper publishing industry. Which of the following ratios would most likely be the most reliable in determining the stock price of a comparable firm? Explain in detail. a. P/E b. Price Book c. Price Sales d. Enterprise Value/Revenue e. Enterprise Value/EBITDA Publisher Name Market Capitalization 48.95M Enterprise Value Trailin g PE N/A Forwar d P/E Price Book Price / Sales Enterprise Enterprise Value Value Revenue EBITDA 3.34 24.29 639.71M N/A N/A 0.09 596.63M 3.95B N/A 6.63 1.54 0.21 5.7 28.78 7.12B 6.63B 50.94 42.02 5.82 4.03 15.53 113.5 933.50M 2.91B N/A 21.6 1.08 0.58 5.9 21.66 6.50B 10.98B 14.37 9.63 2.65 0.67 5.17 34.94 Lee Enterprise (Lee) Meredith Corporation (MDP) Gannett Co., Inc. GCI The E.W. Scripps Company (SSP) The Interpublic Group of Companies, Inc. (IPG) News Corporation (NWSA) Omnicom Group Inc. (OMC) Average (excluding Lee) Maximum (excluding Lee) Minimum (excluding Lee) 8.27B 9.29B N/A 51.81 1.09 0.92 4.39 34.67 10.750 14.36B 11.54 9.06 4.45 0.77 4.48 25.55 25.62 23.46 2.77 1.20 6.86 43.18 50.94 51.81 5.82 4.03 15.53 113.5 11.54 6.63 1.08 0.21 4.39 21.66 At the time of the news release. Lee stock was trading at $0.84 which resulted in valuation multiples that were the lowest among its peer group. The stock is likely performing poorly today as LEE management failed to provide any 1st quarter guidance even though they know the results for the first two months. My guess is the beginning of FY21 is off to a poor start. As the decision hinged on the value of the Lee Enterprise, Alden Capital made an offer to buy out Tribune Publishing at $14.25/share for $520M. They value this company at an EV/EBITDA of 7.8x based on $80M of trailing EBITDA. 1. The shares of Lee Company are currently trading at an EBITDA multiple that is at the bottom of its peer group. Is EBITDA multiple appropriate for Lee? If not, what multiple do you think is justified? What is the implied share price that corresponds to that multiple? 2. The table below shows the multiples for several fimms in the newspaper publishing industry. What is an appropriate multiple to estimate price per share? 3. The table below shows multiples for several fims in the newspaper publishing industry. Which of the following ratios would most likely be the most reliable in determining the stock price of a comparable firm? Explain in detail. a. P/E b. Price Book c. Price Sales d. Enterprise Value/Revenue e. Enterprise Value/EBITDA Publisher Name Market Capitalization 48.95M Enterprise Value Trailin g PE N/A Forwar d P/E Price Book Price / Sales Enterprise Enterprise Value Value Revenue EBITDA 3.34 24.29 639.71M N/A N/A 0.09 596.63M 3.95B N/A 6.63 1.54 0.21 5.7 28.78 7.12B 6.63B 50.94 42.02 5.82 4.03 15.53 113.5 933.50M 2.91B N/A 21.6 1.08 0.58 5.9 21.66 6.50B 10.98B 14.37 9.63 2.65 0.67 5.17 34.94 Lee Enterprise (Lee) Meredith Corporation (MDP) Gannett Co., Inc. GCI The E.W. Scripps Company (SSP) The Interpublic Group of Companies, Inc. (IPG) News Corporation (NWSA) Omnicom Group Inc. (OMC) Average (excluding Lee) Maximum (excluding Lee) Minimum (excluding Lee) 8.27B 9.29B N/A 51.81 1.09 0.92 4.39 34.67 10.750 14.36B 11.54 9.06 4.45 0.77 4.48 25.55 25.62 23.46 2.77 1.20 6.86 43.18 50.94 51.81 5.82 4.03 15.53 113.5 11.54 6.63 1.08 0.21 4.39 21.66